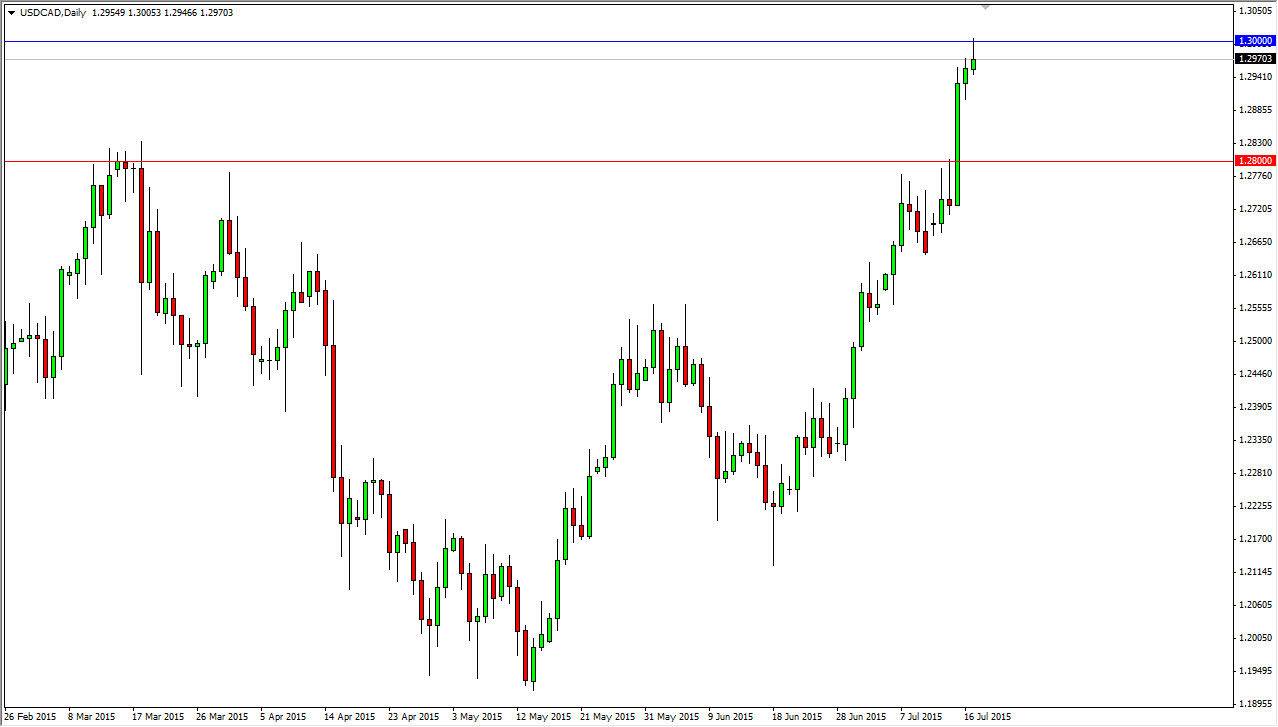

The USD/CAD pair broke higher during the course of the day on Friday, and actually broke just above the 1.30 level at one point during the day. However, we cannot hang onto the gains and we pulled back to form a bit of a shooting star. While this candle is very bearish, the truth is that we have recently broke above pretty significant resistance in the form of the 1.28 handle, which of course extended resistance all the way to the 1.30 level. It was more or less a “zone” from back during the financial meltdown. With that, there is a lot of “market memory” in this area, and as a result traders will pay very close attention to this level.

I believe that a pullback is coming but I also recognize that the 1.28 level could very well offer support. Will we might be seeing is the market getting ready to pull back in order to try to build up enough momentum to finally break out. After all, this is a major barrier, and breaking above here would lead to a multi-year trend move in my opinion.

Oil markets

Oil markets look like the ready to break down. If they do, this pair will eventually break above the 1.30 level as traders tend to use the Canadian dollar as a proxy for the crude oil markets. If that’s the case, I think that you can continue to buy this pair going forward, and the dips will offer “value” in the US dollar going forward. On the other hand, I think that we could fall as low as 1.2650 and still find support. In other words, I’m going to be very patient but I am looking for either break out to the upside, or some type of supportive candle below in order to start buying this pair yet again. After all, the US dollar looks very strong in general, and oil markets are doing no favors for the Canadian currency at this point in time.