NZD/USD Signal Update

Last Thursday’s signals expired without being triggered.

Today’s NZD/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, or after 8am Tokyo time later.

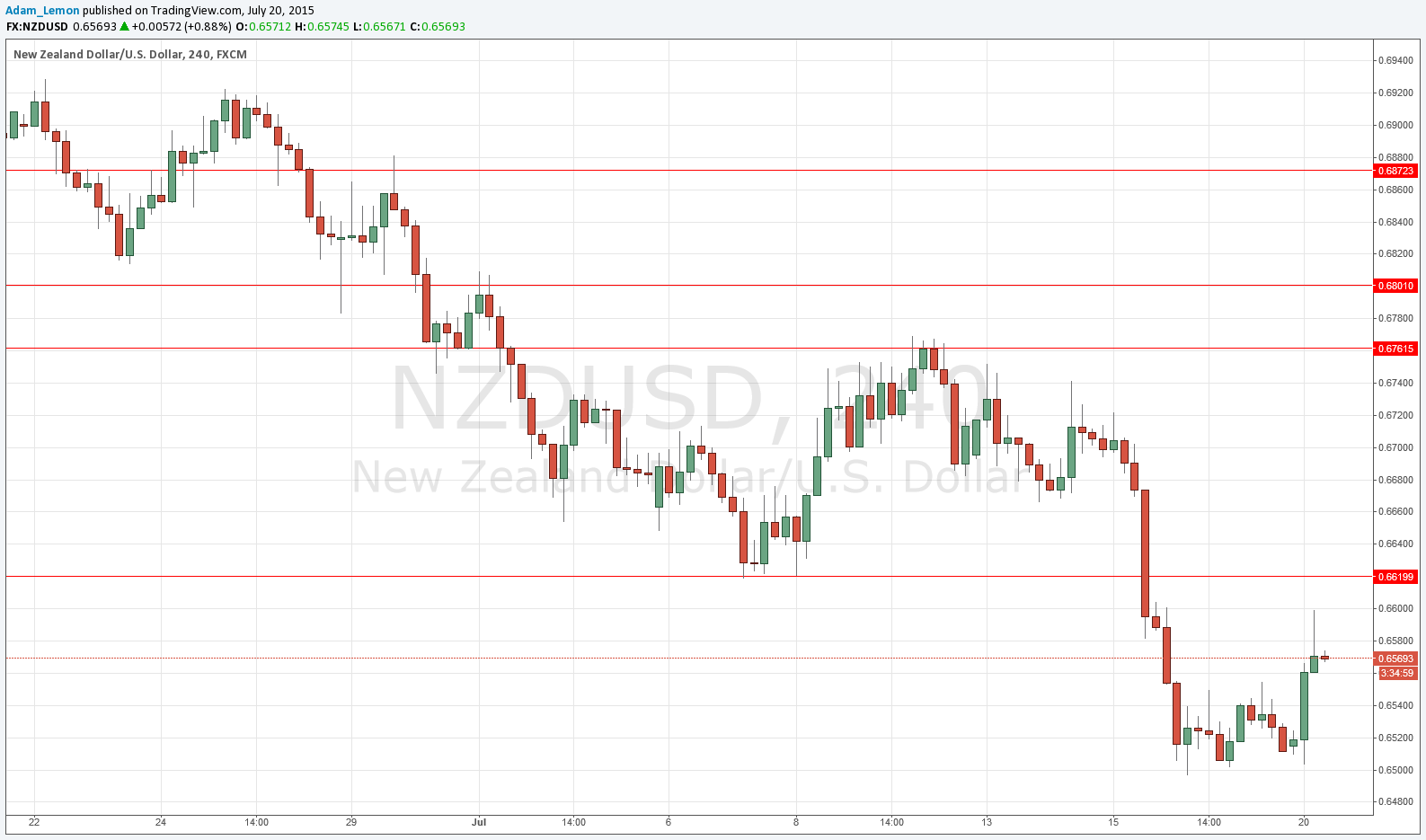

Short Trade 1

Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.6620.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.6761.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 3

Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.6800.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride

NZD/USD Analysis

For once this pair is not the one where the USD is making new 6 year highs. As the week opens, it seems that it is going to take more to break down past the psychologically key round number at 0.9500 which has produced a bottoming out.

There was a strong rise late in the Asian session, but it seems that the price is poised to fall now. Alternatively it may rise again and test the key resistance level at 0.6620, although it did already hit the round number at 0.6600 so that might not happen today.

There is nothing due today regarding either the NZD or the USD.