USD/CHF Signal Update

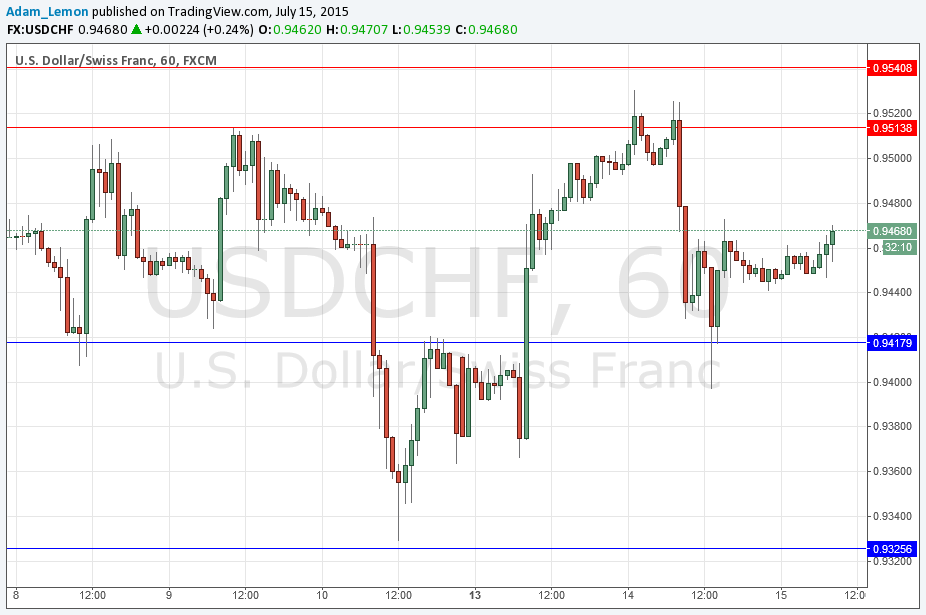

Yesterday’s signals would have given both a profitable short trade below 0.9497 and then a profitable long trade off the support at 0.9418 yesterday! This is one of the possible advantages of ranging / choppy market conditions in a currency pair.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be entered between 8am and 5pm London time today.

Short Trade 1

- Short entry after bullish price action on the H1 time frame following the next touch of the zone between 0.9514 and 0.9541.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

- Long entry after bullish price action on the H1 time frame following the next touch of 0.9418.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

- Long entry after bullish price action on the H1 time frame following the next touch of 0.9325.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

The key levels are holding, with the price ranging around very predictably in between them. At the moment, it looks very much like the pair is going to make a trip back up to the 0.9500 area resistance zone, although this might be determined by what the Chair of the Fed has to say later a couple of hours or so after New York opens.

Regarding the CHF, there is nothing “high-impact” scheduled today. Concerning the USD, there will be a release of PPI data at 1:30pm London time followed by the Fed Chair’s testimony before Congress at 3pm, which is likely to be very important.