The USD/JPY pair rallied hard during the session on Monday after word got out that the Greeks might be signing an austerity agreement with the European creditors. Because of this, the market seems to be rallying in general, as risk assets suddenly are possible options.

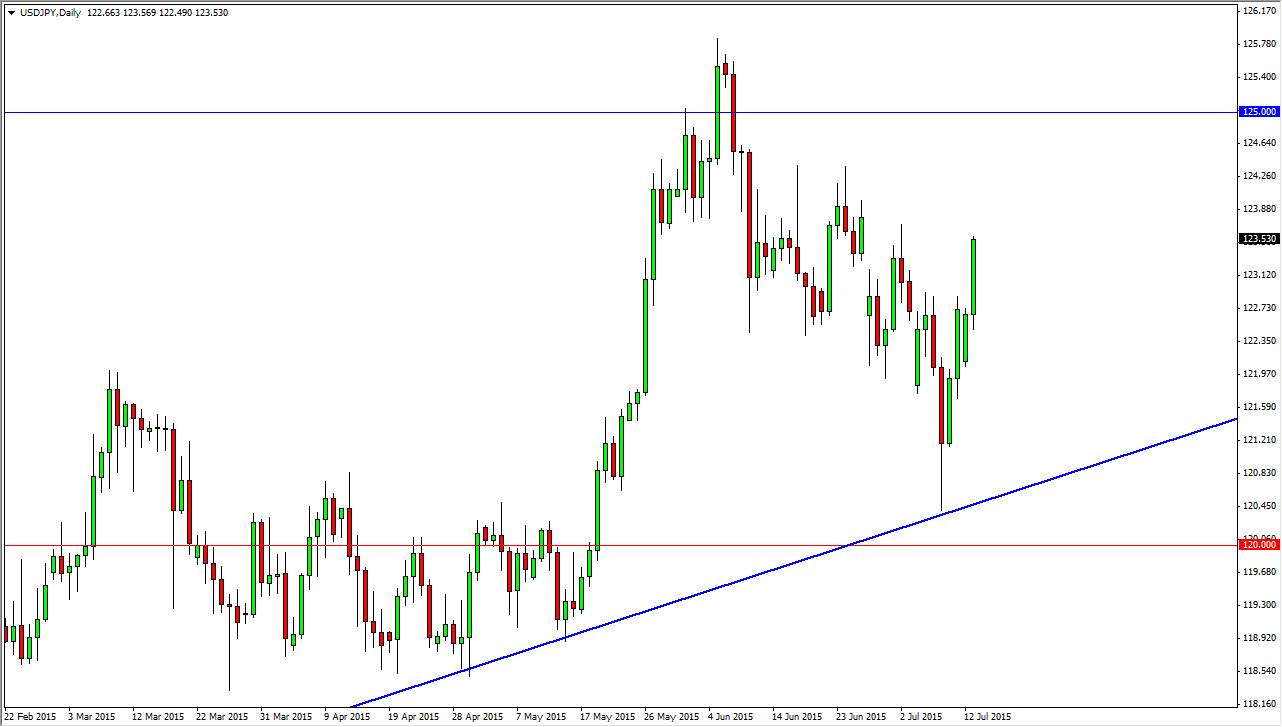

That being said, you can see that the candle was very long, as the move higher was so convincing. That being the case, the market looks as if we’re going to reach back towards the 125 level, as it was the most recent high. I believe that this pair is going to continue to go much higher over the longer term, and I believe that we are in the middle of a multi-year rally. After all, this tends to be a “risk on/risk off” type of pair, plus there is the central bank aspect as well.

Bank of Japan

The Bank of Japan continues to work against the value of the yen in general, and as a result I feel that they will eventually get what they want. They are buying Japanese bonds as well as Japanese ETFs, and many other operations to keep the market at home going higher and the exports leaving Japan. With this, I believe that the US dollar will still be favored, quite frankly because of the Federal Reserve getting ready to raise interest rates which of course the Bank of Japan is light years from doing at the moment.

I think that any pullback at this point in time should be a buying opportunity as the market is well supported below. I think that the 122 level will be a bit of a floor, and the uptrend line just below should continue to offer support as well. Quite frankly, I have no interest in selling this pair at all, and every time it falls I just think of it as offering value in the greenback. I do think that we will eventually clear the 125 handle, and that by the end of the year we will be closer to 1/30 not above that level.