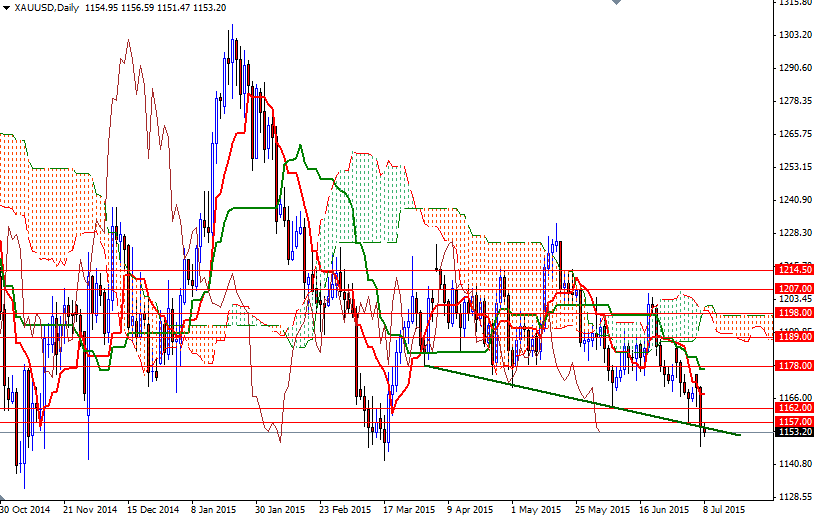

Gold prices ended Tuesday's session down 1.29% as a robust dollar and technical selling continued to weigh on the market. The XAU/USD pair slumped to $1147.83, the lowest level in nearly 4 months, after a breach of some key support levels triggered a sell-off. Gold has come under renewed pressure in recent weeks, as market players flocked to the greenback on expectations of tighter monetary policy in the United States. The dollar is also boosted by the weakness in the euro which has been suffering due to concerns about Greek's debt crisis.

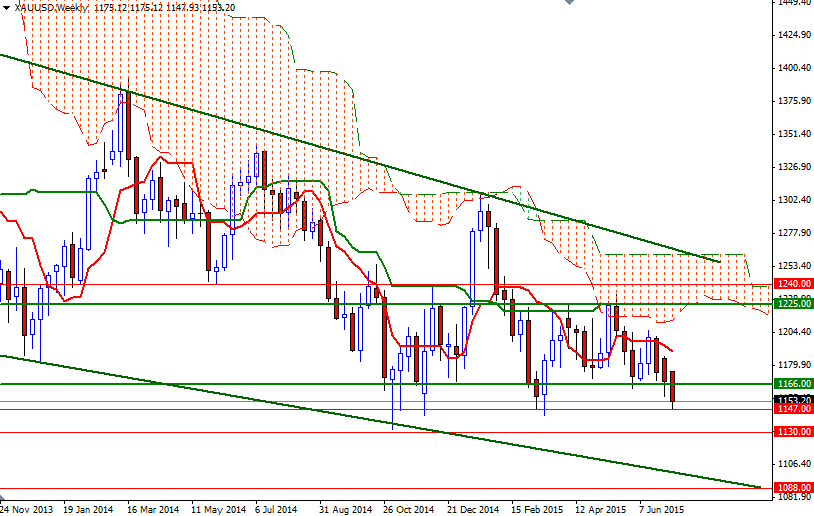

All eyes will be on the U.S. Federal Reserve today, with the release of the minutes of the most recent policy meeting. These records could provide insight into Fed officials' discussion on when to tighten monetary policy. From an intra-day perspective, I believe the key levels to pay attention will be 1147 (a former support) and 1157. As you can see on the weekly chart, there is a significant amount of support in the vicinity of 1147 so it may remain intact before the main event of the day.

In that case, it wouldn't be surprising to see the XAU/USD pair climbing towards 1157. If the bulls can push and hold prices above 1157, then a retest of 1162 is likely. The bulls have to capture the 1166 level, unless they intend to throw the towel. Dropping through the 1147 level would suggest that the bears are getting ready to challenge the support at 1138. If this support is broken, the 1130 level will be the next port of call. I think the support around 1130 will play an crucial role going forward because a successful break might drag gold prices towards the 1092 - 1088 area.