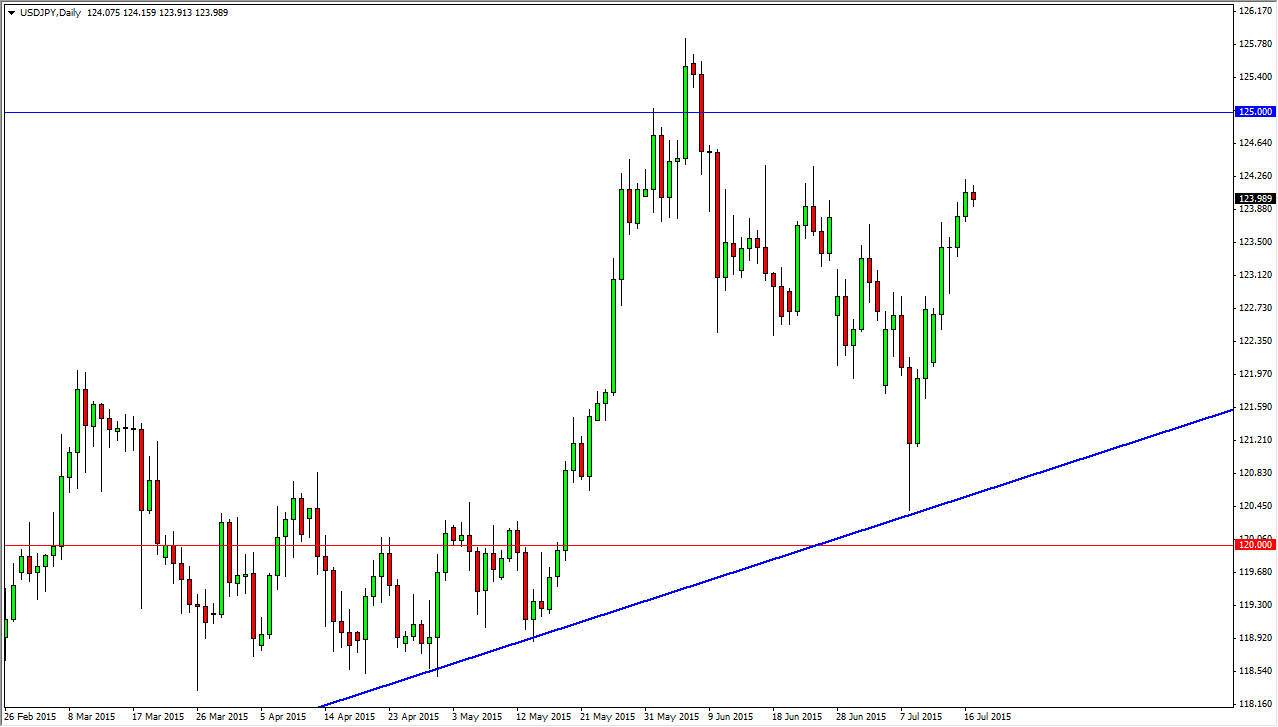

The USD/JPY pair stalled during the session on Friday, as we simply could not get above the 124 level for any real length of time. However, we’ve seen a pretty impulsive move to the upside off of the uptrend line that is on this chart, and as a result I think that the buyers are still involved. With this, the buyers will more than likely reenter the market again and again, eventually pushing this pair above the 125 handle. Once we get above there, we can serve to make serious moves towards the 130 handle by the end of the year in my opinion.

I have no interest in selling this pair, because the US dollar of course is one of the strongest currencies in the world right now. On top of that, the Bank of Japan continues to liquefy the markets by purchasing Japanese Government Bonds, which drives down the demand for the Yen in the first place. I think that the central bank will get what it wants, especially considering that the Federal Reserve is likely to raise rates soon. We are at the beginning of a rate tightening cycle in the United States, and are years away from the same thing in Japan.

Risk on, risk off

This pair will often move as a result of the risk appetite around the world, with the US dollar being favored when risk appetite is fairly healthy. With that being said, it makes sense to watch this market along with the S&P 500, and other stock markets. In general, when the stock markets go higher, so will this pair. I do think that getting above the 125 level is going to take some work, so pulling back from here to build up momentum isn't exactly asking much. I think that there is plenty of support between here and the uptrend line, so I am simply waiting for a supportive candle in order to start buying again. Given enough time, I believe that this pair becomes a “by on the dips” type of longer-term trade.