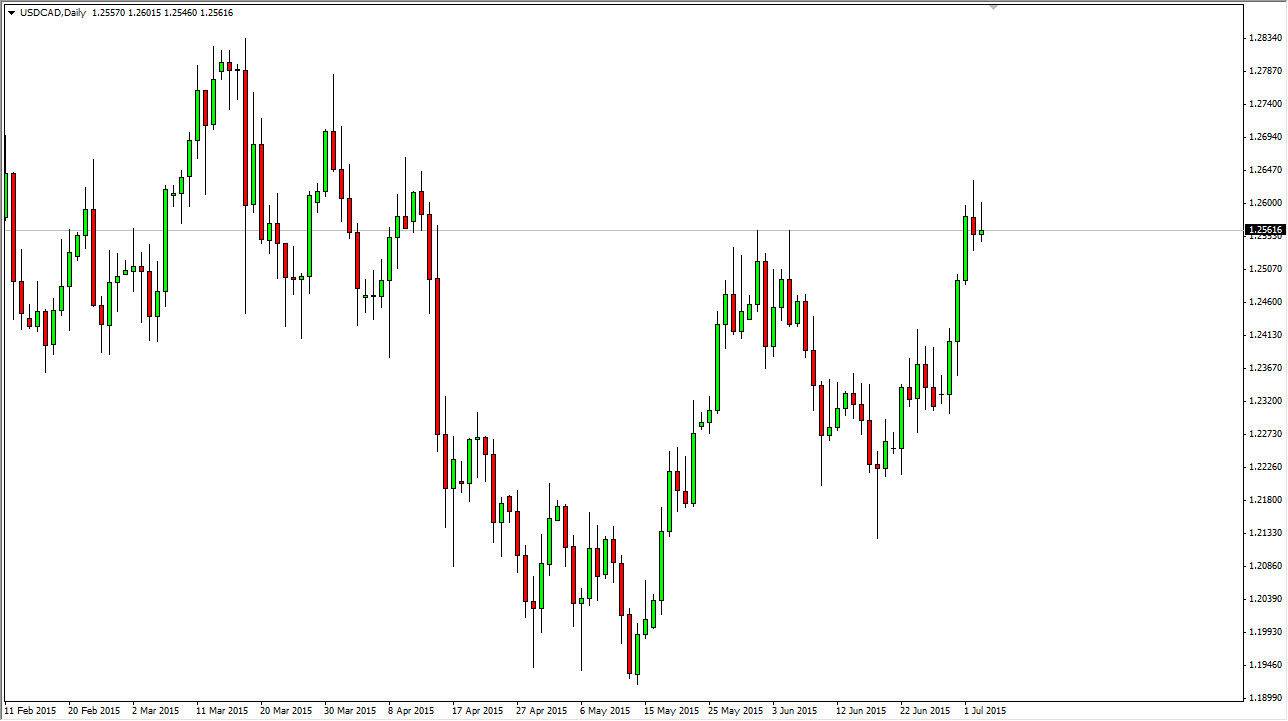

The USD/CAD pair tried to rally during the course of the session on Friday, just as it tried on Thursday. However, we got a repeat session as we ended up pulling back to form a shooting star, which of course is a very negative sign. With that, it’s probably only a matter of time before we break down a little bit. I don’t necessarily think that we are going to fall significantly, just that a pullback may be needed in order to continue the momentum to the upside. I think that the 1.24 level below is probably support, and as a result any type of short-term pullback will only be a short-term selling opportunity at best.

On the other hand, we could break above the top of the shooting star from Friday and Thursday, and if we do I would be a buyer as the market will then head towards the highs again. The 1.2850 level above should continue to be resistive, but it will be a magnet for price. With that, I would not hesitate to sell but I would also recognize that there will be a lot of volatility between here and there. With that, it doesn’t really matter which direction we go, the one thing you can count on in this pair is volatility.

Oil markets certainly aren’t helping

Oil markets are a bit soft, but more importantly they are choppy. So having said that the markets look as if they are ready to make a decision quite yet, and that of course will be reflected in the USD/CAD pair as a Canadian dollar is so highly influenced by petroleum. However, that correlation is starting to die down a little bit, mainly because the United States is starting to produce more and more of its own oil. Over time, this could change completely, but people are still using the Canadian dollar as a proxy for oil, so keep an eye on that market as well. In the meantime, be patient, you’re going to need it in this market.