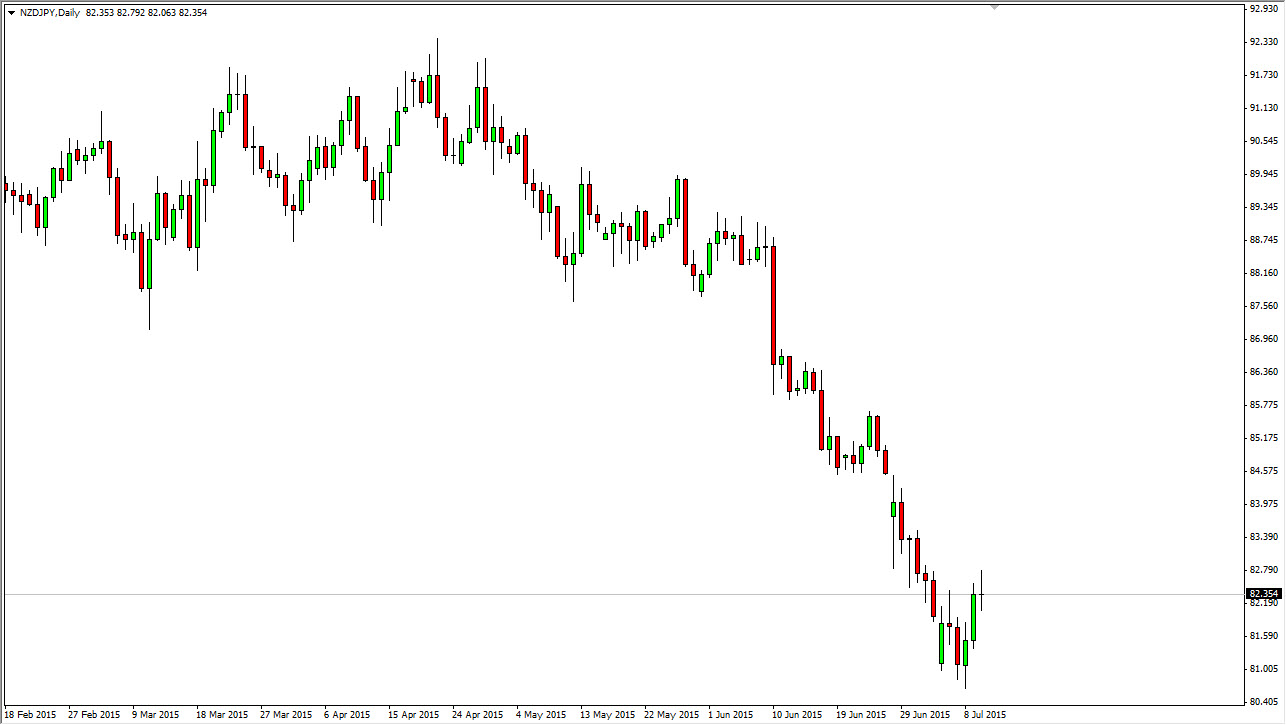

The NZD/JPY pair tried to rally during the course of the session on Friday but pulled back. This was a fairly volatile session but with a tight range, showing that perhaps the buyers are starting to run out of momentum. We believe that the market should continue the downtrend anyway, as the New Zealand dollar of course is a currency that most people don’t want to own right now. I think that the market will more than likely break down below the bottom of the range for the session on Friday, which is a nice selling opportunity. If we get that, the market should then head down to the 81 handle again, perhaps testing the 80 handle given enough time.

However…

If we break above the top of the range for the session on Friday, the market could go back towards the gap at the 84.50 region. Ultimately, we would probably try to get 85 which of course has a cluster and is a large, round, psychologically significant number. On the longer-term charts though, I think that this market continues to fall and with that I have absolutely no interest whatsoever in buying this pair over the longer term. However, there are short-term buying opportunities from time to time so I look at a break above the top of the range as a short-term trading opportunity only.

Ultimately, you have to watch the NZD/USD pair, and as long as that pair looks fairly soft, this pair will be as well. This is about the New Zealand dollar more than anything else, and as a result we should continue to see softness. Also, it looks as if the AUD/NZD pair is looking to rally, which shows that the New Zealand dollar is not only soft against the US dollar, the Japanese yen, but also against the Australian dollar, its closest competitor. That shows just how soft this currency is. This is why I am much more comfortable selling over the longer term.