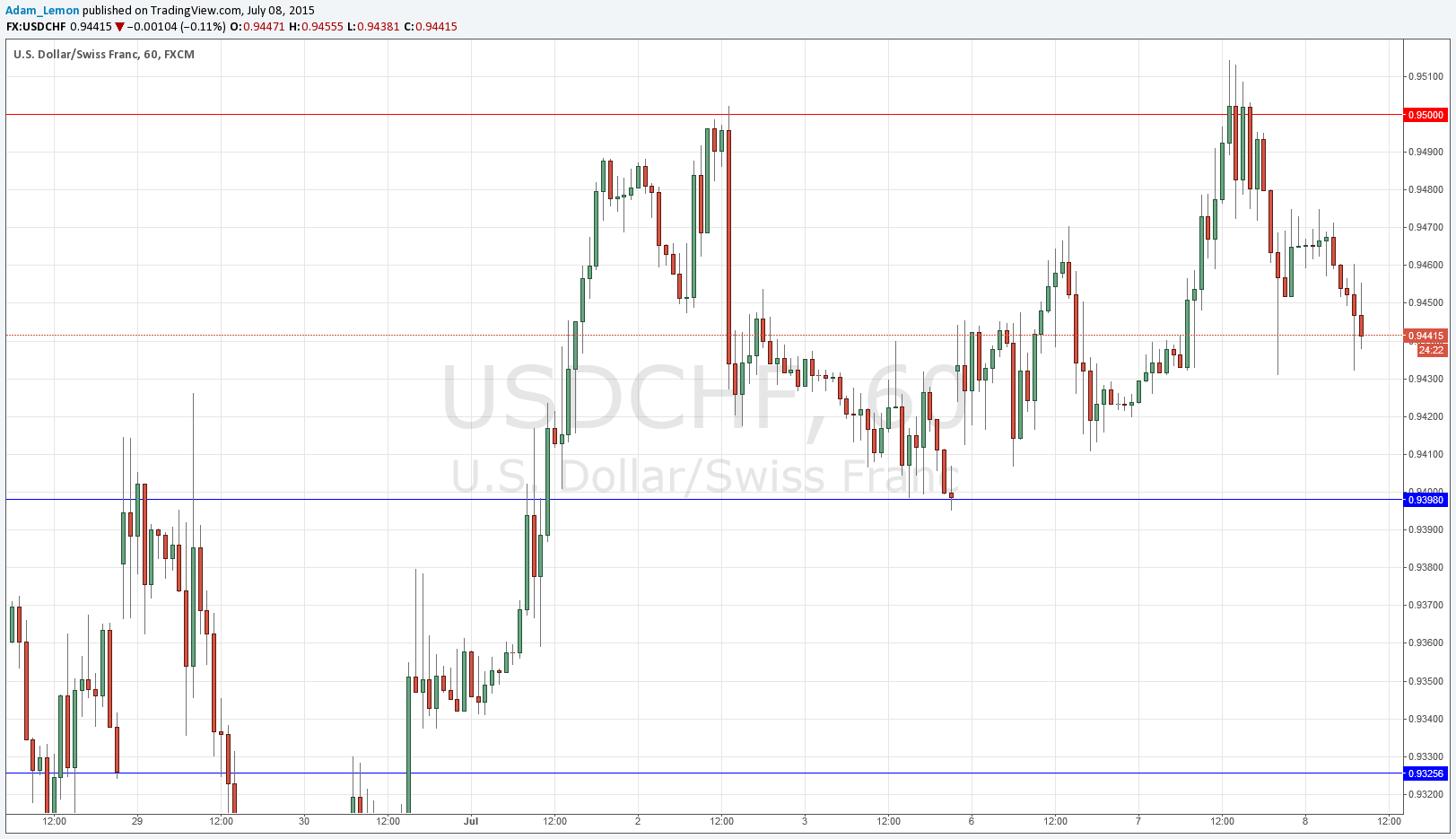

USD/CHF Signal Update

Yesterday’s signals would have produced a profitable short trade on the break of inside bars following a bearish reversal at 0.9500.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be entered between 8am and 5pm London time.

Ensure the risk is taken off all open trades by 6:30pm London time.

Short Trade 1

- Short entry after bearish price action on the H1 time frame following the next touch of 0.9500.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

- Long entry after bullish price action on the H1 time frame following the next touch of 0.9398.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

- Long entry after bullish price action on the H1 time frame following the next touch of 0.9325.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 3

- Long entry after bullish price action on the H1 time frame following the next touch of 0.9248.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

The key levels all remain the same as yesterday as 0.9500 held as resistance. Although the USD is strong at the moment, the CHF is acting as one of the stronger currencies now in this “risk off” environment, so the USD could not really push it beyond 0.9500. It looks like we are heading down to 0.9400 which is likely to act as effective support, at least before the release of the FOMC Meeting Minutes this evening.

There is nothing due today regarding the CHF. At 7pm London time there will be a release of the FOMC Meeting Minutes.