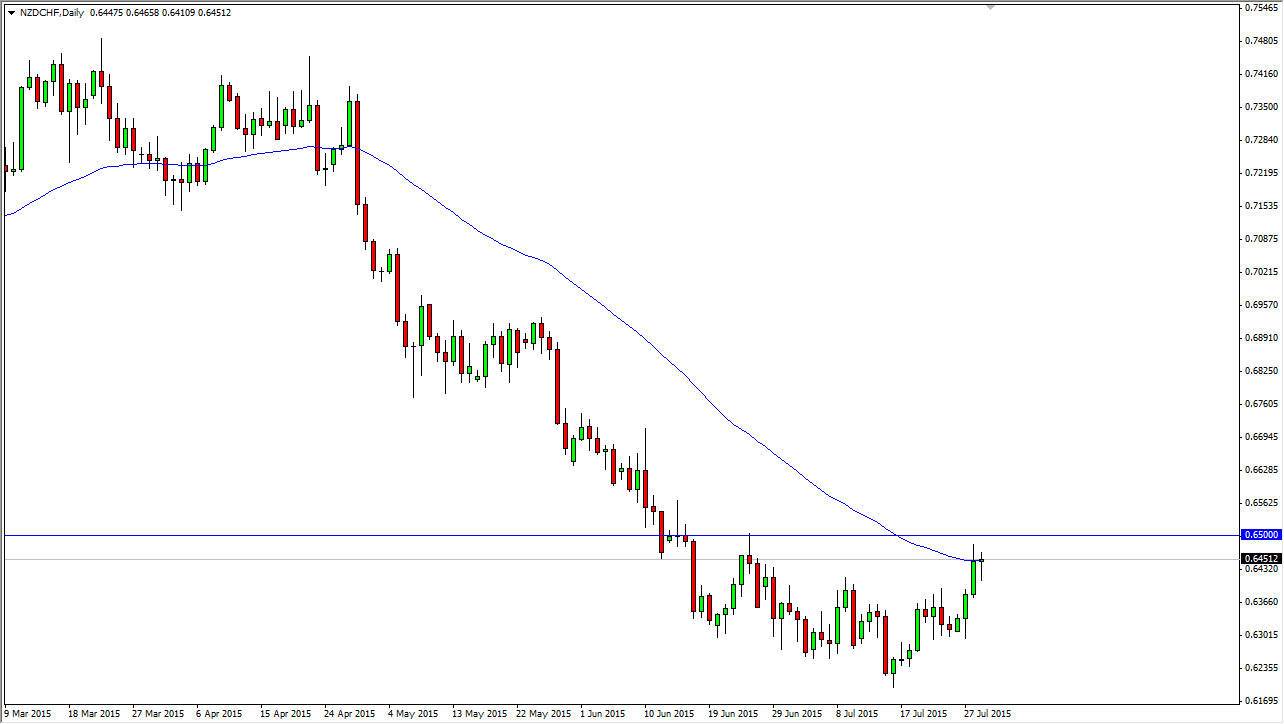

The NZD/CHF pair initially fell during the course of the session on Wednesday, but as you can see turned back around to form a hammer. The 0.64 level below offered enough support to turn things back around, and it now appears that the hammer that has appeared it looks like a market that wants to try to break above the 0.65 handle. Breaking above there, of course is a bullish sign as it is a large, round, psychologically significant number. However, we are most certainly in a downtrend, so we have to think about this as a market that is making a strong countertrend bounce.

Looking at the chart, you can see that the 50 day exponential moving average on the chart which is of course a popular moving average for the longer-term traders out there who tend to follow trends in general. Yes, you also have to pay attention to the 100 day and 200 day exponential moving averages as well, but at this point in time it does look as if the market is trying to break out.

Swiss franc

One of the things that continues to linger the back of my mind is the fact that the Swiss National Bank has been working against the value the Swiss franc lately. The fact that the New Zealand dollar of all currencies can gain against this currency tells me just how unloved the Franc is at the moment. I don’t want on that currency, because if the central bankers get involved again, we could very quickly see all pairs that are XXX/CHF in relation could shoot much higher. That being the case, the market should be one that is going to be difficult to short anyway. With that being the case, I think that we could very well move towards the 0.6750 level if we clear the 0.65 level on a daily close today. Pullbacks could offer buying opportunities, but I don’t feel its “safe” until we get above the blue line on the chart.