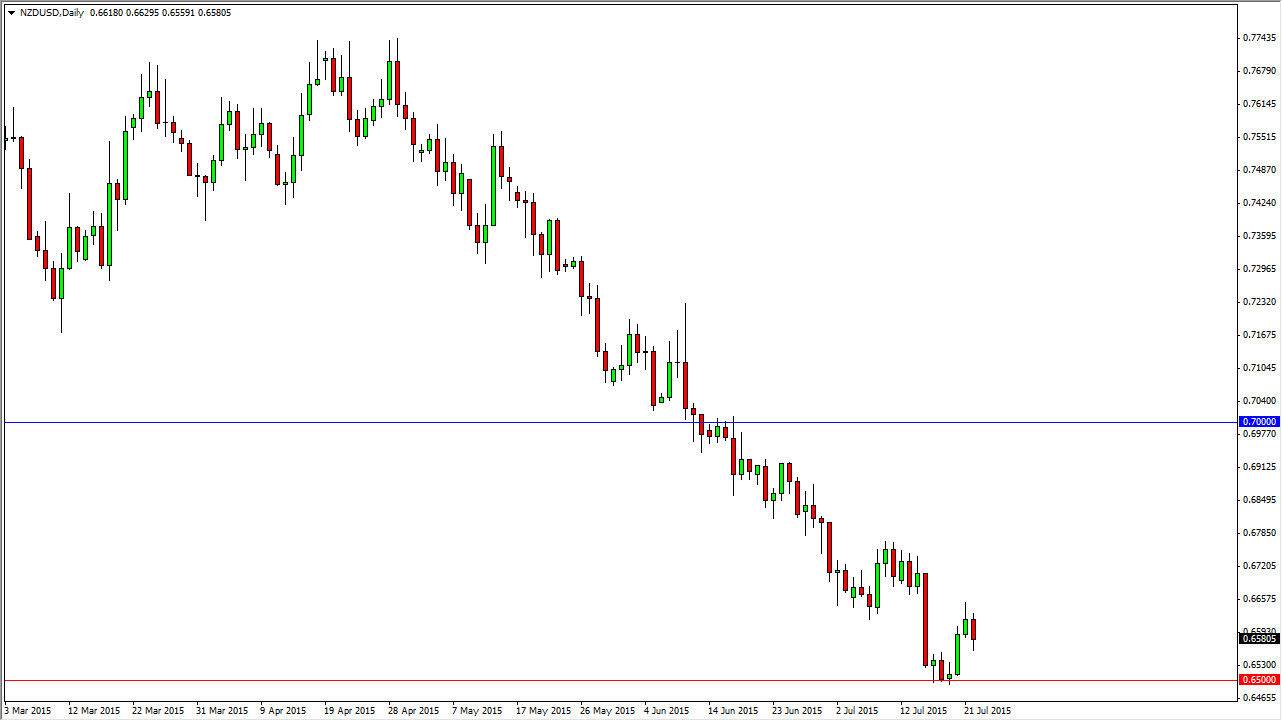

The NZD/USD pair broke down below the bottom of the shooting star from the previous session on Wednesday, triggering a classic sell signal as far as I am concerned. Because of this, I feel that the market is probably going down to the 0.65 level next, as the market simply continues to punish the New Zealand dollar in general. After all, the market should head to the next basic support level, as it does tend to move from “point A to point B.”

The candle isn't necessarily overly impressive, but what is impressive is the trend itself. With that being the case, the market looks as if selling is the only thing that’s truly possible. I agree with this premise, simply because the commodity markets in general continue to soften. On top of that, we have to keep in mind that the Asian economies are starting to show signs of slowing down yet again. With that, I have a hard time believing that the New Zealand dollar will be favored as it is so highly leveraged to the general attitude of commodities worldwide.

Selling rallies

I believe that selling rallies will be the way to go going forward, and with the Reserve Bank of New Zealand expected to cut rates, we should continue to see softness in the New Zealand dollar overall. With this, it’s probably only a matter of time before we not only break down below the 0.65 handle, but head towards the 0.6250 level which is the next minor support level. With this, there will be a massive amount of support somewhere, but we are not near it yet.

Any rally at this point in time will more than likely run into a lot of resistance near the 0.6750 level, and most certainly at the 0.70 level which I see as the current “ceiling” in this particular currency pair. Ultimately, I think that we will have to look to longer-term charts to even think about going long at this point in time.