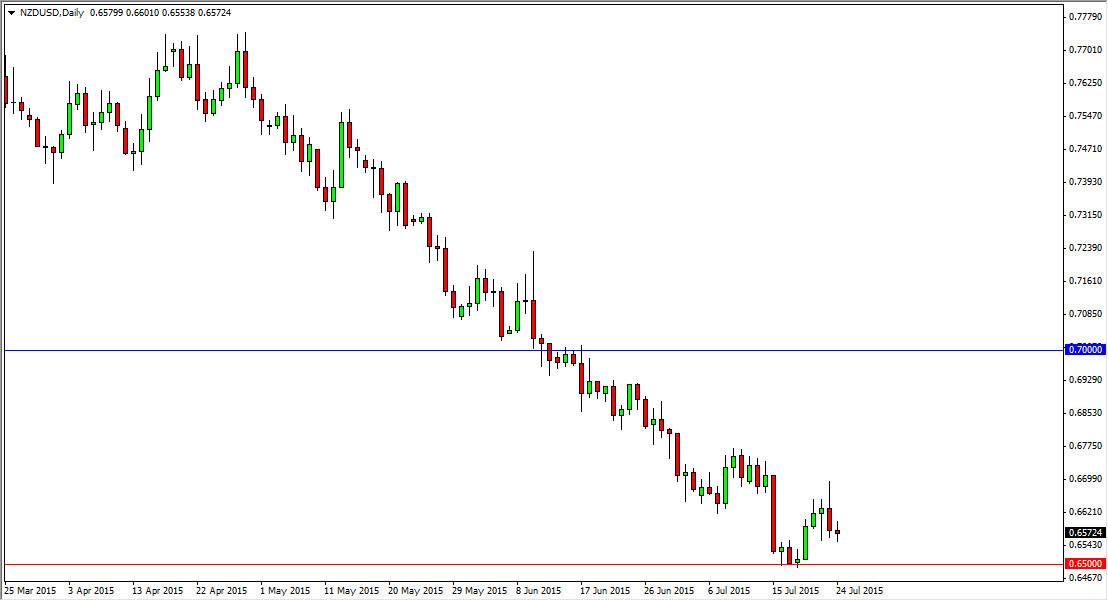

The NZD/USD pair went back and forth during the course of the session on Friday, ultimately forming a slightly negative candle for the session. The market has been in a massive downtrend lately, which of course makes a lot of sense as the New Zealand dollar is so highly leveraged to so many commodity markets, especially agricultural. You have to think of the New Zealand dollar as a barometer for “risk appetite” when it comes to commodity markets, and as a result we have to look at the overall attitude. Right now, most commodity markets look very soft, so that should continue to work against the New Zealand dollar. On top of that, you have to keep in mind that the Reserve Bank of New Zealand has recently cut interest rates, and that of course diminishes confidence in the Kiwi dollar going forward.

Selling rallies

I’m looking for short-term rallies to start selling, as there is so much in the way of downward pressure. I believe that the 0.6750 level is massively resistive, and I also believe that the 0.70 level above is the “ceiling” in this market, and as a result I have no interest in buying this pair. I am simply biding my time and waiting for resistive or exhaustive candles in order to start shorting. I look at it as “value” in the US dollar but time we rally. I think that eventually we break down below the 0.65 handle, and go to much lower levels.

A break down below that level should send this market looking for the 0.6250 level, which has been supportive in the past. I believe that until we get some type of turnaround in several different commodity markets at the same time this pair is going to continue to struggle overall. As far as a technical signal is concerned, I have absolutely no interest in buying this pair until we break above the 0.71 handle, something that isn’t going to happen anytime soon. This is by far one of my favorite trades on short-term charts.