Gold prices ended slightly lower Tuesday as the majority of market participants opted to remain on the sidelines ahead of Federal Reserve Chair Janet Yellen's congressional testimony. Gold has come under renewed pressure in recent days as investors abandoned the precious metal on expectations of tighter monetary policy in the Unites States. Yellen said last Friday the Fed was on course to hike interest rates later this year. U.S. retail sales data came in weaker than expected but the unexpected drop in June failed to have a long lasting impact on the greenback.

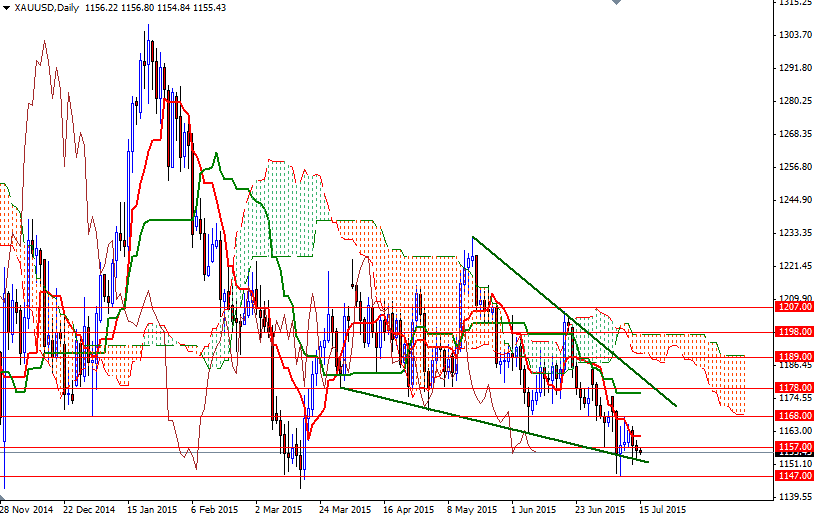

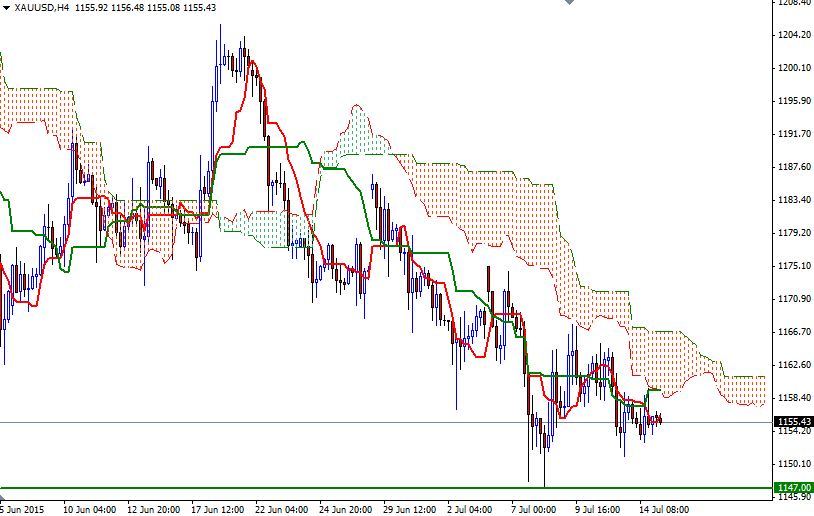

The market has been locked in a narrow range of around $21 an ounce (roughly between $1168 and $1147) for the past seven sessions and the support below has a significant importance. As you can see on the 4-hour time frame, prices continue to feel the pressure of the Ichimoku clouds. Technically speaking, the Ichimoku cloud indicates an area of resistance (or support depending on its location) so basically the trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself.

At this point, XAU/USD will have to either break through the 1168 resistance and move towards 1178 or drop below the 1147 level and start a journey to the 1133/0 area. While a sustained drop below this zone would prolong the bearish momentum and open up the risk of a move towards 1083, clearing the resistance at 1168 would make me think that the bulls are ready to tackle the next barriers at 1172 and 1178.