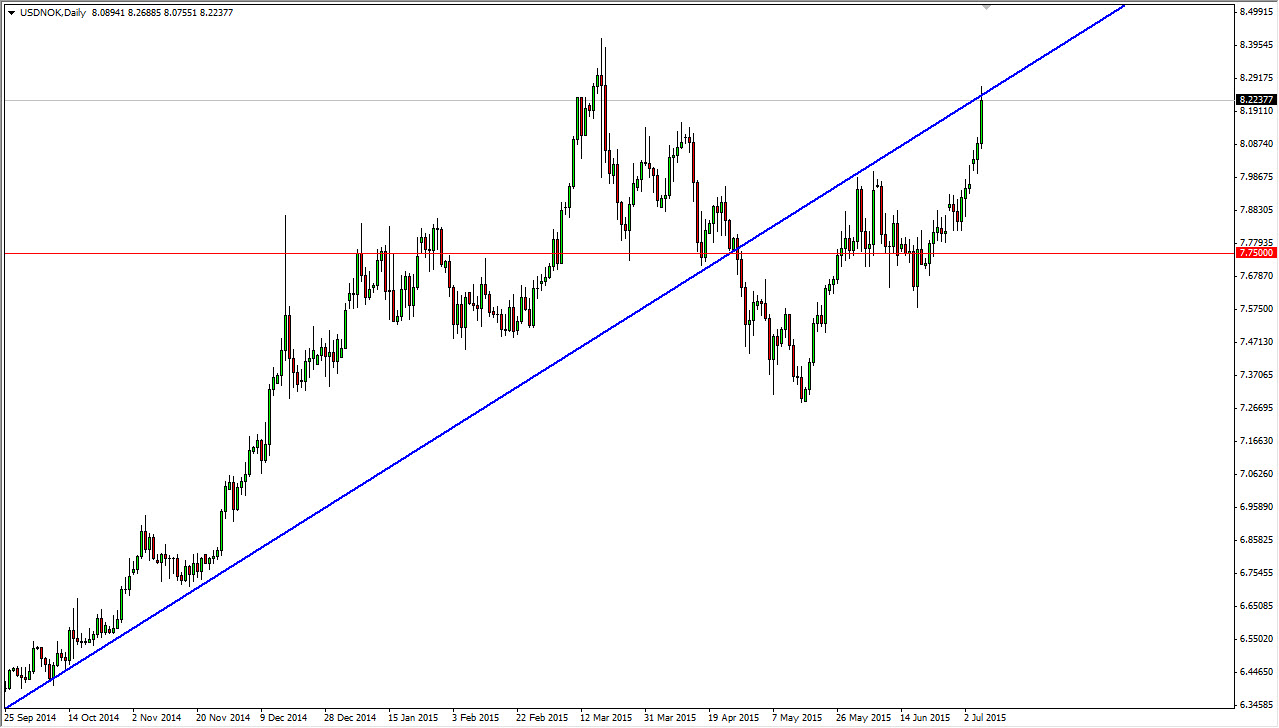

The USD/NOK pair broke higher during the course of the session on Tuesday, testing the bottom of the previous trend line that held as support for so long. Because of this, it is an area that I am paying very close attention to, because quite frankly these trend lines will often reverse course later, offering resistance. We will have to wait to see what happens next, but you have to keep in mind that the Norwegian krone is highly influenced by oil, which of course is getting absolutely pummeled out the moment.

The US dollar of course is a safety currency, and as a result it makes sense that it would climb against what is essentially a proxy for petroleum. If we can get above the top of the range for the session on Tuesday, that would be an extraordinarily bullish sign as the Norwegian krone would get absolutely pounded at that point. Pullbacks from here could be buying opportunities as well, as I would anticipate seeing some type of support at the 80.00 handle.

Greece

I really hate saying this, but one of the biggest movers of the markets right now is going to be the situation in Greece. The situation is getting a bit old for my taste, but at the end of the day it still is moving the market. Oil markets have been absolutely pummeled due to the Greek problems, and of course the Iranian nuclear deal talks. With this, there’s going to be a lot of volatility in petroleum, and as a result it would be very difficult to own the Norwegian krone for any real length of time.

If we get below the 8.00 handle, at that point in time I would consider selling this pair, but I do recognize that at the red line on the chart, which is the 7.75 handle, we could see a significant amount of support. The main reason I brought this market to your attention is simply the fact that it is at such a pivotal level.