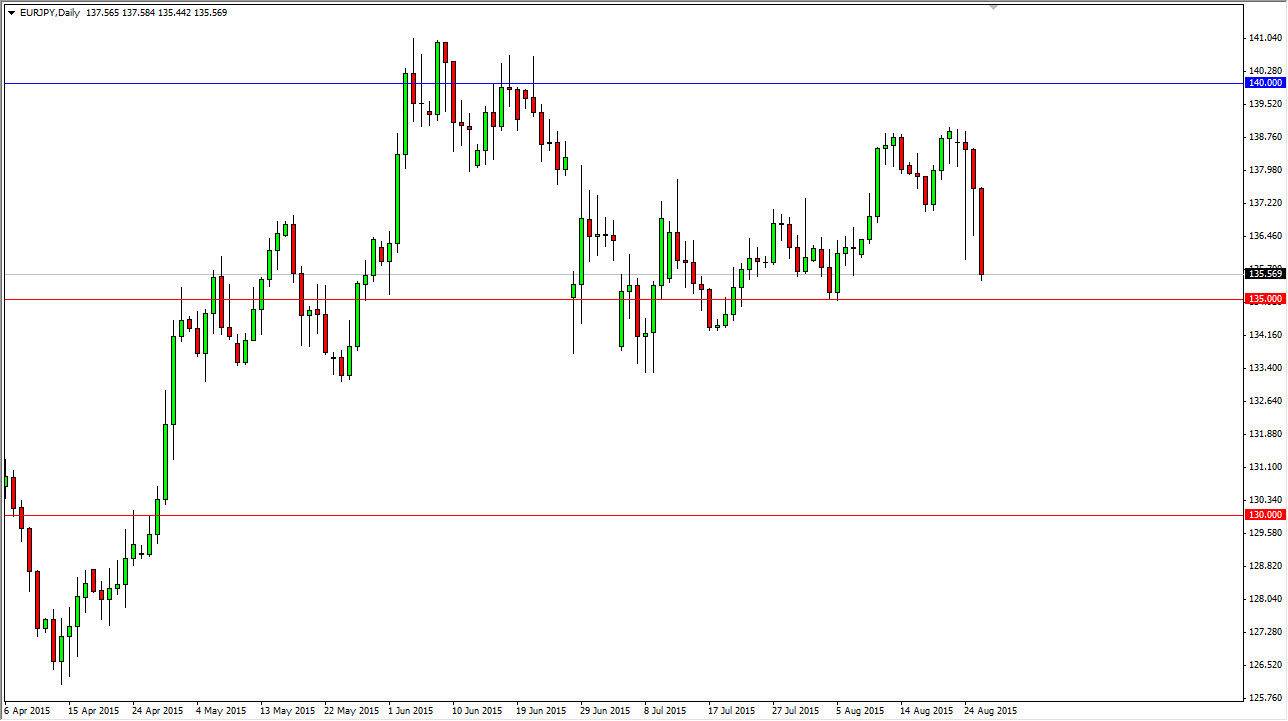

The EUR/JPY pair fell significantly during the session on Wednesday, as the Euro itself sold off around the world. This is a pair that is highly influenced by risk aversion, and risk appetite. With that, it makes sense if the pair continues to drift a little bit lower but we are starting to come near a floor in my opinion.

I think that the 135 level is massively supportive, and that it extends all the way down to the 1.34 handle. With this, I would be very cautious about shorting the market here but I would not be completely adverse to shorting rallies on short-term charts that show signs of exhaustion. After all, this is a market that is struggling and the fact that we broke down so significantly and below the hammer from the Monday session does show some real strength to the downside.

134 is my “line in the sand.”

As long as we stay above 134, I feel that this market has a chance of going higher over the longer term. However, if we do decide to break down below the 134 level, I think at that point in time the only thing you can do is sell as the market would certainly be broken at that point. I think that this pair does have the probability of showing quite a bit of volatility in the next couple of sessions, simply because we are coming back from vacation season which of course means a flood of liquidity, and we recently have seen such destruction in the equity markets. With that, there are going to be a lot of nervous traders out there, and of course they will be concerned about holding onto this pair as long as there are doubts out there.

One secondary indicator you look at for this market is the S&P 500. If it starts to rally, and perhaps break above the 1950 level, I would be a buyer of this pair on the first sign of support or strength.