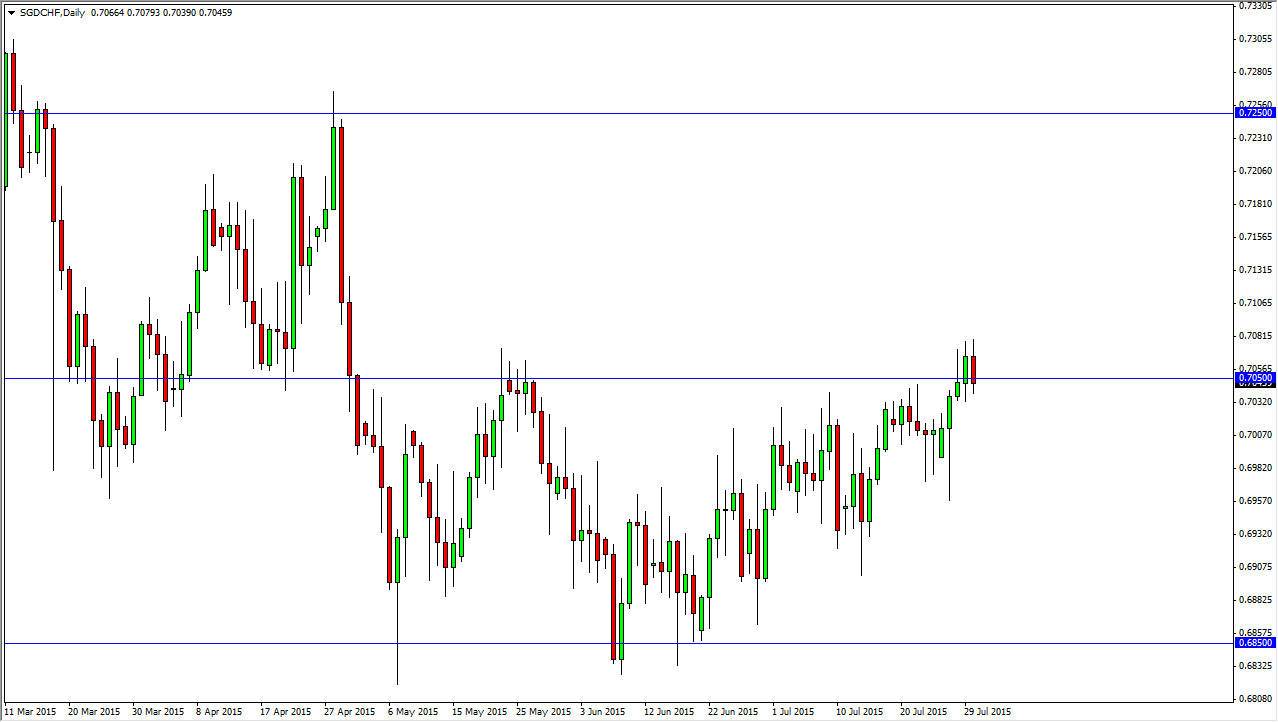

The SGD/CHF pair fell during the session on Thursday, testing the 0.70 level. Because of this, I think that the buyers are going to step back into this market on a short-term chart, and as a result we should continue to go higher. After all, we did break above pretty significant resistance recently, and that should send this market looking for the next significant resistance barrier, the 0.7250 level. Quite frankly, I don’t think that the market is going to shoot straight to that level, but I do recognize that we should get there. It should be fairly choppy on the way up, but that will be a surprise either because both of these are considered to be “safety currencies.”

However, there is one caveat in this pair that we don’t typically see, and that of course is the fact that the Swiss National Bank has been working against the value the Swiss franc again. That of course will favor the Singapore dollar in this particular circumstance, even though I’m not a big fan of the Sing dollar either. With that being said though, this is all about relative strength.

Buying on dips

Going forward I think the best way to trade this market is to simply buy the Singapore dollar every time it dips against the Swiss franc. Ultimately, you look at the recent move, and it has been very back and forth, and somewhat of a “perfect channel. Because of this, I think as long as we can stay above the 0.70 level, we might as well continue to buy as we have a nice 45° angle going higher, which of course is a perfect uptrend. It’s not too strong, not too soft, and of course is well supported. With that being said, I have no real interest in selling at this point in time because I don’t trust the Swiss National Bank not to get involved before it’s all said and done. Granted, it won’t be in this particular pair, but there were always be a “knock on effect.”