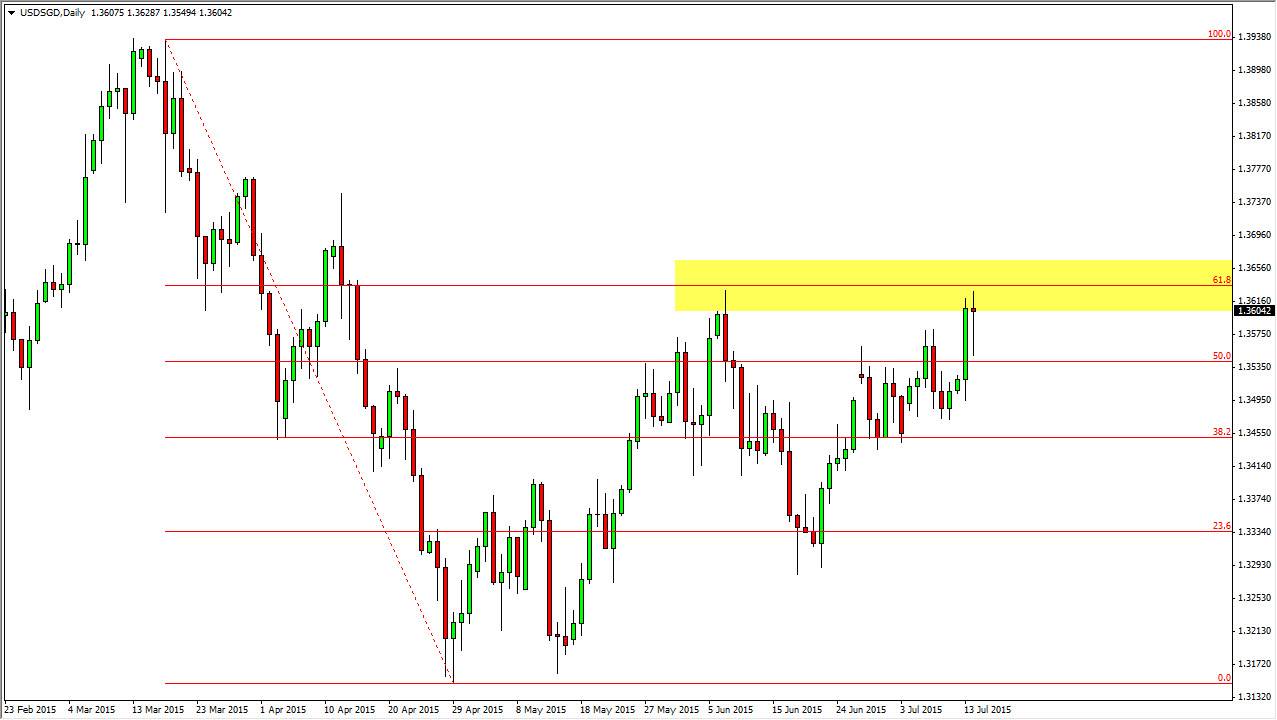

The USD/SGD pair initially fell during the course of the session on Tuesday, but found enough support down at the 1.3550 reason to turn things back around and form a nice-looking hammer. The hammer is of course a very bullish sign, and the fact that we bounced off of the 50% Fibonacci retracement level isn’t much of a surprise as we will often see those levels act as support and resistance long after they are normally thought of as being “useful.”

The fact that we formed a hammer and it favors the US dollar makes it a little bit easier to believe that we may have a decent trade set up. After all, we are pressing up against the 61.8% Fibonacci retracement level, and that is of course known as the “Golden mean”, which of course always attracts a lot of attention.

Trend change?

If we can break above the 61.8% Fibonacci retracement level, I found that typically the trend will change or I should say at least the market will go back to the 100% Fibonacci Retracement level, which of course completely wipes out the move lower. If that’s the case, the trend is all but broken, and at that point in time I would have to think that we will head to the 1.40 level. That is the area that which we had originally fallen from, and as a result breaking above there would of course be a massively bullish long-term move as well.

I believe that if we break the top of the hammer, we should then head to the 1.3750 region first, where I see a significant resistance barrier. Once we get above there though, really it’s a straight shot to the 1.40 level eventually.

Even if we pullback from here, I believe that there is plenty of support at both the 1.3550 level, and the 1.3450 level below as these areas have already shown themselves to be fairly useful. With that, I believe that the US dollar should continue to strengthen in general, especially when it comes at the expense of Asian currencies as there is quite a bit of economic disruption in that region. This is one of my favorite trades if we can get the move higher.