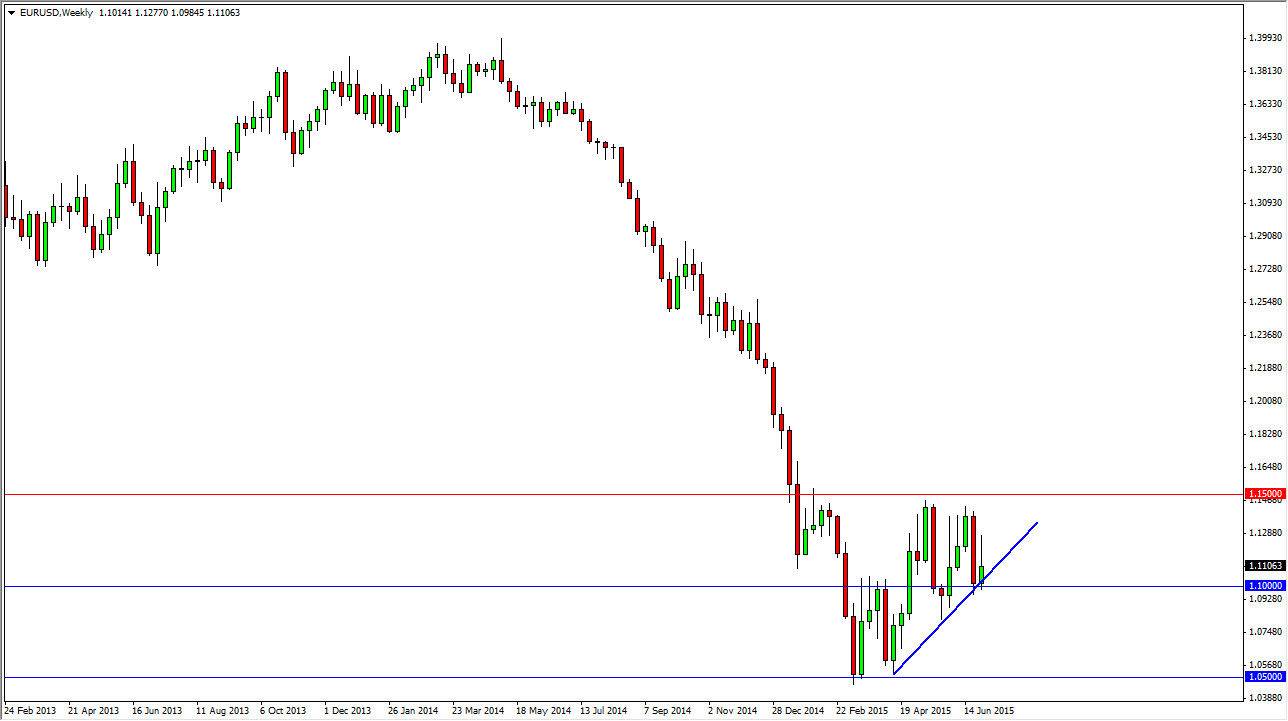

EUR/USD

The EUR/USD pair initially tried to rally during the course of the week, but we pulled back in order to form a shooting star. The shooting star sits just above a pretty significant uptrend line, and of course the psychologically significant 1.10 level which I believe has plenty of support all the way down to the 1.09 handle. With this, it is possible that we break down, but quite frankly I think with the Greek referendum coming, it’s only a matter of time before people start looking to try to pick up the Euro on the cheap again.

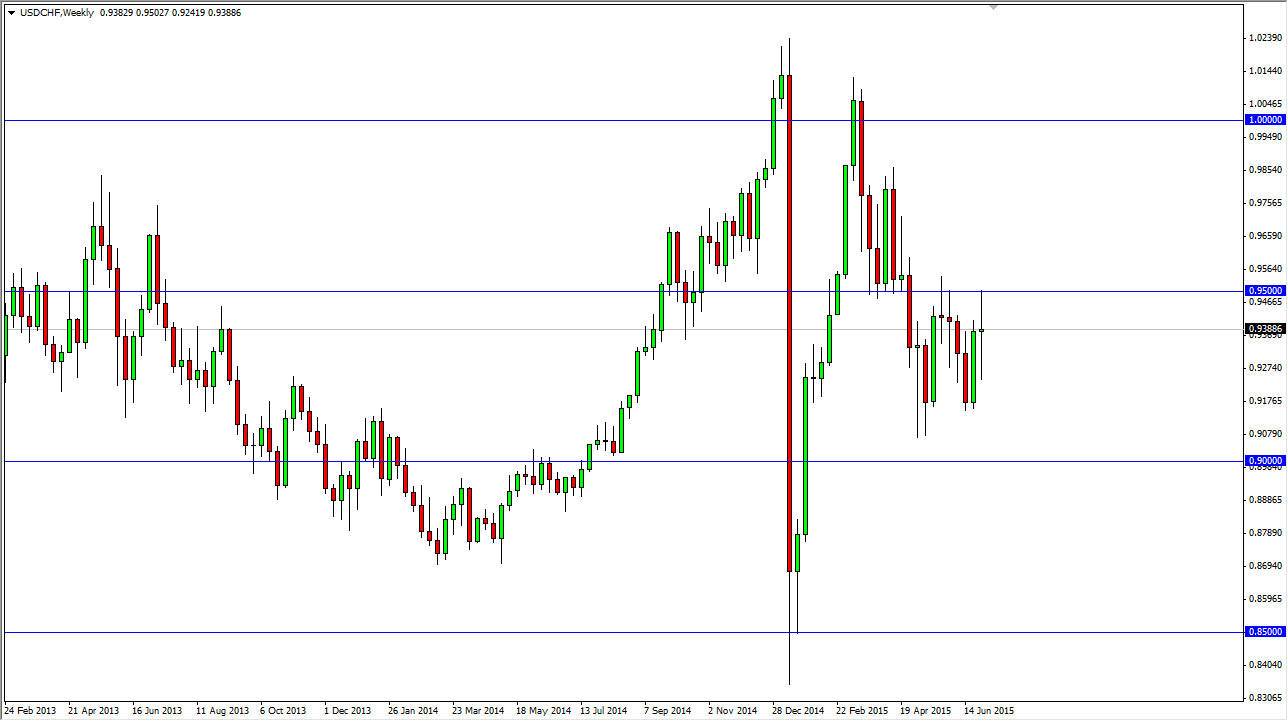

USD/CHF

The USD/CHF pair went back and forth during the course of the week, but couldn’t come up with a decisive move either way. Ultimately, I believe that the Swiss franc has been greatly ignored in general as we are trading during the summertime and using the summertime range. I believe that you can’t buy this pair until it breaks above the 0.96 level, or sell it until you get below the 0.92 handle. In the meantime, expect a lot of volatility in choppiness. Short-term trades only.

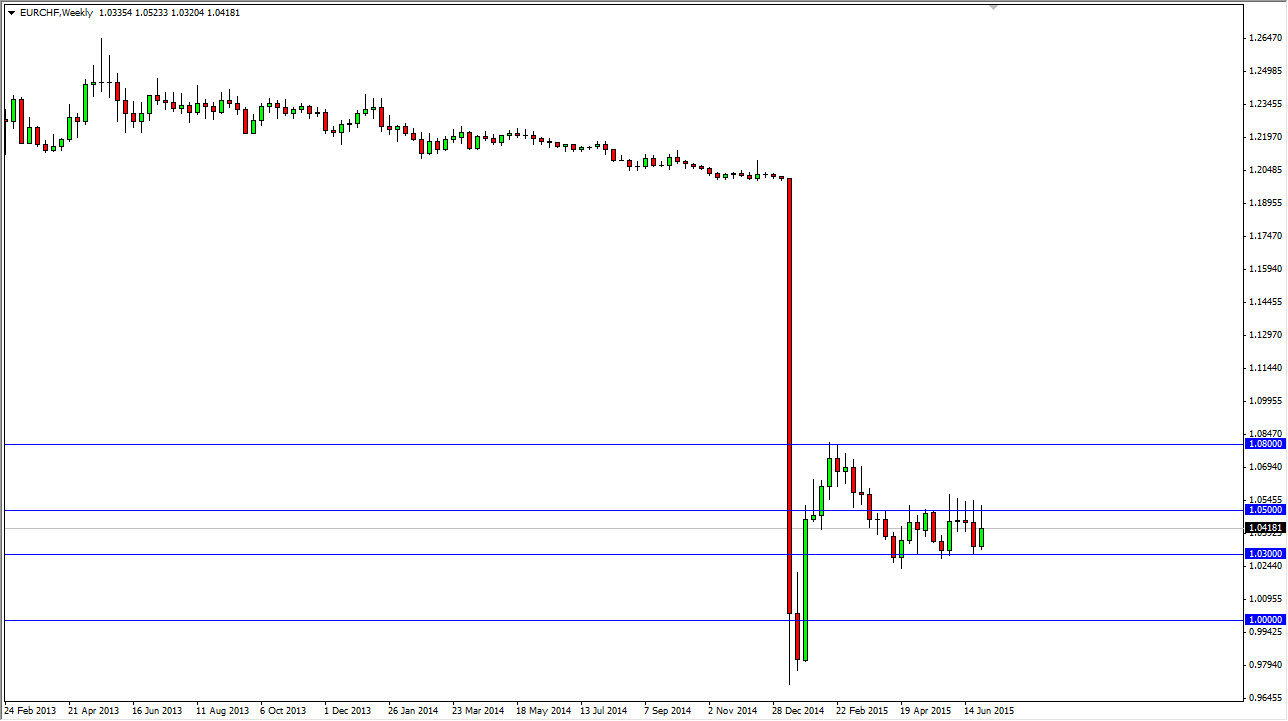

EUR/CHF

The EUR/CHF pair tried to rally during the course of the week but found quite a bit of resistance above the 1.05 handle. At this point in time, I believe that we will continue to consolidate between the 1.03 level on the bottom, and the 1.06 level on the top part of the consolidative area. With that being the case, you can continue to range trade this pair as far as I can see. I have no interest in placing any trades for any real length of time though.

USD/JPY

If there was ever a poster child for “dead money”, it would be the USD/JPY pair. I do have an upward bias though, so I am only buying short-term pullbacks for short-term trades. As far as longer-term trades are concerned, we will probably have to wait until the end of summer, when the liquidity starts to pick back up in the Forex markets.