This is a pretty unique pair and exotic for a lot of you out there, but the truth of the matter is that these are two major Asian currencies. With this, a lot of traders and Asia are heavily involved in this market, as Singapore is a major financial home in Asia, just as Hong Kong is. A lot of banks will transfer back and forth between the Singapore dollar, and the Hong Kong dollar.

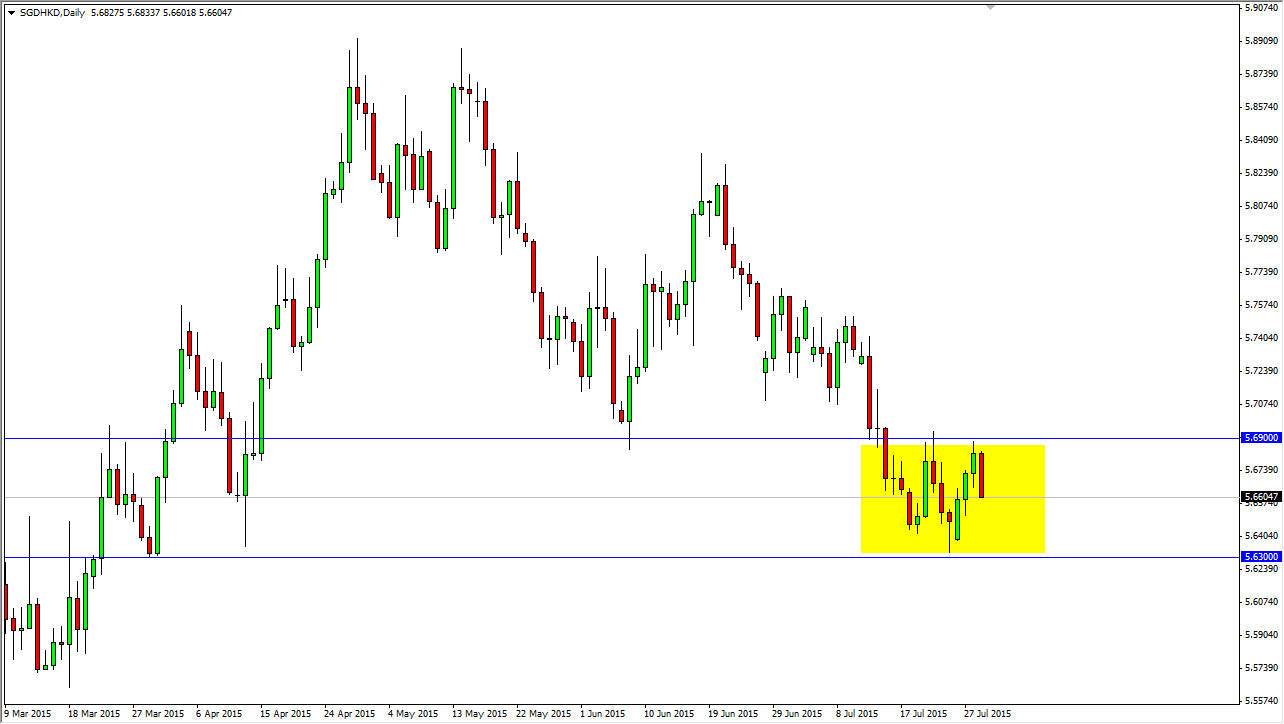

Looking at this chart, you can see that I have drawn a yellow box on this chart. I believe that the 5.69 level above is resistance, while the 5.63 level below is support. The market tends to be fairly choppy but eventually will move in a trend. You simply have to be patient and a market like this that is traded back and forth quite often. After all, the market features a lot of banking, so therefore there is a lot of necessity when it comes to trading this pair, which of course can have a major influence as it isn’t necessarily always going to be about speculation.

Summertime

On top of that, it is the middle the summer. Liquidity will be low in most markets, and then exotic pair like this one of certainly will suffer from that. Ultimately, the market fell significantly during the course of the session on Wednesday, heading towards the middle of the yellow box. This means that we should continue to go lower, perhaps heading down to the 5.63 level. I do believe that eventually we break down below there, but recognize that we may need to make a few different attempts at it, so I think that short-term rallies will probably be jumped on by Hong Kong dollar buyers.

On the other hand, if we did break above the 5.69 level, I feel that we probably head to the 5.73 level which is the beginning of more noise again. The trend recently of course has been down, and I think that continues going forward.