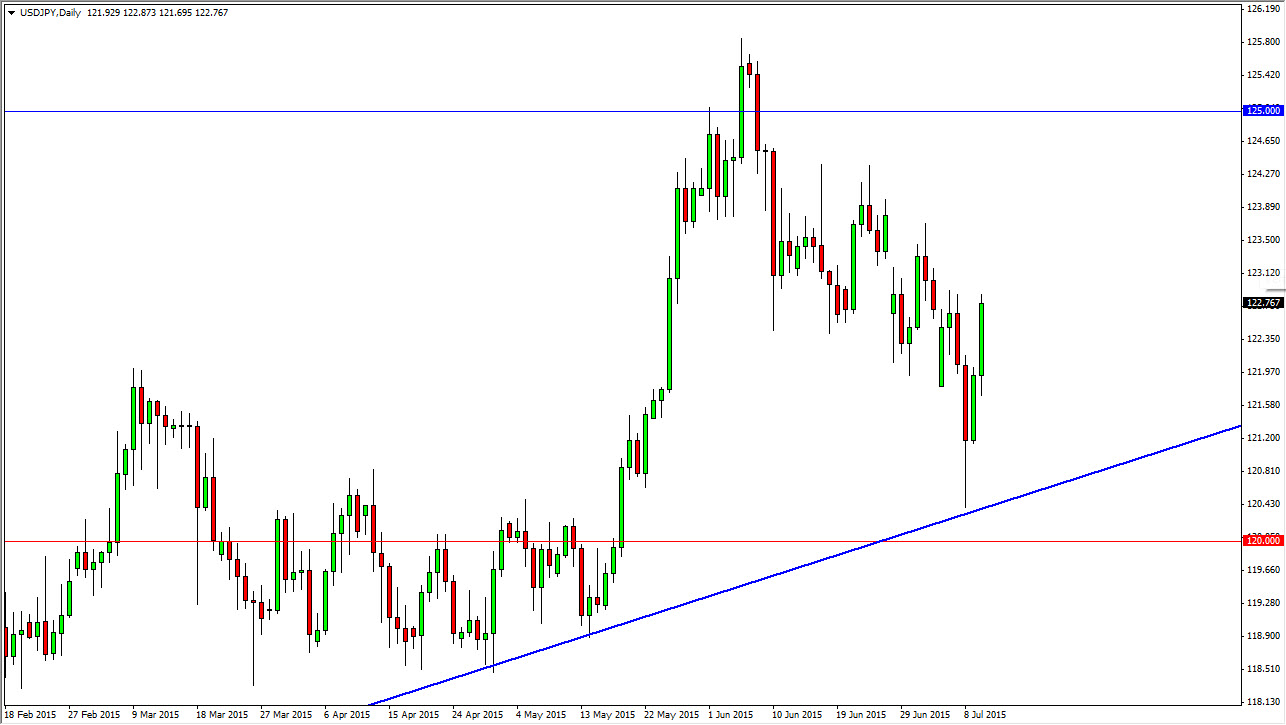

The USD/JPY pair broke higher during the course of the session on Friday as we got wind of a potential solution to the Greek debt crisis being worked out. If that’s the case, the markets should start finding quite a bit of risk appetite going forward, and that should send this pair higher as it does tend to be very risk sensitive. With that, I think that pullbacks are buying opportunities, and that it’s only a matter of time before we finally get that move higher than I’ve been waiting on. As you can see on the chart, there is an uptrend line below that has held as support, and I think we will now reach towards the 125 level.

Even if we pullback from here, I think it will be plenty of buyers below and as a result it’s only a matter time before this “risk on” type of market continues to grind its way higher. I think we will finally break above the 125 level and then head to the 130 handle.

Buying dips

Longer-term, I believe that buying dips will be the way to go going forward. With that being the case, the market should continue to go much higher over the longer term and longer-term traders will continue to add to their positions every time the US dollar gets “cheap.” The Japanese yen will continue to soften due to the Bank of Japan and its quantitative easing measures, which of course are massive in their scope and should continue to see quite a bit of pressure from Tokyo going forward. With that, I expect the Japanese yen to continue to weaken against most currencies, and while the US dollar certainly offers some type of interest-rate differential to the Japanese yen, this pair should continue to go higher. With the Federal Reserve expected to begin a rate tightening cycle soon, it makes sense of this pair continues to grind much higher given enough time.