USD/CHF Signal Update

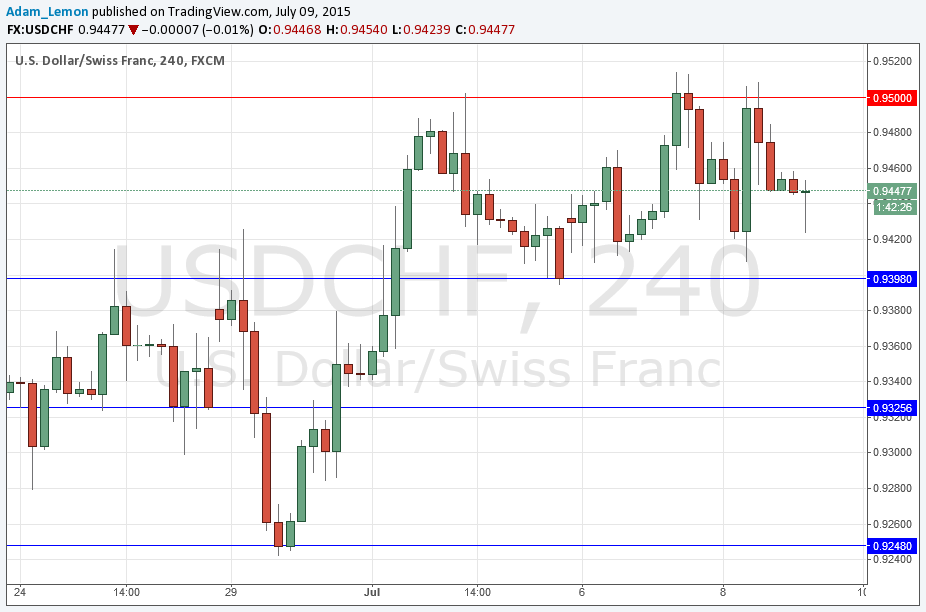

Yesterday’s signals may have given another short off the resistance identified at 0.9500, which should have been a profitable trade.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be made before 5pm London time only.

Short Trade 1

- Go short after bearish price action on the H1 time frame following the next touch of 0.9500.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

- Go long after bullish price action on the H1 time frame following the next touch of 0.9398.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

- Go long after bullish price action on the H1 time frame following the next touch of 0.9325.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 3

- Go long after bullish price action on the H1 time frame following the next touch of 0.9248.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

Again, the key levels all remain unchanged, and for the second day running the 0.9500 level acted as good resistance. With the FOMC failing to trigger any strong reaction, it is likely the ranging conditions will continue.

There is nothing due today regarding the CHF. At 1:30pm London there will be a release of U.S. Unemployment Claims data.