NZD/USD Signal Update

Yesterday’s signals expired without being triggered as the price never got up to 0.6762.

Today’s NZD/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, or after 8am Tokyo time later.

Short Trade 1

- Go short following bearish price action on the H1 time frame immediately upon the next touch of 0.6620.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

- Go short following bearish price action on the H1 time frame immediately upon the next touch of 0.6720.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

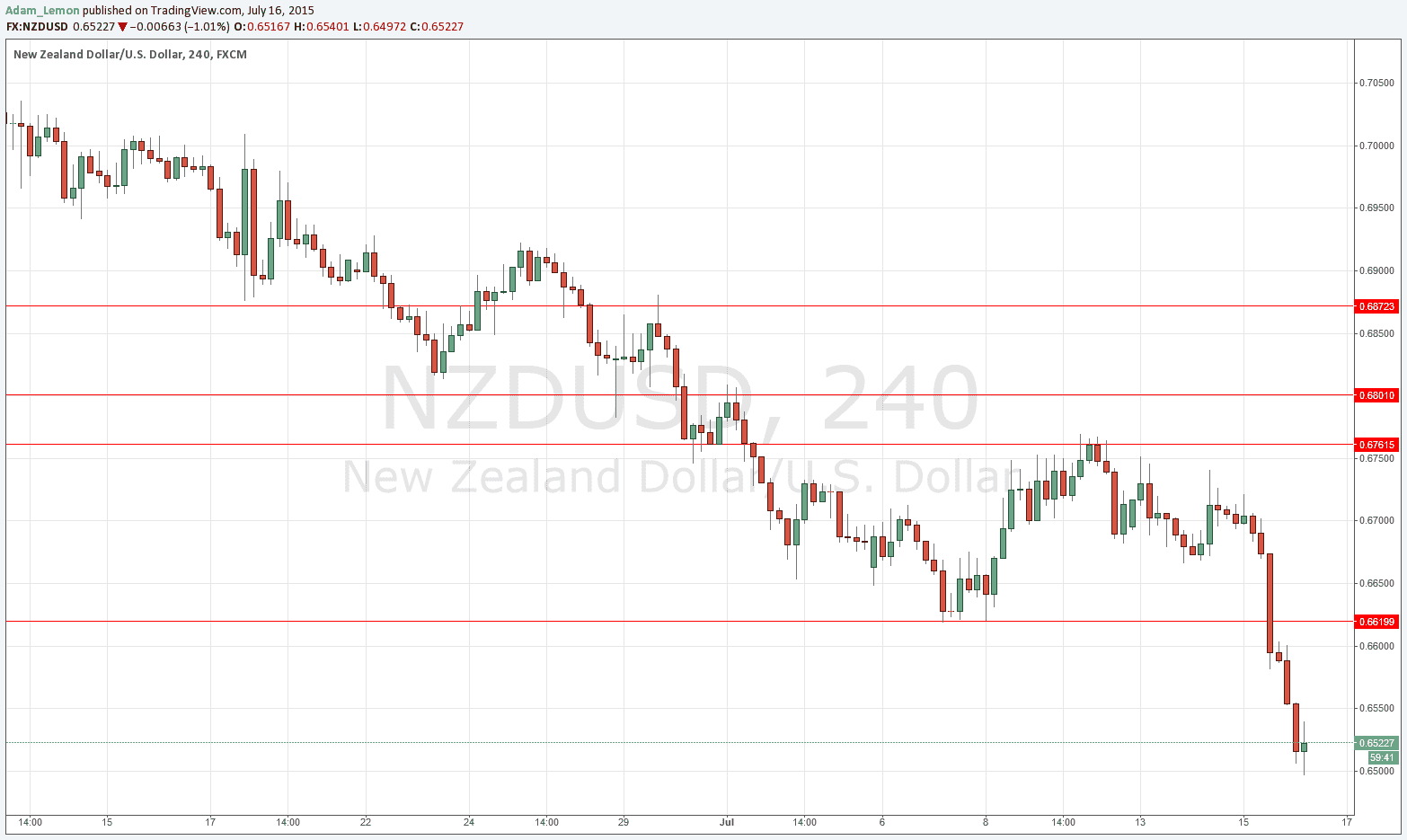

NZD/USD Analysis

We have a nice continuation of the strongly bearish trend in this pair, with a great combination of renewed strength in the USD and poor economic data coming out of New Zealand (a big drop in the GDP Price Index and worse than expected CPI). This led the pair to fall in two bursts: firstly after Janet Yellen’s comments, secondly after the CPI data was released.

We can expect the previous support at 0.6620 to now flip and act as good resistance.

This pair has now made a 6 year low but there are some initial signs of support coming in at the psychologically key round number of 0.6500.

It is no accident that the pair that benefits the most from a renewed push within an existing trend is the pair that has been trending most strongly. This pair has been falling hard and should be a magnet for trend traders interested in being long USD. The only drawback is the very negative overnight interest, but this trend has more than paid for it.

There is nothing due today regarding the NZD. Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm London time followed by the Fed Chair’s testimony before Congress and the Philly Fed Manufacturing Index at 3pm.