Gold prices fell for a second day and settled at $1171.94 per ounce, losing $7.67, as strength in the U.S. dollar and a recovery in stock markets weighed on the market. Although ongoing concerns surrounding Greece lured some buyers back into the market, gold continues to struggle with multiple headwinds. On the economic data front, the Chicago purchasing managers' index came in weaker than expected with a print of 49.4 and the Conference Board reported that its consumer confidence index jumped to 101.4 from 94.6 the prior month.

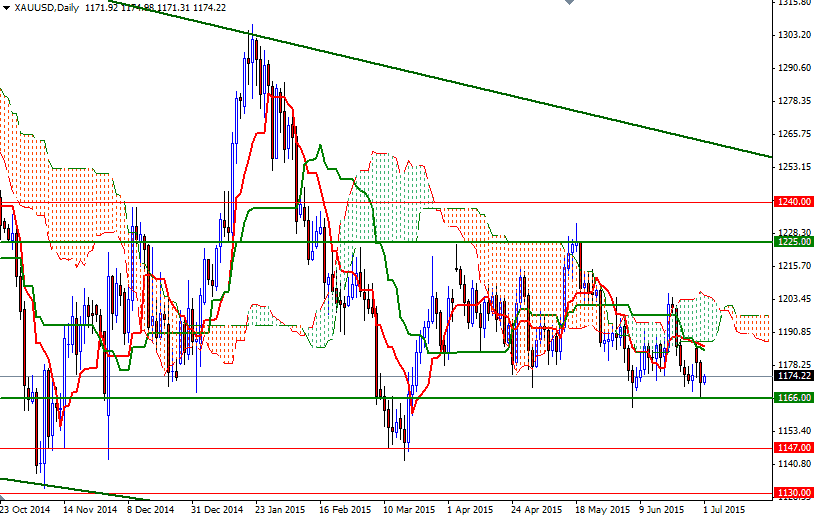

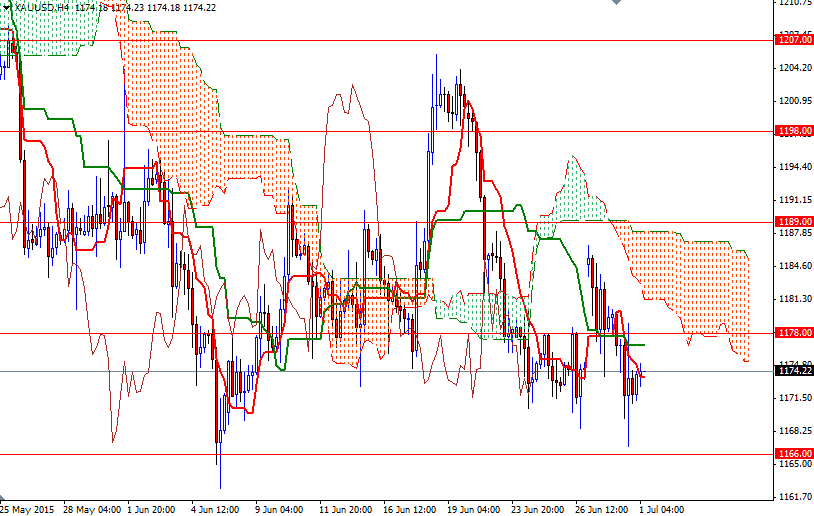

Technical selling was also behind gold's 0.65% decline on Tuesday. Failing to hold above the 1178 level caused short-term charts to realign with longer-term bearish inclinations and as a result the XAU/USD pair grinded lower to test the 1168/6 support region. As I mentioned in my previous analysis, this area is significantly important as it has been holding the market up lately. Therefore it is essential we break below this floor for a bearish continuation. A successful drop below 1166 would place control back in the paws of the bears as we head towards the 1147 support level.

On the other hand, if the 1168/6 support remains intact and prices start rising, look for a retest of 1178 and 1188/3. Since the Tenkan-Sen (nine-period moving average, red line), Kijun-Sen (twenty six-day moving average, green line) and the lower border of the Ichimoku cloud reside in the same region, it may not be an easy target for the bulls. I think breaching this barrier will pave the way towards the 1202 - 1198 zone.