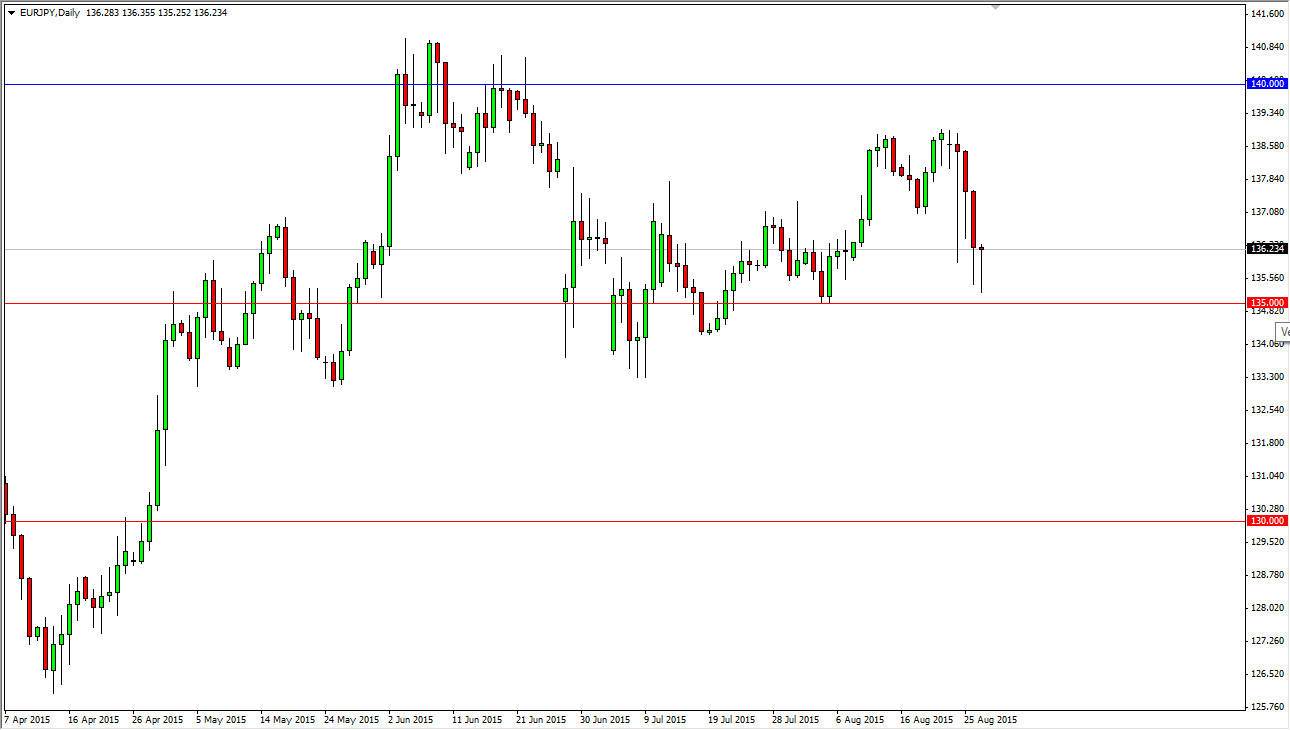

The EUR/JPY pair initially fell during the course of the day on Thursday but found enough support at the 135 level to turn things back around and form a hammer. The hammer of course is one of the more positive candles that you can form, and having said that it’s very likely that we will bounce from here and continue to go higher. The 139 level above here is resistance, and of course the major resistance is the 140 level. At this point in time, I anticipate this market continuing the overall consolidation, and as a result we should continue to bang around. We are near the bottom of the consolidation area, and as a result it makes sense that we would go higher from here going forward.

Buying the breakout

A break out above the top of the hammer from the session is reason enough to go long, and I also believe that pullbacks and showing signs of support could be buying opportunities. The 135 level has been supportive in the past, but the real support runs all the way down to the 134 level. With that in mind, I think that it is only a matter time before buyers step in every time we drop. I think that we should continue to go higher than the 140 level given enough time, especially considering that the Euro has shown signs of resiliency lately. However, it should also be noted that the volatility in the EUR/USD pair will probably transfer into slower movements in this market. Pay attention to the USD/JPY pair, as it will most certainly have a major influence in this market as well. If it goes higher, the EUR/JPY pair almost automatically will as well. Ultimately, I am a buyer and not a seller as long as we can remain above the 134 level as mentioned previously. A break down below there should send this market looking for 130 though.