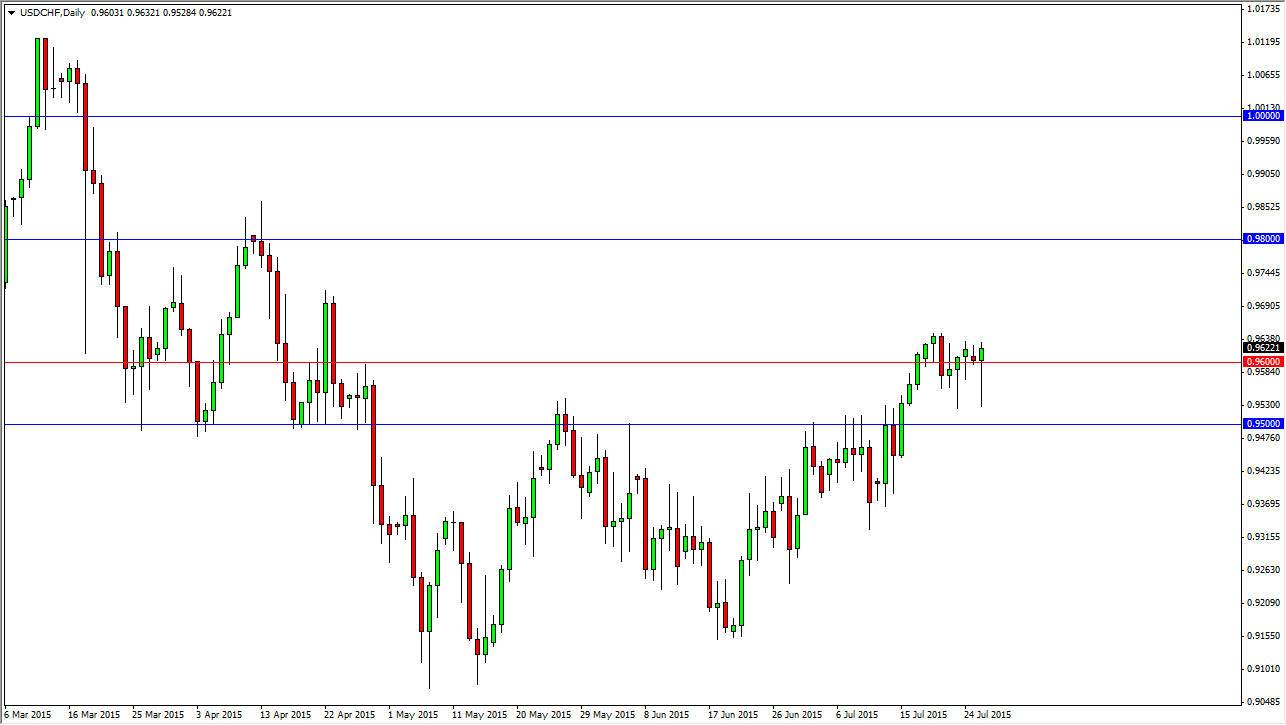

The USD/CHF pair initially fell during the course of the session on Monday, but found support just above the 0.95 level yet again. By doing so, we ended up forming a nice-looking hammer, and as a result it looks as if the market is going to continue going higher. With this, a break above the top of the hammer, or even the highs from last week would be reason enough to start buying. I believe at that point in time we would head towards the next blue line on the chart, which was significant resistance at the 0.98 handle.

Above that area, I think we go back to the parity level. I also believe that this will happen given enough time, as the US dollar is still favored. Granted, the European Union is getting a little bit of a reprieve lately, but you also have to remember that there are several forces at work here.

Swiss National Bank

The SNB has recently been “outed” for shorting the Swiss franc itself. This of course should drive all XXX/CHF pairs higher. After all, the market will continue to trying to hide from the central bank, because the central bank is not somebody that anybody in their right mind wants to fight. Long gone are the days of being able to “break the bank” as George Soros did. After all, the SNB recently thought the 1.20 “line in the sand” in the EUR/USD pair for over 4 years. A lot of traders lost a lot of money.

The Swiss will continue to do what serves their interests over anybody else’s, and as a result I believe that the Swiss franc continues to lose value. This will be especially true against the US dollar, especially as we continue to have trouble in the European Union itself. Keep in mind that Switzerland sends over 85% of its exports into the European Union, and as a result it is inexorably tied to the health of that region.