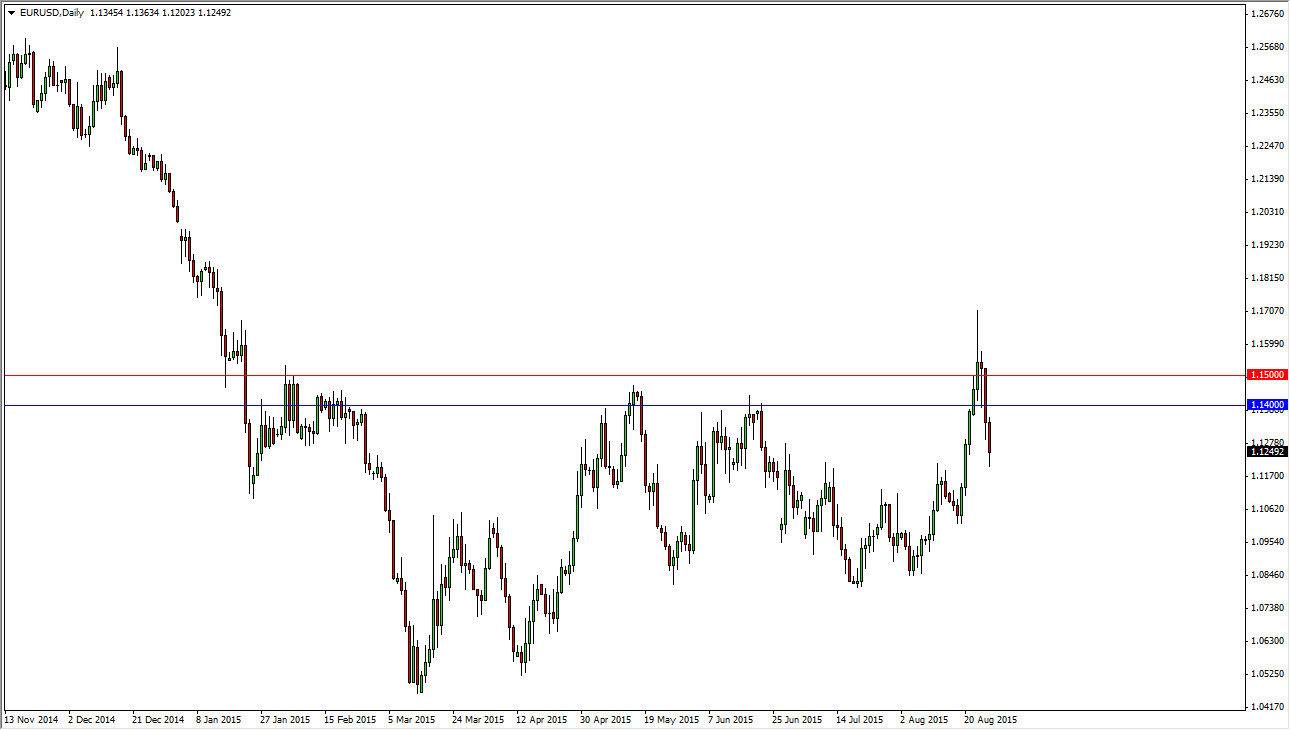

The EUR/USD pair fell during the course of the session on Thursday, testing the 1.12 level. This was an area that has been resistive previously, and now should offer support. However, we have broken down quite significantly after the massive rally, so this shows just how volatile and unsure this market is right now. I believe that if we break down below the 1.12 level, this market will continue to collapse. However, we could bounce from here but I feel that this is a market that’s probably best left alone overall.

Personally I will not be trading this market anytime soon as I think the volatility is simply going to be far too strong to be bothered with. Ultimately, I believe that smarter traders will step to the sidelines and let the dust settle. It will be interesting see what happens today as it is Friday, and a lot of traders will be looking to square up positions.

Staying on the sidelines, looking for impulsivity.

I’m looking for impulsivity in a candle before I go in one direction or the other. Ultimately, I think that if we can get a large red or green candle, it could give us an opportunity to go in one direction or the other. If we can get above the 1.15 level, I would be a buyer as well, as the market would show significant momentum building to the upside. As far as the downside is concerned, there is a lot of choppiness below so even if we break down below the 1.12 level it’s very likely that things will be difficult to hang onto. Quite frankly, it’s probably going to be easier to trade the Euro against other currencies around the world that aren’t as resilient as the US dollar is at the moment.

Looking at this chart, I cannot help but think that breaking out should have moved this market even higher, so at this point in time I have to wonder whether this is simply momentum trying to be built back up again, or is it just a false break out. With this, the market looks very dangerous.