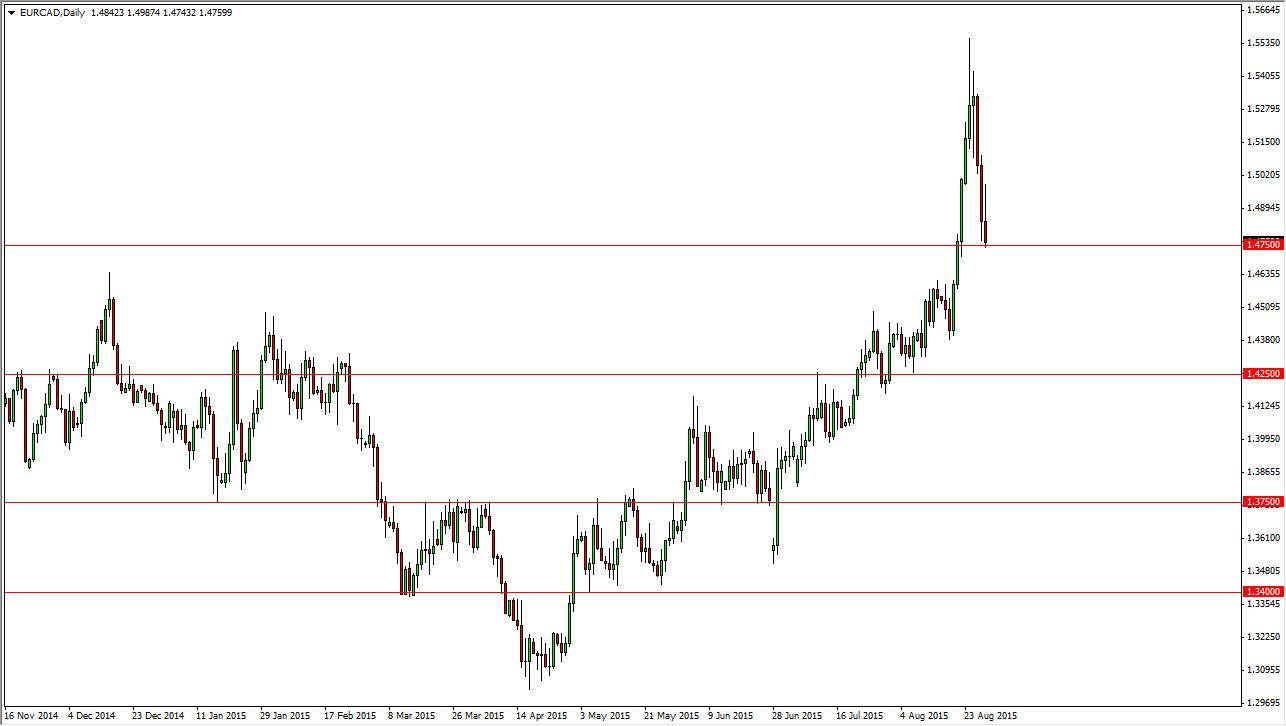

The EUR/CAD pair initially tried to rally during the course of the day on Friday, but as you can see fell significantly after trying to do so, and found quite a bit of buying pressure at the 1.50 level. We ended up forming a shooting star that is sitting just on top of the 1.4750 level, and that signifies that perhaps we are going to continue to the downside. A break down below the bottom of the shooting star and more importantly the 1.4750 level, should send this market looking for the next round number which of course is 1.45, and the beginning of the next cluster lower.

At this point in time, it does look like the Euro is going to continue to sell off in general, and it’s very likely that this will be the case in this particular pair. The EUR/CAD pair tends to mirror the EUR/USD pair in general, and therefore it makes sense that we continue to the downside.

Don’t forget the oil market

The oil markets of course have shown significant strength recently, and as a result I think that it’s very likely the EUR/CAD pair continues to fall as stronger oil prices tend to strengthen the Canadian dollar in general. I believe that a move to the 1.45 level is very doable, and we could even drop down to the 1.4250 level. After all, oil markets look like they are ready to continue even higher, breaking above some significant resistance. As long as that’s the case, it makes sense that the Canadian dollar will strengthen against most currencies. Quite frankly, the USD/CAD pair looks like it’s ready to fall as well. If the Canadian dollar can strengthen against the US dollar right now, and most certainly can do it against the Euro which is falling apart yet again. Ultimately, I feel that this market is not only a sell below the 1.4750 level, but also on rallies.