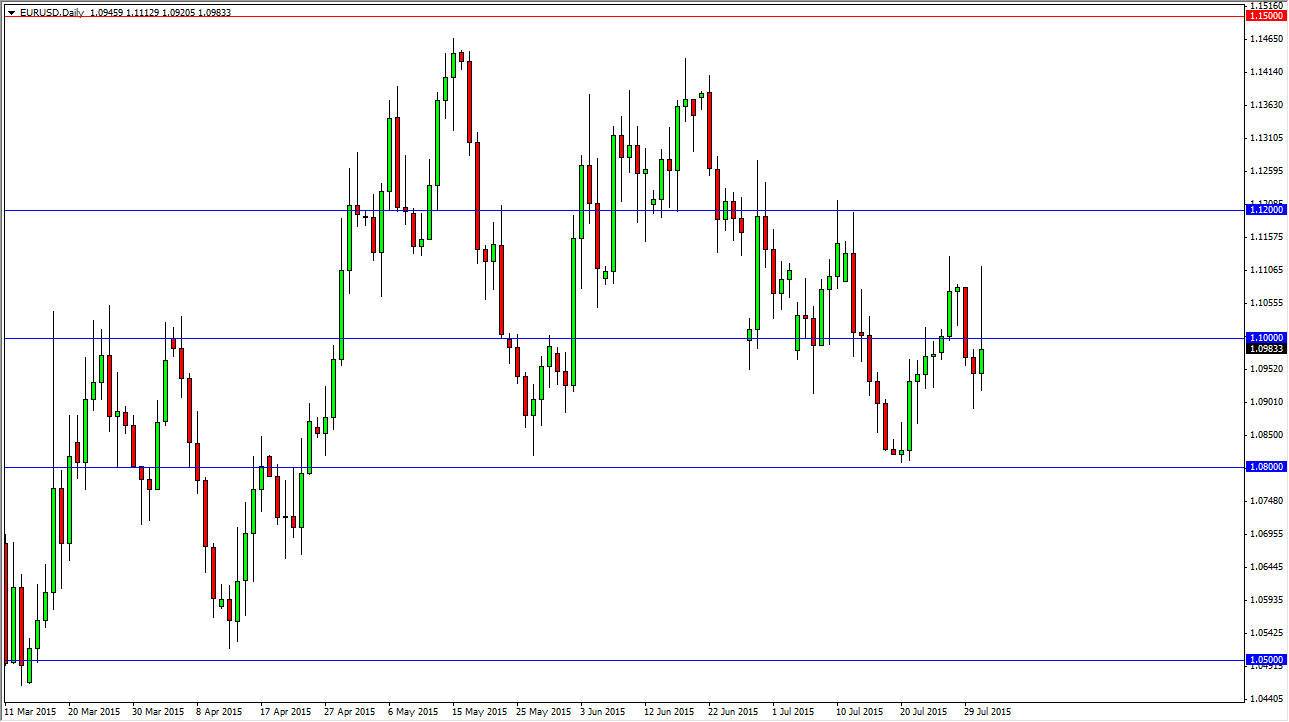

The EUR/USD pair initially tried to rally during the course of the session on Friday, but as you can see struggled as the 1.11 level offered far too much resistance. By doing so, the market looks as if the sellers took control late in the day, as the market pushed below the 1.10 handle. I look at this market as essentially consolidating in a longer-term type of way, so at this point in time I believe that the 1.08 level will be the supportive level that the market respects, and the 1.12 level should offer a significant amount of resistance. With that, I think that a lot of volatility is going to end of the market now, and there’s no way to truthfully hang onto a trade for more than a few hours.

Lots of volatility

I believe that this market continues to have lots of volatility going forward, and as a result there’s no way to hang onto a trade for more than a short amount of time. On top of that, I believe that you should probably trade this market with small position size, as the volatility can get very expensive if you are not careful.

If we broke out above the 1.12 level, I think that would be a massively bullish sign, but we also recognize that a break down below the 1.08 level would be massively bearish. The 1.05 level would be targeted next, but at this point in time we are probably just going to stay in this overall consolidation level.

Keep in mind that there is a lot that could move the Euro now, but the US dollar will remain the true focus of the markets. After all, the Greek debt solution has gone through, and now at least some of the fears will have subsided. Ultimately, this market probably should continue to favor the US dollar in the short-term, but only for little burst of time here and there. Truthfully, I wouldn’t blame you at all for staying away from this pair.