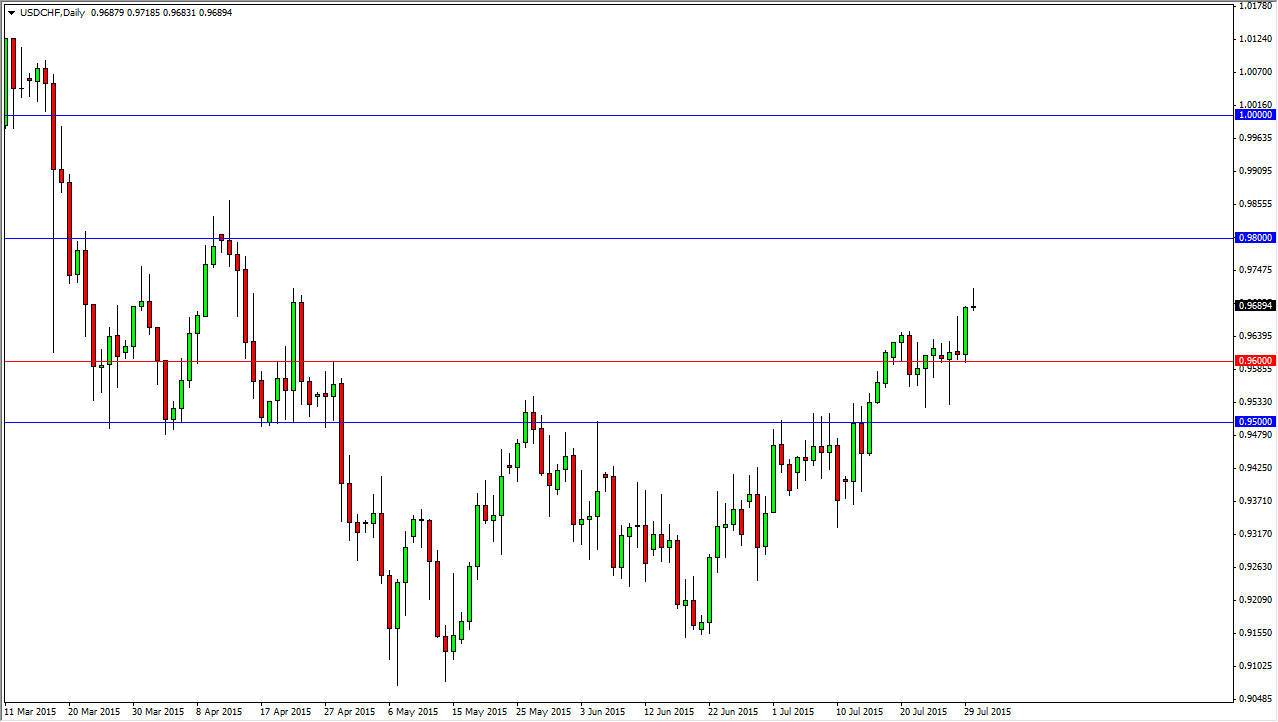

The USD/CHF pair initially tried to rally during the course of the day on Thursday, but found the 0.97 level to be a bit too resistive. By doing so, the market ended up forming a shooting star, which of course is a fairly bearish sign. However, I think this merely means that we are getting ready to have a little bit of a pullback. This will be the pullback that refreshes, and not some type of trend change in my opinion.

I look at the 0.96 level as supportive, because it was previously so resistive. With that being the case, I feel that any pullback at this point in time will attract buyers and that’s exactly what I’m looking to do in this point in time: buying again.

Ultimately, we go to parity

Keep in mind, the Swiss National Bank is working against the value of the Swiss franc in general, and as a result I think that this continues to go higher. After all, the US dollar is one of the most favored currencies around the world, and will more than likely continue to be. After all, the European Union continues to struggle in general, and this was of course a very vulnerable to what goes on in that area, as they send 85% of their exports into that region. Of course, if you have your biggest customer struggling, that doesn’t help your economy at all.

On the other hand, the North American economy is doing quite a bit better, and of course the US dollar is considered to be safety as well. Don’t get me wrong, so is the Swiss franc, but with the Swiss been so exposed to Europe, that will be a bit different this time.

Ultimately, I think as long as we see some type of supportive candle between the 0.95 and the 0.96 level, it’s time to start buying again. We could of course break above the top of the shooting star for Thursday, and that would be bullish as well. I believe the 0.98 level will be targeted first, and then of course we had to parity given enough time.