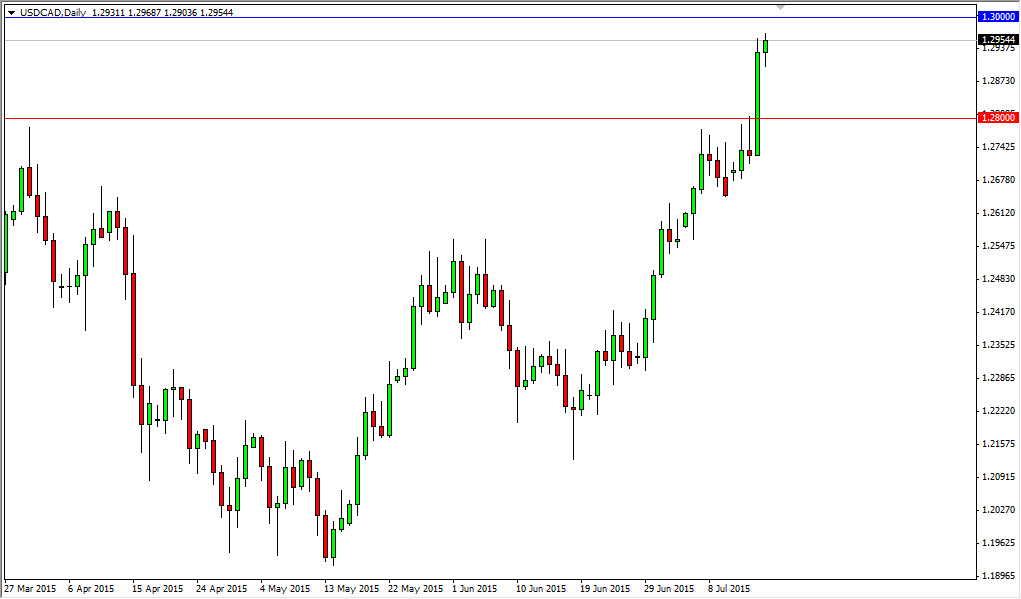

The USD/CAD pair broke higher during the course of the session on Thursday, breaking all the way up to the 1.2950 level. With this, I feel that it’s going to try to reach towards the 1.30 level given enough time, but you have to keep in mind that is a major level when it comes to the currency pair. After all, this is exactly where we stopped several times during the financial crisis, and that type of memory certainly weighs heavy upon a market.

Because of this, I think it’s only a matter of time before the seller’s pushes market lower. However, I think that with the recent move we should continue to see buyers come back into this market again and again. Dips are buying opportunities, but I recognize that the area near the 1.30 level is massively resistive, and will probably continue to be so over the longer term.

Interest-rate cut

The Bank of Canada had an unexpected interest-rate cut during the session on Wednesday, and that of course got the buyers excited yet again. With that, it appears that the market might finally have a catalyst to break out above the aforementioned 1.30 level, but quite frankly there is so much in the way of resistance there we will need to build up a massive amount of momentum to make that happen. Pullbacks could be used as opportunities to build, but ultimately the volatility could be out of control.

On the other hand, if we can break above the 1.30 level, and more importantly get a daily close above that level, I would buy this currency pair hand over fist as it should be a longer-term buy-and-hold type of signal. In fact, I think we could go astronomical a higher if we clear this barrier.

Pullback should be supported all the way down to the 1.2650 level, so any type of supportive candle between here and there is a short-term buying opportunity. However, I’m not willing to hang onto a positive trade to the upside until we clear the aforementioned 1.30 barrier.