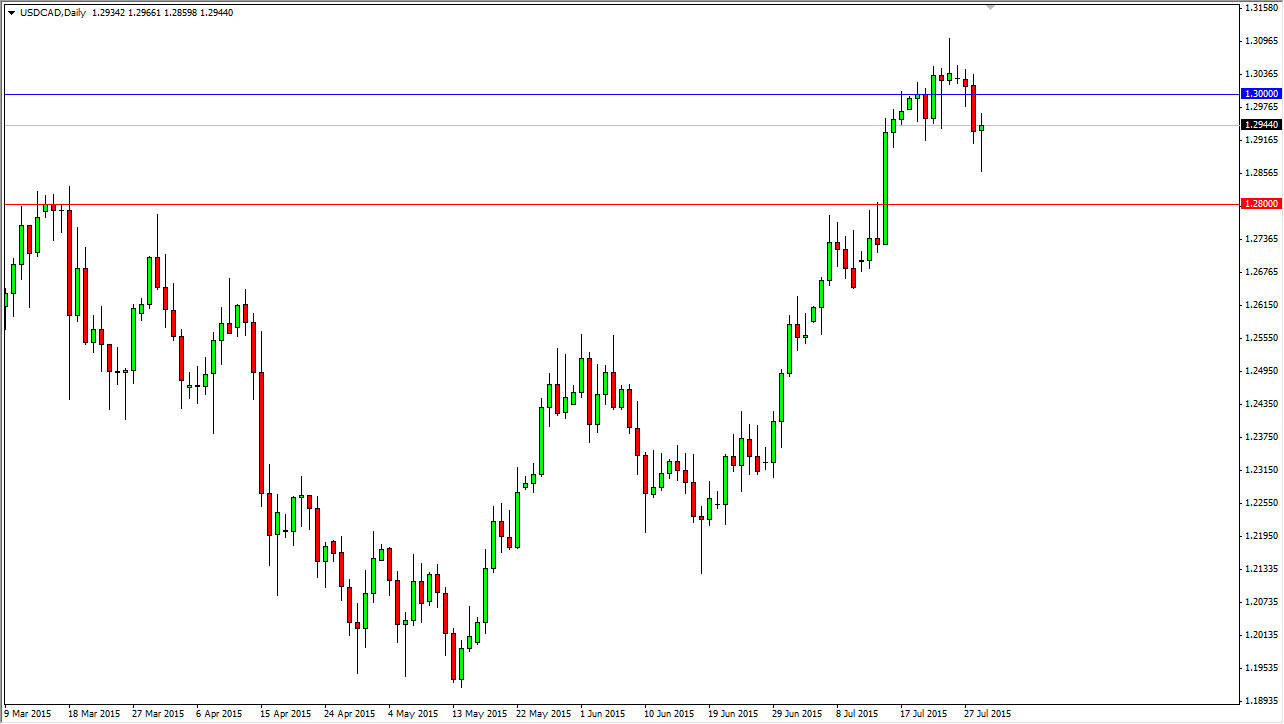

The USD/CAD pair initially fell during the course of the day on Wednesday, but found enough support near the 1.2850 level to turn things back around and form a hammer. This hammer of course is a sign of bullish behavior, and as a result I think that this pair is going to continue to go much higher. I have a red line on this chart near the 1.28 handle, and I think that is essentially the “floor” in this market at the moment. The fact that we bounced during the session course is a very good sign for the US dollar, and as a result the market should continue to go much higher.

I believe that this market continues to consolidate in this general vicinity, reaching towards the 1.31 level over the course of the next several sessions. With that, it will be choppy but ultimately it’s a situation where the US dollar of course will strengthen over the Canadian dollar as long as the US dollar is favored in general. On top of that, we have issues in the oil markets.

Crude oil

Crude oil markets of course are not helping the Canadian dollar all, and although they did rally during the course of the session on Wednesday, the truth is that the market has a long way to go before it would look bullish. In fact, the $50 level needs to be broken well above in order for the oil markets and turned back around and continue to much higher. However, at this point in time there is the high probability that the market will have sellers in that general vicinity, so at that point in time I would be willing to sell a resistive candle in the oil markets. This should coincide with a move higher in the USD/CAD pair, as well as all other pairs that are in fact XXX/CAD. This pair of course will be different, especially considering that the Federal Reserve is looking to tighten its interest-rate situation.