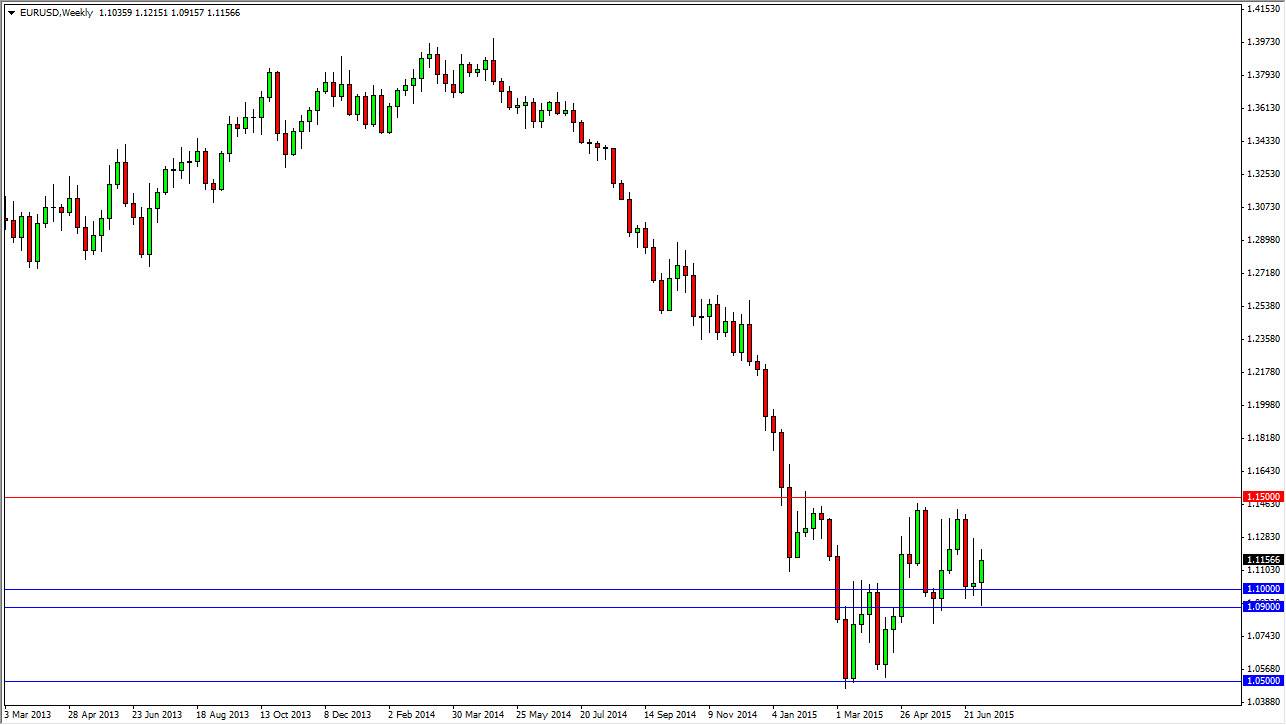

EUR/USD

The EUR/USD pair initially fell during the course the week but found enough support at the 1.09 level to continue the potential uptrend. Currently though, it appears that we are more or less consolidating in general but we have certainly made “higher lows” recently, which of course is a sign that the trend may be changing. With the Greeks possibly coming to the table with something the Europeans can live with, I fully anticipate seen this pair go higher during the course of the week, testing the 1.14 level for resistance, and possibly going above there and clearing the 1.15 handle. At that point, I believe the trend has changed completely.

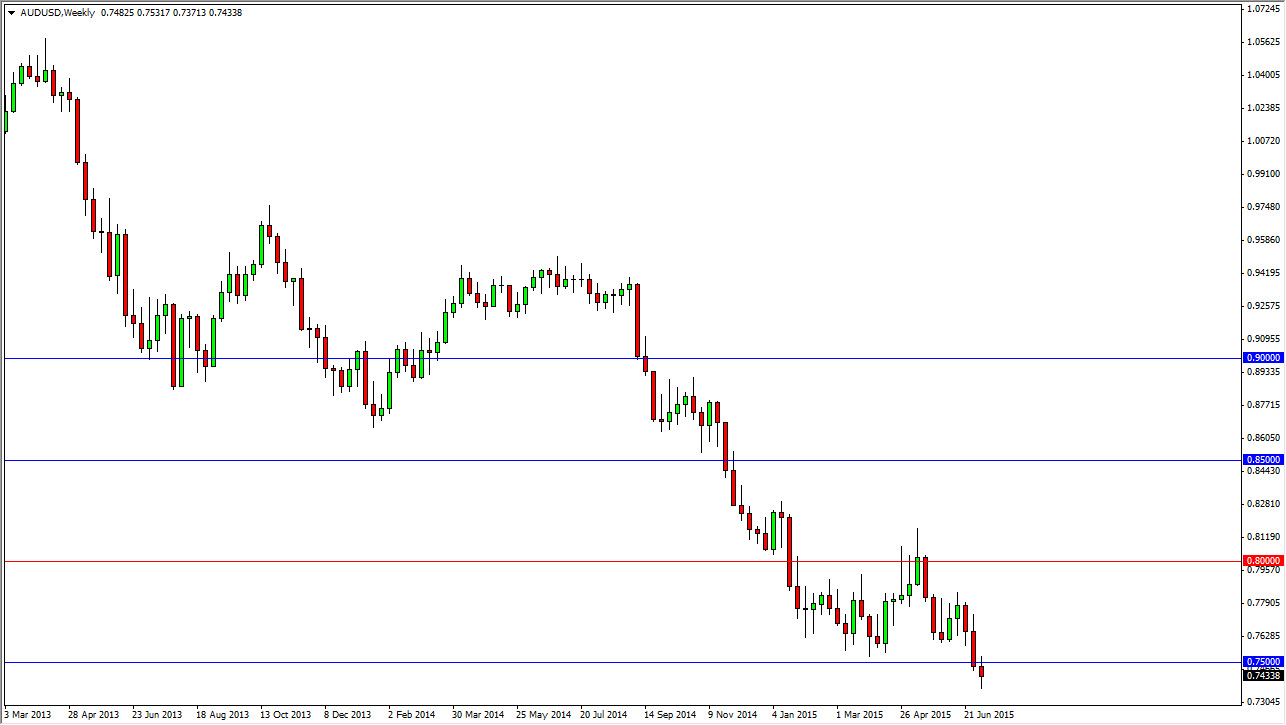

AUD/USD

The AUD/USD pair had a slightly negative week, as we broke down below the 0.75 level. That level is of course a large, round, psychologically significant number, so it makes sense that the market would be attracted to it. However, I believe that breaking below that level is a fairly negative sign in general, and as a result I would anticipate seeing the Australian dollar fall from here.

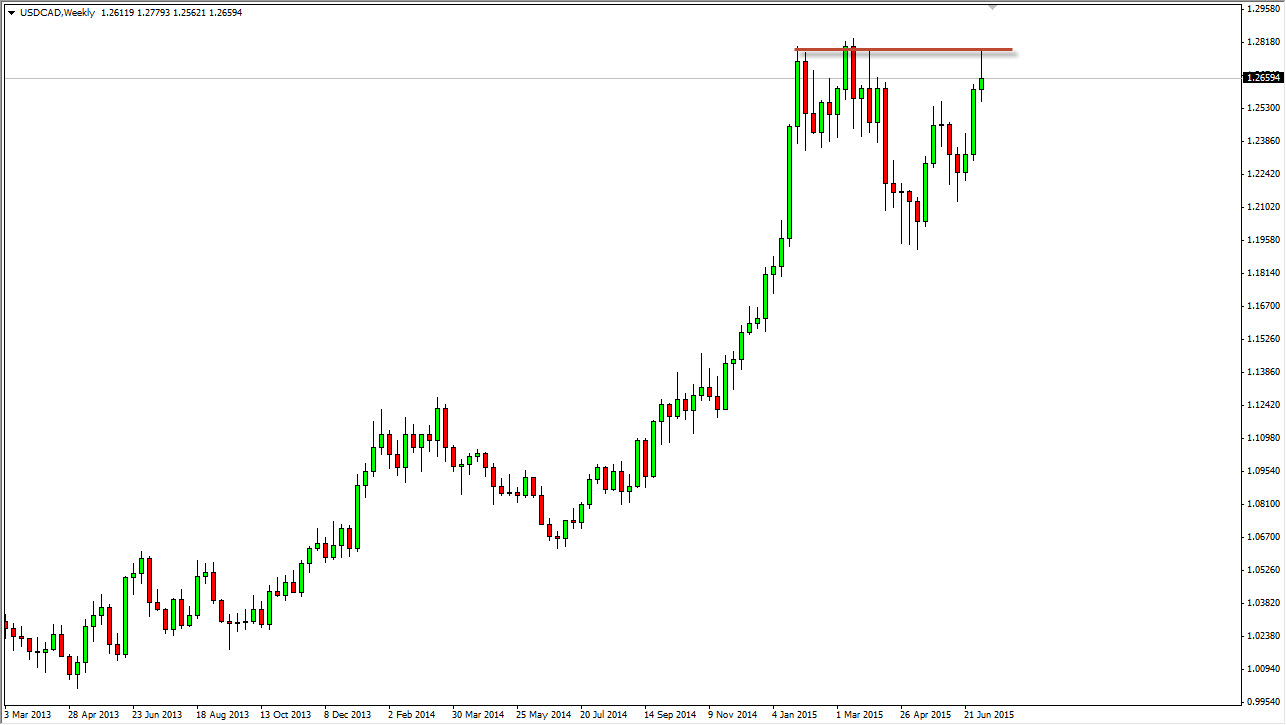

USD/CAD

The USD/CAD pair initially tried to rally during the course of the week but as you can see gave back most of the gains. By doing so, we ended up forming a shooting star, which of course is a very negative sign. I think if we break down below the bottom of the range for the week, we will probably head back towards the 1.25 level, and then the 1.22 level. On the other hand though, if we can break above the top of the shooting star, we will go much higher and then start reaching towards the 1.30 level.

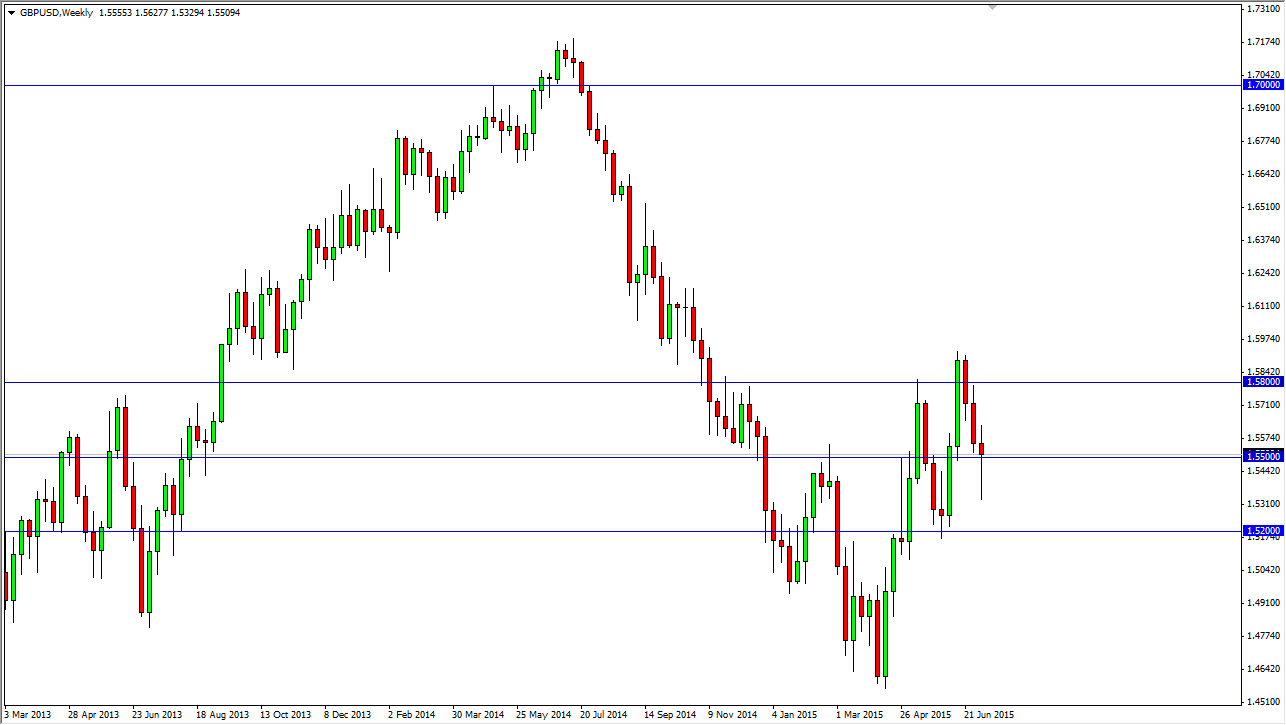

GBP/USD

The GBP/USD pair broke down during the course of the week, dipping below the 1.55 handle. However, we bounced enough to form a hammer and it now looks as if the market is ready to rally. I believe that if we get any type of good news out of Greece, the British pound will continue to go much higher and perhaps reach towards the 1.58 level. I have no interest in selling this currency pair the moment.