The EUR/USD pair continued to grind away during the course of the session on Wednesday, as we did get a little bit of bullishness, but at the end of the day I don’t expect much out of this market. After all, Friday is the Nonfarm Payroll Numbers announcement, and with that I anticipate that the market will continue to be very choppy. Because of this, I think you’re going to have to focus on short-term charts, but at the end of the day it appears that we will probably try to rally towards the 1.0950 region. In other words, I’m talking very little in the way of motion, and more often than not going to be very small moves.

I think that it’s only a matter of time before the markets break out, but it’s probably not going to be until we get these employment numbers. After all, they are the biggest movers of the US dollar in general, and as the market seems to be fairly consolidative at the moment and the fact that we are towards the end of summer, I think we’re going to need some type of shock to the system in order to get a real move.

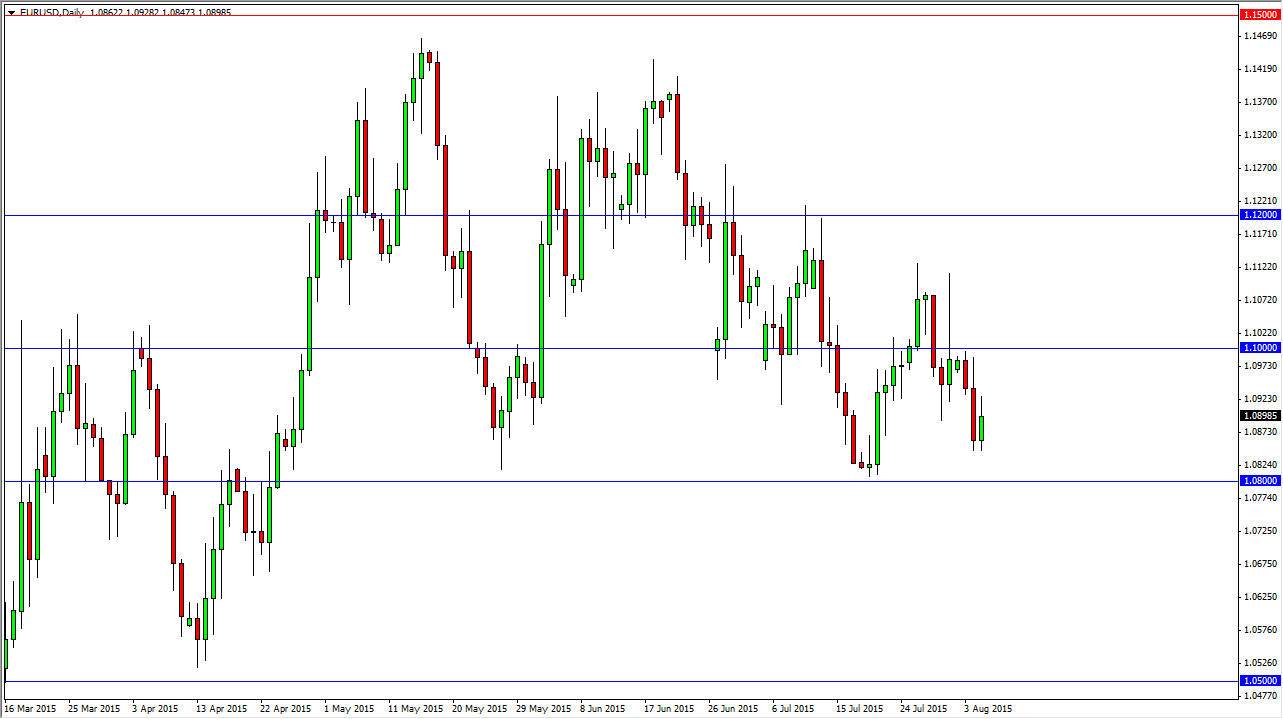

400 pips

I think were essentially stuck between 1.08 level on the bottom, and the 1.12 level on the top. In fact, I would be very surprised to see the market burst out of this region anytime soon. I think that we will make a short-term move to the upside during the session on Thursday, and then probably give back any gains by the end of the day as traders will more than likely want to be out of the market before the Nonfarm Payroll Numbers. Ultimately, it’s going to come down to what the jobs market looks like in the United States, quite frankly the better the numbers look, the more likely this pair is to fall. The meantime, you’re probably going to be relegated to trading for 20 pips at a time.