NZD/USD Signal Update

Yesterday’s signals expired without being triggered

Today’s NZD/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, or after 8am Tokyo time later.

Short Trade 1

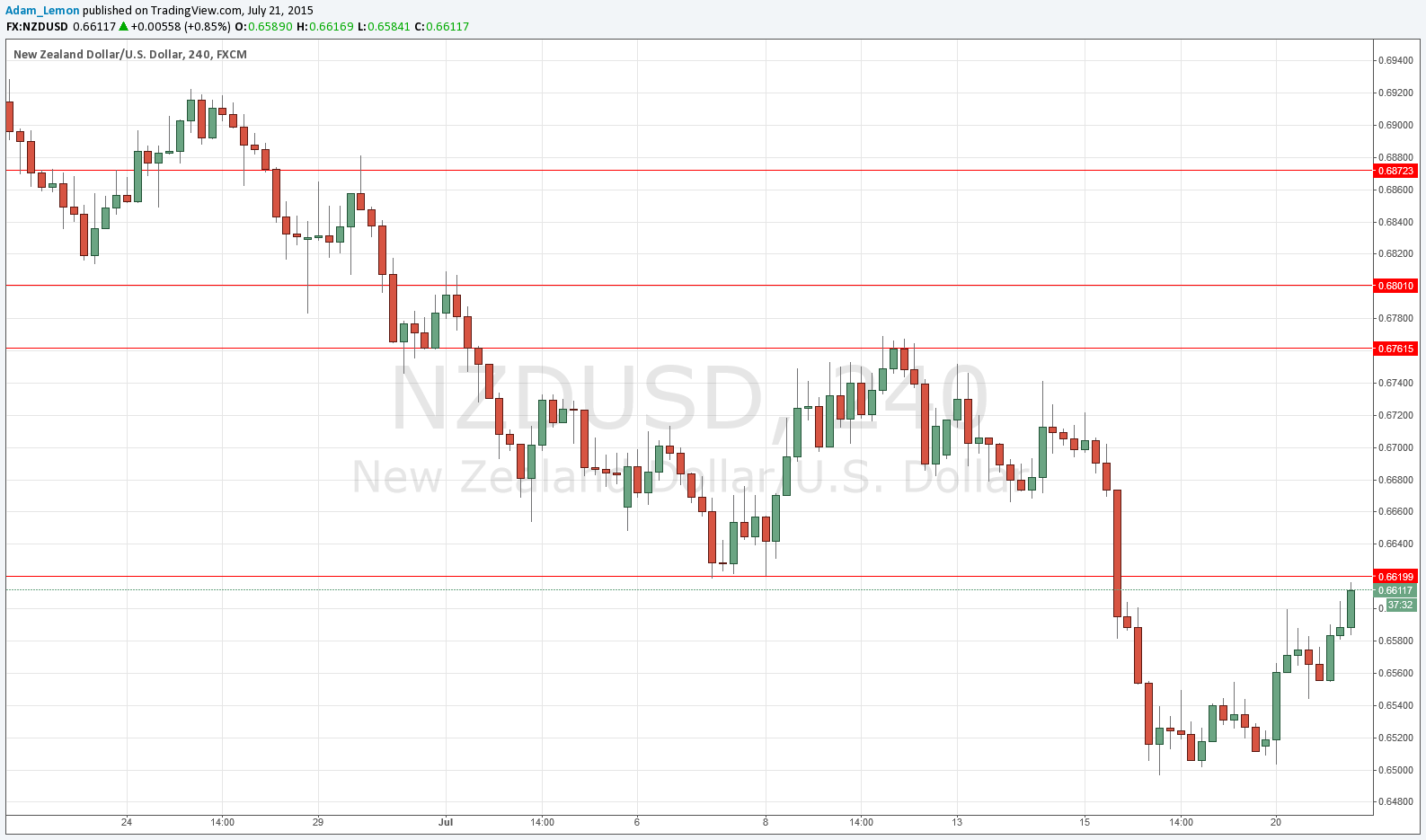

Go short following bearish price action on the H1 time frame immediately upon the next touch of 0.6620.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following bearish price action on the H1 time frame immediately upon the next touch of 0.6761.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 3

Go short following bearish price action on the H1 time frame immediately upon the next touch of 0.6800.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

NZD/USD Analysis

There are signs that the strongly bearish trend has ended or is at least undergoing a deep pull back, following yesterday’s comments by New Zealand’s Prime Minister signalling that the recent strong fall in the Kiwi had gone far enough. It is always easier for governments and/or central banks to weaken rather than strengthen their currencies of course, so this does not necessarily mean the end of the long-term downwards trend.

At the time of writing, we are approaching the first likely resistance level of 0.6620. During yesterday’s New York session it had looked as if this pair was ready to fall again, but the price moved up instead.

Below, as many analysts anticipated, 0.6500 was supportive.

There is nothing due today regarding either the NZD or the USD.