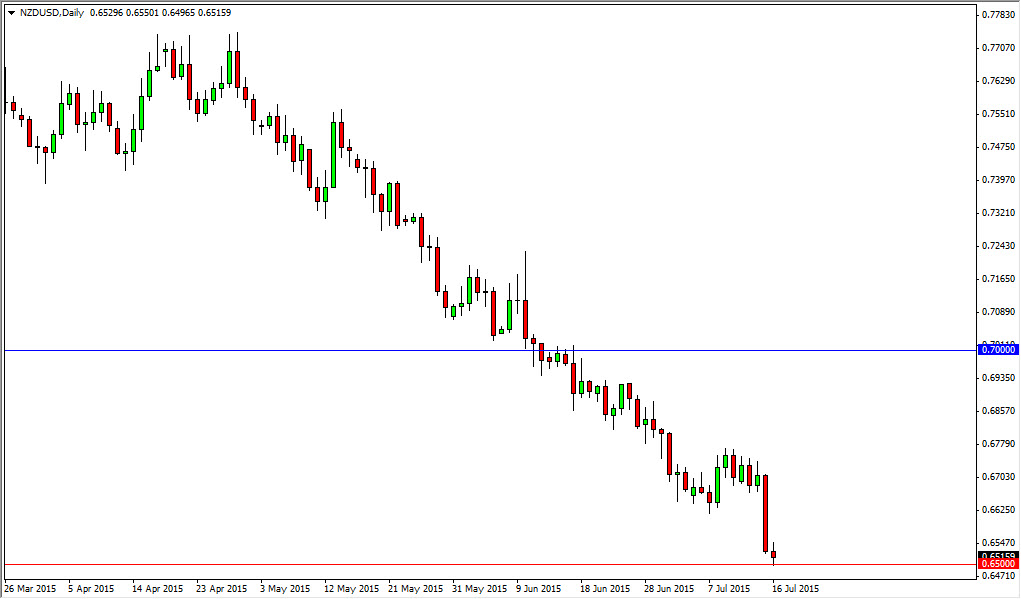

The NZD/USD pair fell slightly during the session on Thursday, slamming into the 0.65 handle. This is of course an area that should be supportive based upon the fact that it is such a large, round, psychologically significant number, and as a result it does not surprise me that we may have stalled a bit as far as the downtrend is concerned. Because of this, I believe that we could get a little bit of a bounce, but I think that will only offer value as far as the US dollar is concerned. The US dollar is of course the strongest currency in the world at the moment right now, and as a result it makes sense that the pair should continue to go even further to the downside.

New Zealand dollar and commodity markets

The New Zealand dollar is of course highly leveraged to the commodity markets as the Asian demand for commodities will certainly have an influence on New Zealand. Granted, it’s mainly due to agricultural commodities in general, but the Kiwi dollar does tend to follow the overall attitude of commodity markets in general. With that, I feel that this is a market that cannot be bought just simply because in order for the attitude of commodity markets to change, we would suddenly have to be quite a bit of demand worldwide. Right now, we simply do not have that.

I think that the higher that this pair goes, the more interesting it will be to start selling again. The 0.70 level above is essentially what I considered to be the “ceiling” in this market, so as long as that’s the case, I believe that every rally that shows any hints of failing will be a nice opportunity to get short again. Having said that though, we could just simply sliced through the 0.65, which of course would be a sell signal as well. At that point time, I would anticipate a move down to the 0.64 handle.