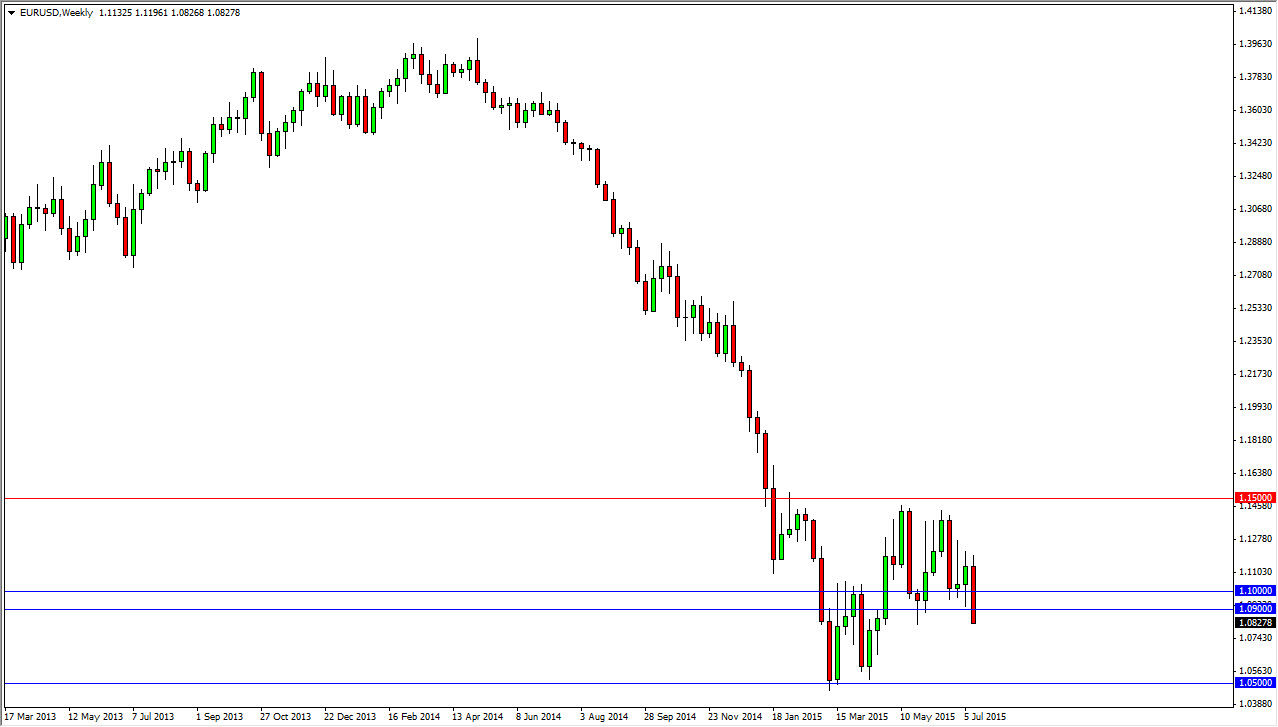

EUR/USD

The EUR/USD pair finally broke down below the 1.09 level, which is what I thought needed to happen in order for the pair to fall further. It appears that people don’t trust the whole “solution”, as we have seen this time and time again. With this, I feel that this pair is looking to reach 1.05, but will be choppy. I am trading this pair with a downward bias, but on short-term charts mainly.

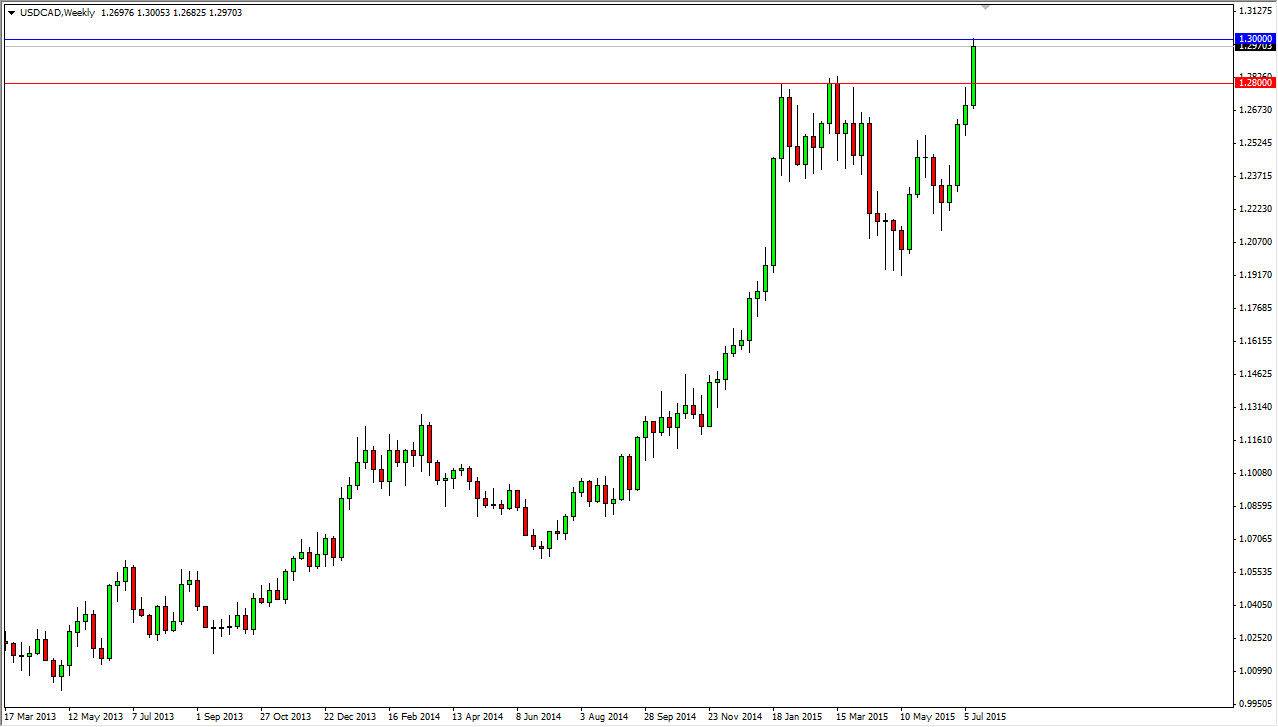

USD/CAD

The USD/CAD pair tried to break out during the week, but the vital 1.30 level was a bit too much in the way of resistance to overcome. This was the area where the market kept stalling during the financial crisis, so I think it is going to have to pull back a little in order to build the momentum necessary to go above there. I am a seller short-term, but think we are going to eventually go much higher over the long run.

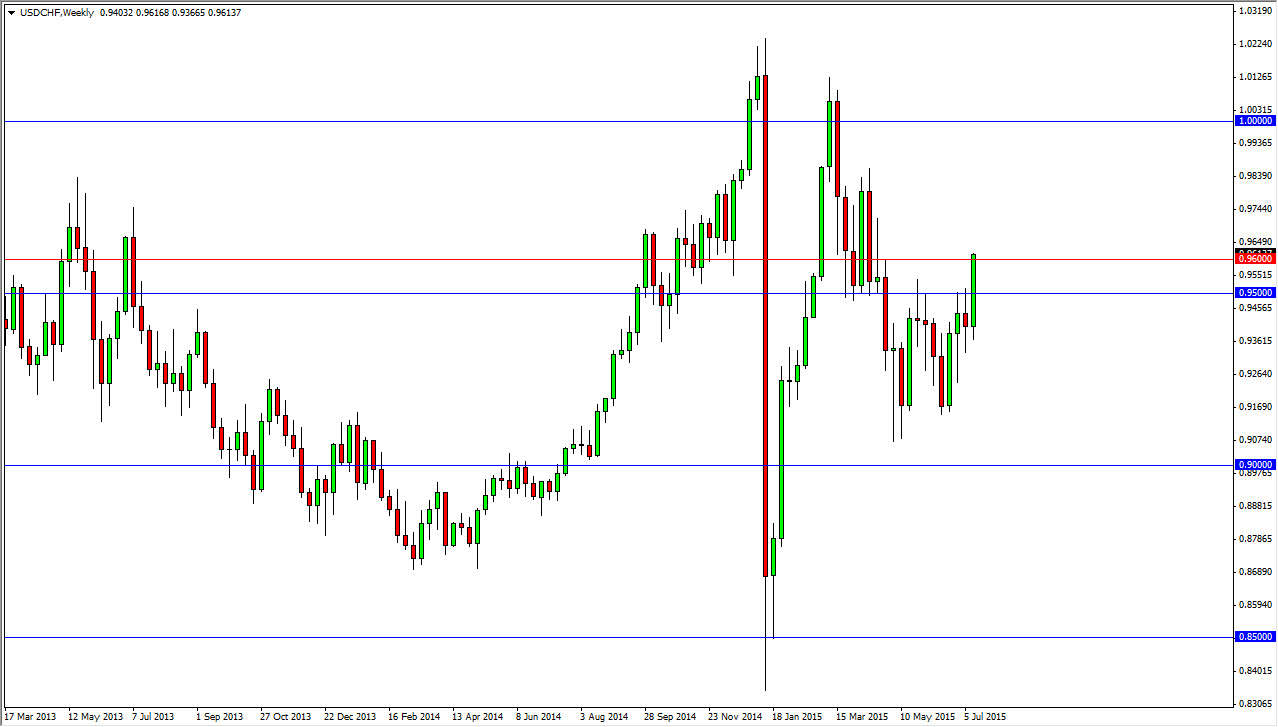

USD/CHF

The USD/CHF pair broke above the 0.96 level, and now looks ready to go to the 0.98 level, and then the parity level above there. I think that this will be a slow mover, but it should be relatively steady in the direction. This is a “buy on the dips” situation as far as I can see, and should provide a steady move.

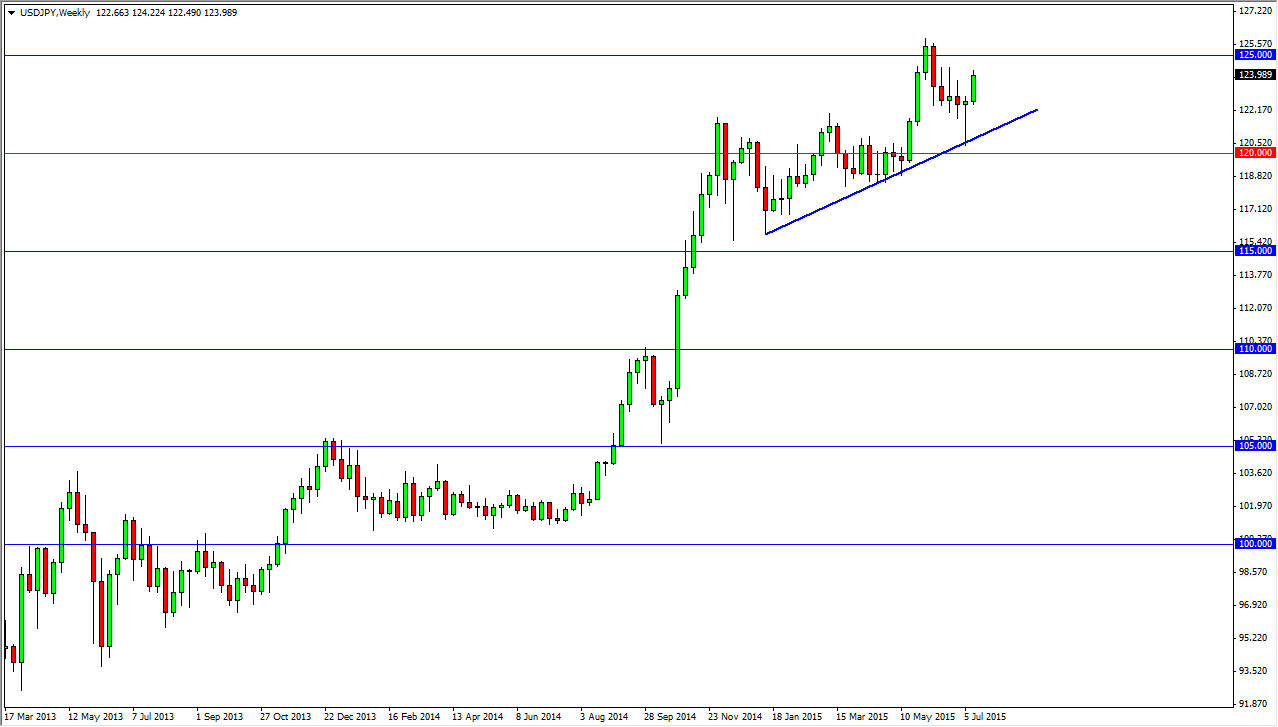

USD/JPY

The USD/JPY pair pulled back a little on Friday, but in general had a very strong showing this past week, as we broke the top of the hammer from the last week. The 125 level above should continue to be resistance, but I think we should break out given enough time. In the short-term, I think that this pair needs to build up momentum to make this move. The interest rate differential should continue to push this pair higher, as well as the “risk on” appetite around the world.