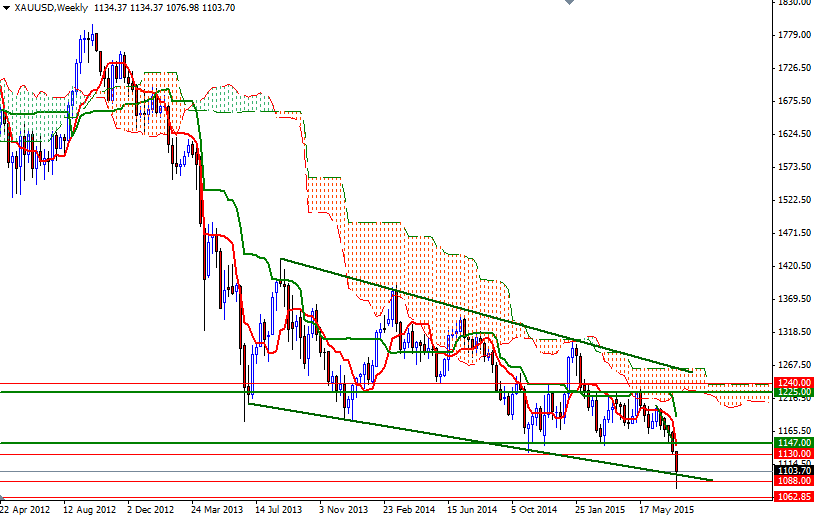

Gold prices ended yesterday's session down 3.34% after a breach of the key support level at $1130 triggered a sell-off. The XAU/USD pair slumped to $1076.98, the lowest price since mid-February 2010, pretty quickly before climbing back above the $1100 level. The precious metal has been struggling lately as interest rates talks and a friendly risk environment have provided better investment opportunities elsewhere.

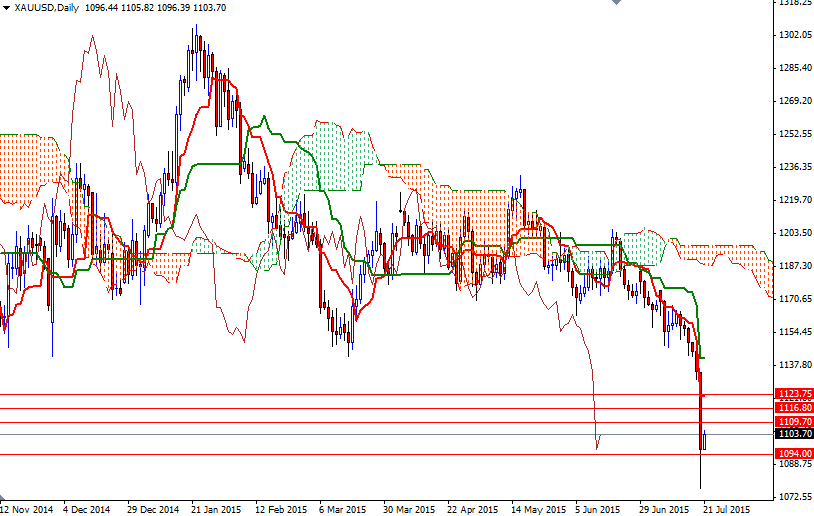

The outlook for the dollar remains upbeat amid expectations interest rates in the world's largest economy would rise sooner than later. St. Louis Fed President James Bullard told that there was a better than 50% chance that the Fed will hike rates in September. Speaking strictly based on the charts, I expect technical picture to maintain a negative outlook over the long-term and favor sellers as long as the market trades below the weekly and daily Ichimoku clouds.

From an intra-day perspective, I will be keeping an eye on the 1094 and the 1109.70 levels. If the XAU/USD pair fails to hold above 1094, then it is likely that the market will retest the 1088/6 area. The bears will have to capture this camp so that they can make a fresh assault on the 1071 support level. On the other hand, if the bulls manage to retain the market above the lower line of the descending channel, we might see a rebound towards the daily Tenkan-Sen (nine-period moving average, red line) at 1123.75. Currently, initial resistance stands at 1109.70, followed by 1116.80.