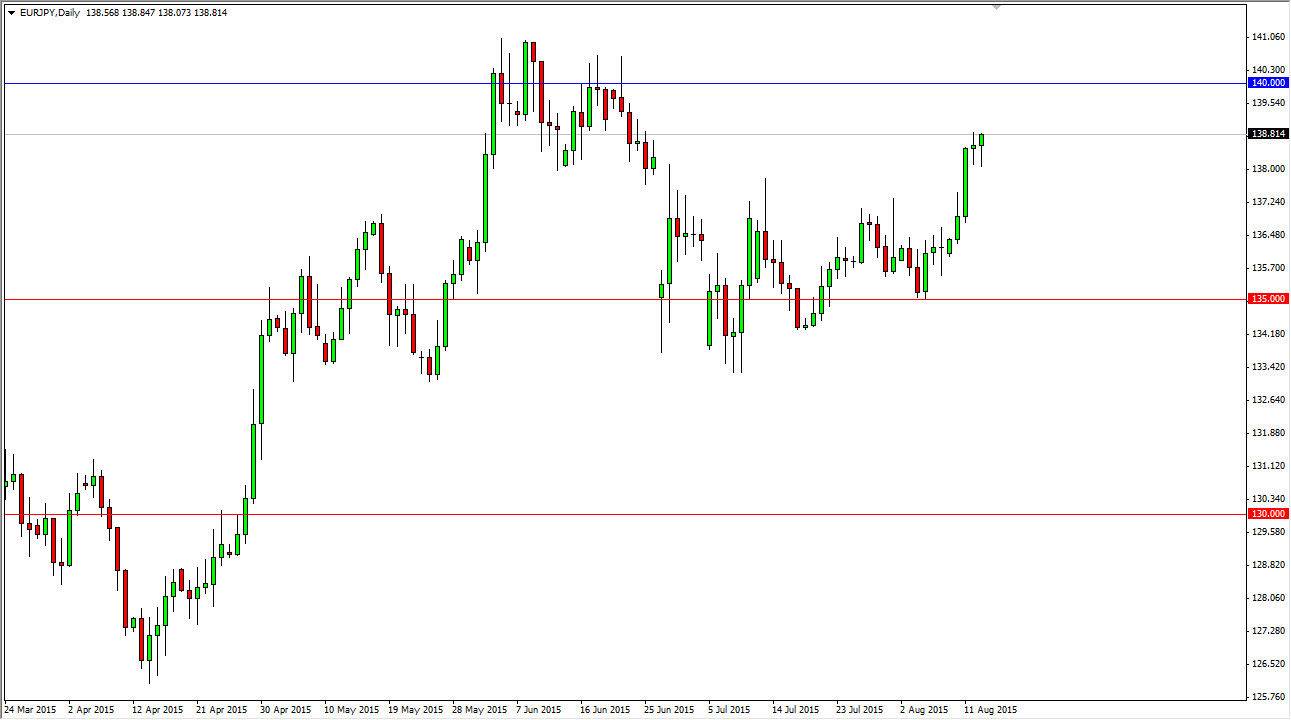

The EUR/JPY pair initially fell during the course of the session on Thursday, but found enough buying pressure near the 138 level to turn things back around and form a hammer. That hammer of course is a very bullish sign, and as a result I am a buyer of this pair if we can break above the top of the range for the day. Breaking above the top of that candle sends this market looking for the 140 handle, which is my longer-term target anyway. I do recognize that the 140 level will probably be pretty resistive, so at this point in time I do not expect the market to break above there with any type of disease.

Ultimately though, we could break down below the bottom of the hammer and that of course makes it a “hanging man.” However, I am not willing to sell the market at that point as I would just simply step to the side. I recognize that the 137 level would be support, just as the 135 level would be. The Euro continues to be strengthened overall as the European Union is starting to stabilize.

Let us not forget the Bank of Japan

The Bank of Japan of course is working against the value of the yen, buying Japanese Government Bonds, and as a result it drives down the demand for the currency. With this, the market continues to punish the Japanese currency but at the end of the day what is most important on is the fact that the central bank is light years away from raising interest rates. While I have no illusions of the European Central Bank raising rates anytime soon, the truth is they are probably closer to doing so than the Japanese are. With this, I believe that the upward pressure continues, and if the EUR/USD pair can break above the 1.12 handle, we may have enough momentum to break above the 140 level in this particular market.