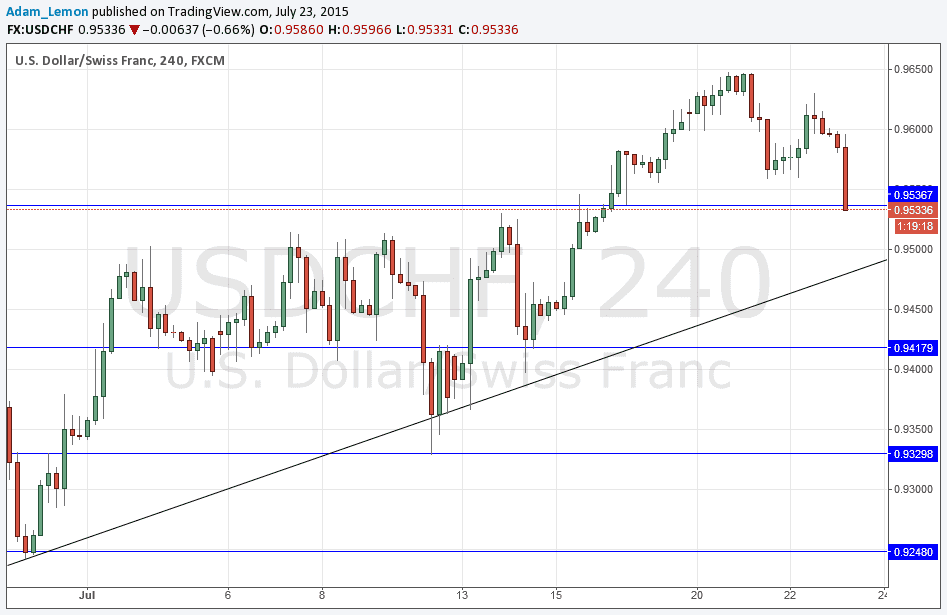

USD/CHF Signal Update

Yesterday’s signals were not triggered as although the price did reach the 0.9600 level, there was no bearish price action there.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today only.

Long Trade 1

Go long after bullish price action on the H1 time frame following the next touch of 0.9537.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Go long after bullish price action on the H1 time frame following the next touch of the bullish trend line currently sitting at around 0.9490.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

I was wrong about 0.9600 being a decisive point as we broke that price yesterday but then pivoted around it, and the price is now falling below it.

It therefore now looks as if the bullish trend line, which is currently becoming confluent with the psychologically key 0.9500 level, is going to be a very interesting area with a good chance of a significant long reversal to take off, if it gets going.

As I write, the price is being held at the 0.9537 support level after falling sharply. It also may turn around here.

There is nothing due today regarding the CHF. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time.