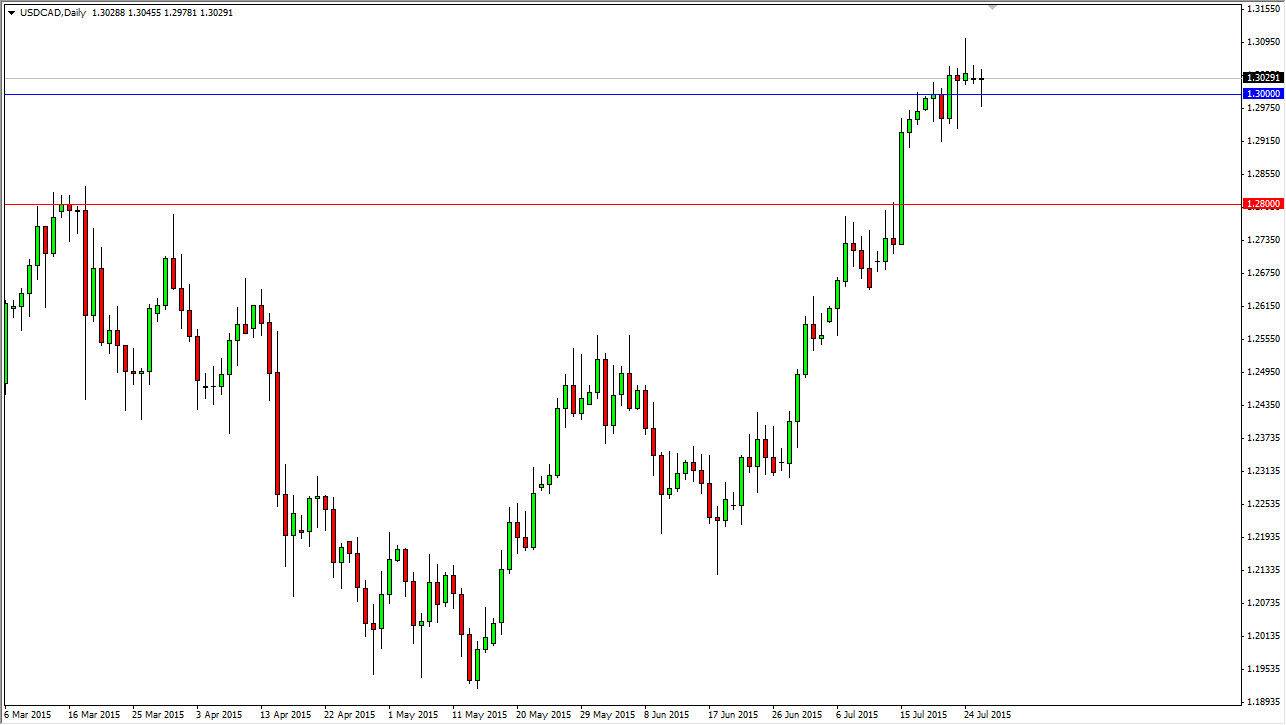

The USD/CAD pair initially fell during the course of the session on Monday, but found the 1.30 level to be supportive enough to turn the market back around and form a hammer. With this, it suggests that we are going to go much higher, perhaps finally breaking out given enough time. You have to keep in mind that the move higher has been rather impulsive, and of course with the Bank of Canada cutting interest rates recently, it makes sense that the Canadian dollar would be on its back foot.

On top of that, we have will markets that are falling apart, and that of course does not help the Canadian dollar either. I believe that the Light Sweet Crude (WTI) grade is probably heading down to the $45 handle, and as a result we should still see plenty of pressure on the Canadian dollar in general, thereby making this pair finally break out to the upside for a longer-term move.

1.28

I believe that the 1.28 level offers a bit of a “floor” in this market, and as a result any type of support between here and there is a buying opportunity as far as I can tell. After all, the US dollar will be favored as there is a lot of uncertainty out there, especially considering that the Shanghai Composite Index fell over a percent during the session on Monday. That of course has a lot of people concerned about demand for crude oil, and that of course works against Canada as it is a bit of a proxy in the currency markets for oil.

I believe that every time we pullback it’s a buying opportunity, and I do think that once we get above the 1.31 handle, we will continue to go higher, perhaps even starting a multi-year buying opportunity. This is the area that had been so resistive during the financial crisis previously, so breaking out of this area is in fact a very massive signal to start buying.