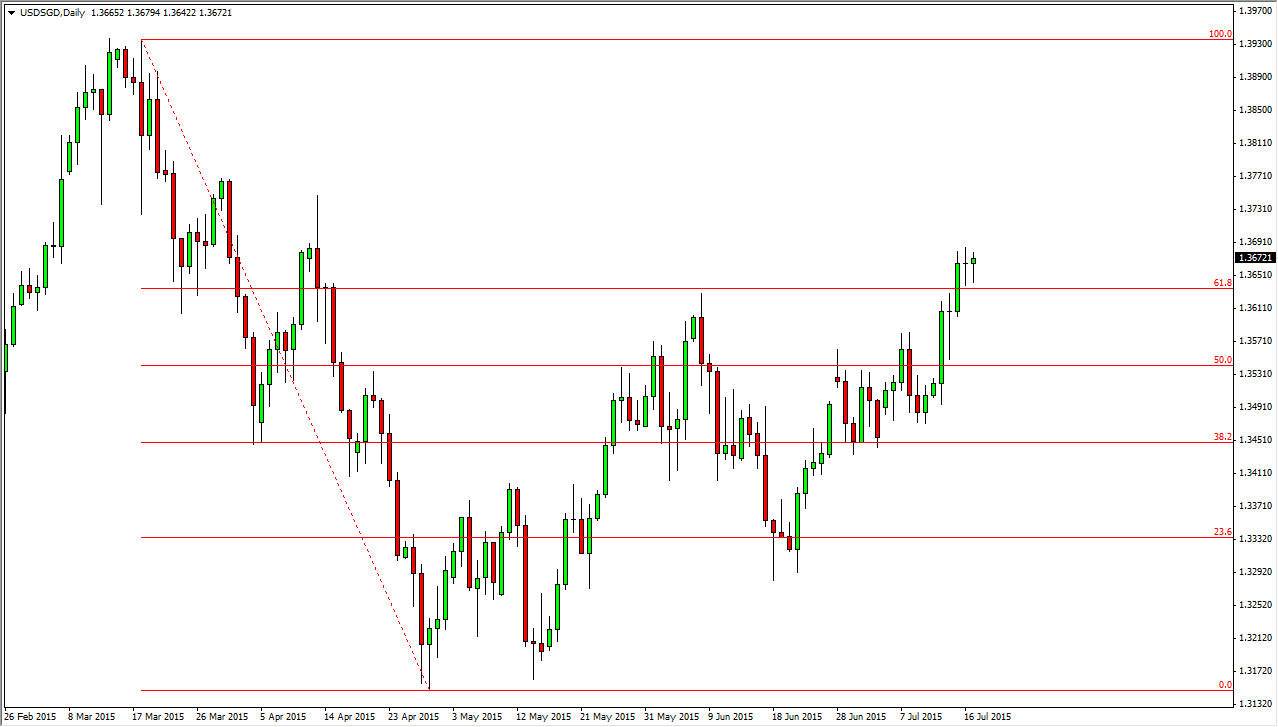

The USD/SGD pair fell during the course of the session on Friday to test the 61.8 Fibonacci retracement level of the recent downtrend. That area offered support, and as a result it appears that it is now going to be supportive going forward. I essentially look at this as the 1.3650 level, and like this because quite typically you will see the Fibonacci levels act as support and resistance going forward. So once resistive, should now be supportive in theory.

Looking at the shape of the candle, it is of course a hammer and that is a very positive sign as well. With that I feel that if we can break above the 1.37 level we should start to see this pair rise again. You have to look at it as the US dollar been strong against almost everything, and the Singapore dollar of course isn’t going to be any different.

USA versus Asia

I believe that this is a good way to play the United States versus Asia. While longer-term I prefer Asia, the truth of the matter is that Asian demand in general is down. The Chinese economy is slowing down, and Singapore tends to finance most of the projects around the Asian region of the world. Because of this, the Singapore dollar is considered to be one of the “safer” currencies in Asia, but it of course can suffer when Asian growth is very slow or nonexistent.

With this being said, I believe now we are going to go back to the 100% Fibonacci level, which of course is near 1.3950. If there is a lot of upside in this move, and I like this trade in particular as not only is the US dollar being strong, but it looks as the Singapore dollar itself is starting to weaken against most currencies. It’s essentially the “best of both worlds” that you look for in a decent trade that you can hang onto. I am a buyer of this pair once we clear the 1.37 level.