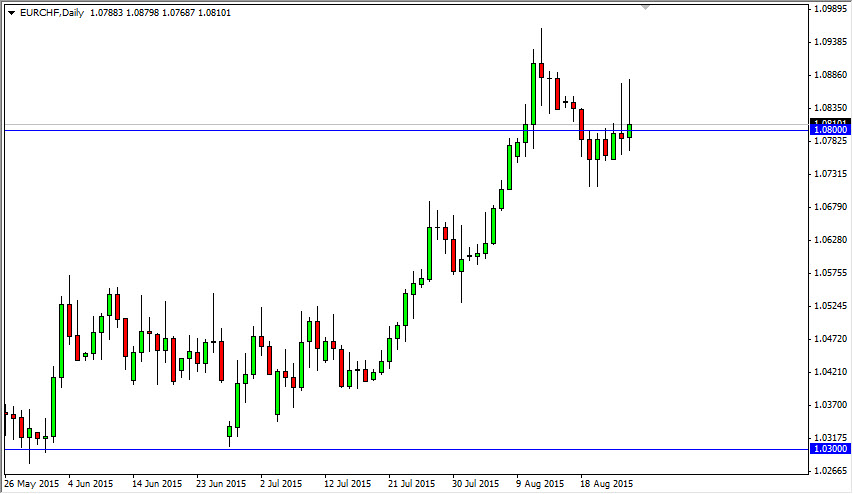

The EUR/CHF pair is a market that I thought would be going higher much more quickly than it is. In fact, we struggled quite a bit as the area above the 1.08 level has offered quite a bit of resistance. This flies in the face of the Swiss National Bank going long in this pair recently, as they have been trying to bring down the value of their own currency. The fact that we formed a shooting star on Tuesday, just after forming one on Wednesday, suggests that the market is going to continue to struggle to go higher for any real length of time.

Having said that, we have a couple of hammers from last week just below here. With this, it’s very likely that we will continue to see a lot of sideways action. While I do have a generally upward bias, I don’t have any real interest in putting money to work quite yet. I think that eventually we will go higher, but quite frankly we need to see some type of catalyst move this pair.

Buying the breakout

I’m actually buying the breakout at this point, and I believe that is signified by the marketplace going above the top of the shooting stars that have formed over the last couple of sessions. If we can get above those, that would of course be a very strong sign, and I believe it would attract a lot of attention. However, I would need to see some type of daily close above there in order to get excited about going long. I think ultimately we will do this, and that we will probably head towards the 1.10 level. However, this is the end of summer and there are going to be some issues as far as liquidity is concerned.

Having said that, I don’t really have any interest in going short of this market, because I believe that the 1.087 level is massively supportive. That of course is what caused the two hammers from last week to form.