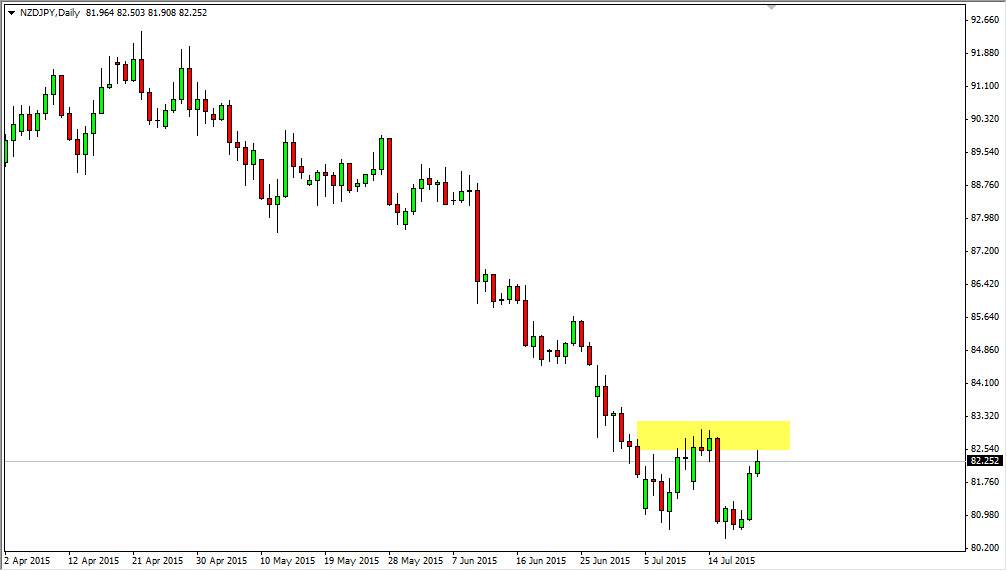

The NZD/JPY pair initially tried to rally during the course of the session on Tuesday, but as you can see we pulled back and gave quite a bit of the gains back after seeing the 82.50 level too strong as far as resistance is concerned. Quite frankly, I think that the resistance is really closer to the 83 handle, so we could see a little bit more of a grind higher. Ultimately though, I am ignoring that because I do not like owning the New Zealand dollar at the moment. After all, it is highly leveraged to the commodity markets, while the Japanese yen most certainly is not.

I don’t like owning the Yen in general, but in this particular case and willing to make an exception. After all, New Zealand continues to show concerns when it comes to Asian economies slowing down. With this, you could watch such futures markets as cattle or milk, but at the end of the day it’s easier just to follow the overall “attitude” of commodity markets and trade the New Zealand dollar accordingly.

Selling resistive candles

What I need to see is some type of resistive candle, or perhaps a break down below the Tuesday range. At that point in time, I would anticipate that the markets going to drop to the 81 handle, and possibly even lower than that if we can pick up momentum. In fact, I believe that we break down below the bottom of the range without trying to rally from here that is a sign that the sellers are starting to pick up momentum again. That would make the odds of a break down below the 81 handle much more significant.

I have no interest in buying this pair, at least not until we get above the 86 handle. At that point in time, I’m willing to consider a bit of a trend change, but in the meantime I don’t necessarily think that’s going to happen anytime soon.