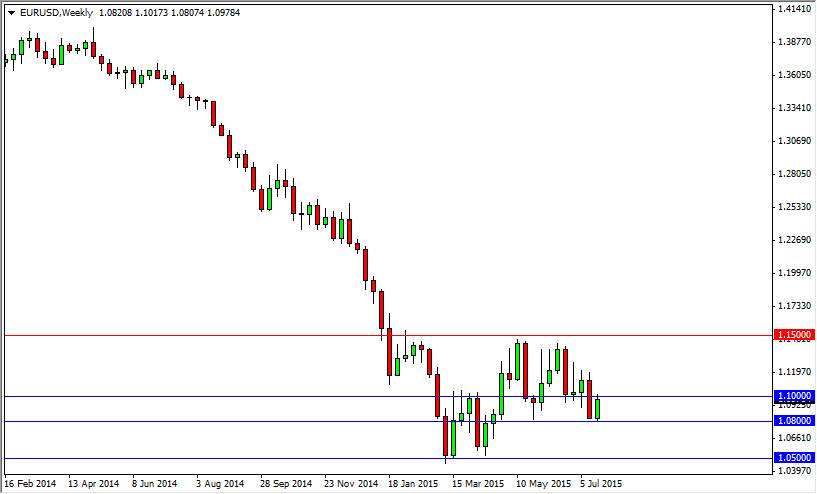

EUR/USD

The EUR/USD pair bounced off of the 1.08 level during the week, and then bounced to the 1.10 level. Because of this, we feel that the market continues to grind back and forth, and as a result it is going to be short-term traders market. If we can get above the 1.10 level, I feel that the market will eventually grind its way to the 1.12 level. With that, short-term traders will continue to take advantage of bullishness.

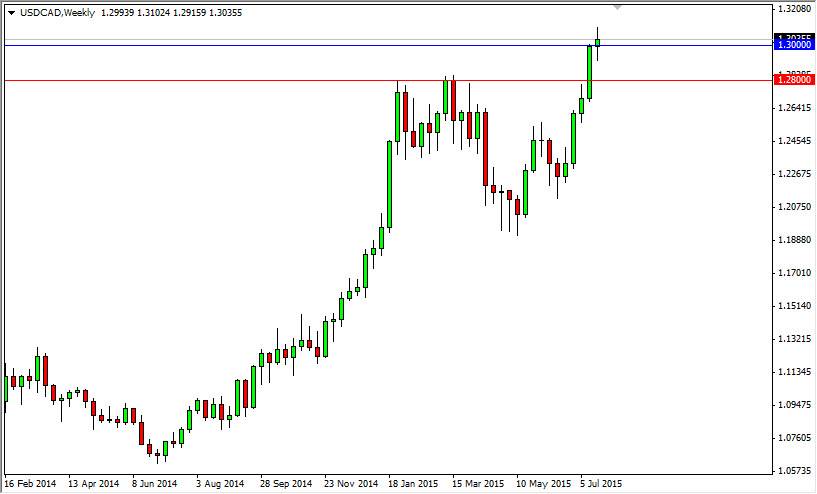

USD/CAD

The USD/CAD pair went back and forth during the course of the week, struggling at the 1.30 level. With this, it looks like the market's ready to continue going higher, but I also recognize that the 1.28 level below is massively supportive. With this, a pullback that is followed by a supportive candle would be interesting for me, but I would also by a break above the top of the range for the week. Ultimately, the market should continue to be a bit of a “buy-and-hold” type of situation.

AUD/USD

The AUD/USD pair initially rallied during the course of the week, testing the 0.75 handle. However, we saw more than enough resistance to turn the market back around as we formed a shooting star. The shooting star at the bottom of the downtrend should send this market looking for the 0.70 level. The level is a large, round, psychologically significant number, so of course the markets will be attracted to that level. We should see more bearish pressure as the gold markets have been sold off so drastically.

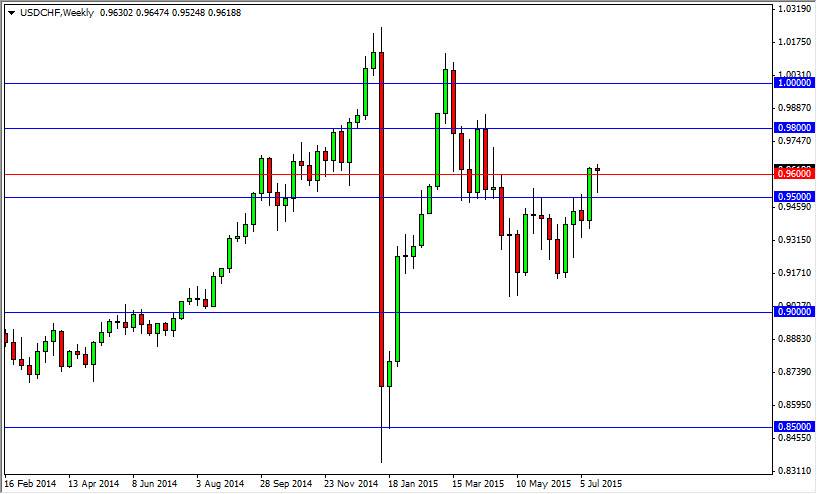

USD/CHF

The USD/CHF pair fell significantly during the course of the week, but found enough support above the 0.95 level to turn things back around and form a nice-looking hammer. With this, looks like the markets ready to go higher, and a break above the top of that hammer would of course be a nice buying opportunity that could send this market looking for the 0.98 level. I have no interest in selling this market, as the 0.95 level should be massively supportive going forward.