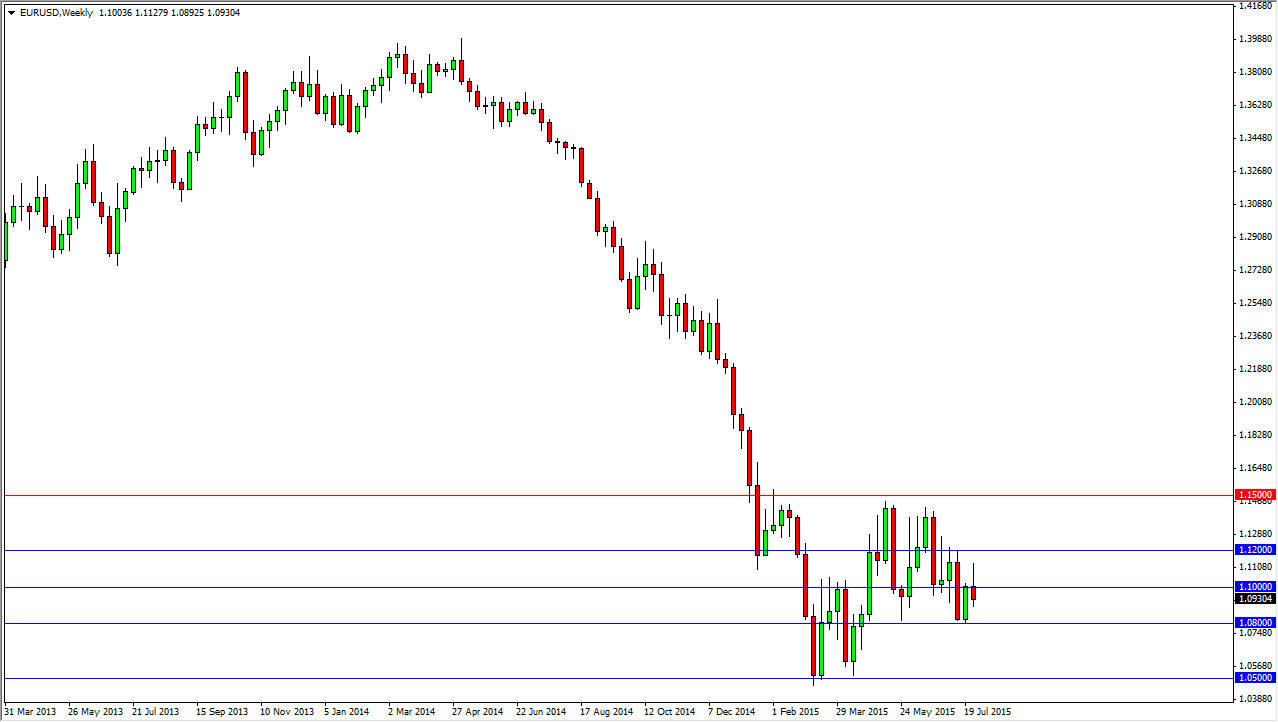

The EUR/USD pair initially broke higher during the course of the last week of July, but as we have seen time and time again, the pair seems to be stuck between the 1.08 level on the bottom, and the 1.12 level on the top. Quite frankly, with all of the drama coming out of Greece, this shouldn’t be much of a surprise. Granted, we supposedly have “fixed” the problem for the meantime, but in the meantime I think really what’s happened is a lot of large traders are simply out of the market. This is the domain of high-frequency trading, and of course day traders with small accounts. In other words, there’s is no reason for this pair to move drastically one way or the other.

That being said…

I believe that the market will finally make a move sometime in September, but this market will be very important, as it will be a bit of a set up for that move. I don’t know what will break this pair out of the 1.08 - 1.12 region, but eventually it will happen. Once it does, I think that if we can break above the 1.15 level, this trend has completely changed, and the euro will continue to gain. On the other hand though, if this pair breaks them below the 1.08 level, we will head towards the 1.05 level, and then perhaps finally make a move to parity that so many people had been asking for.

All things being equal though, I look at this chart and I realize that we have gotten very choppy recently, and that generally means that we are getting towards the end of the downtrend. I would suspect that eventually this pair will go higher, even if it is just a bounce for another year or 2, and then sell off yet again as the pair has done over the last several cycles. In the meantime, keep your position small, and focus on the 400 PIP range.