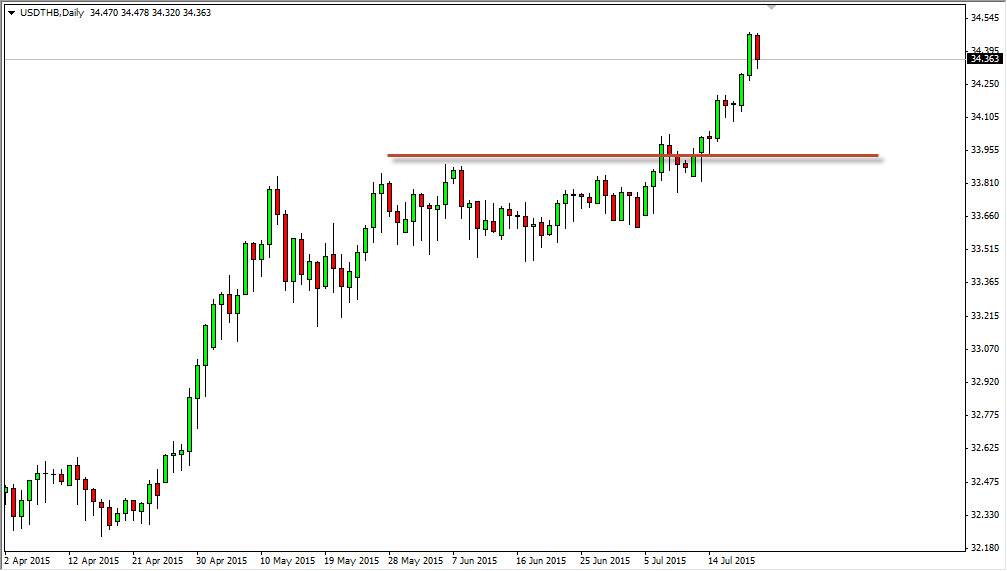

The USD/THB pair pulled back during the session on Tuesday, offering a bit of value in the greenback as far as I can see. I recognize that most of you probably don’t pay too much attention to the Thai baht, but quite frankly it is an excellent way to play of emerging Asia. After all, there is quite a bit of exporting done out of Thailand, so it shows a good way to play or measure what happens with such economies as Thailand, Laos, Vietnam, etc.

I believe that this is a simple “risk on, risk off” type of situation in this market place, as the US dollar of course is a safety currency in this particular circumstance. You can think of it this way: Are exports flying out of Southeast Asia and into the United States, or not? This simply measures which direction the money is flowing in this particular trading environment.

Looking for supportive candles

I believe that the breakout above the 34 region was significant, and as a result I am looking for some type of supportive candle between here and there in order to start buying. The spread in this pair really isn’t that bad, but you should keep in mind that it tends to move fairly slowly. This is a long-term trader’s type of market, which is what I like about it in general. You don’t typically get a lot of massive movement in this particular currency pair, with the notable exception being back in 1997.

Ultimately, I think that we are going to reach towards the 35 handle given enough time. I think the pullbacks continue to offer buying opportunities, and I also believe that eventually we break out above the 35 handle as far as longer-term trading is concerned. In the meantime, you can continue to buy dips as they offer value for short-term moves. I have no interest whatsoever in buying the Thai baht at the moment, as I believe the US dollar will continue to be favored in general.