EUR/USD Signal Update

Yesterday’s signals were not triggered as there was no bullish price action at 1.1394.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made between 8am and 5pm London time today only.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next entry into the zone between of 1.1292 and 1.1274.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1186.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1433.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

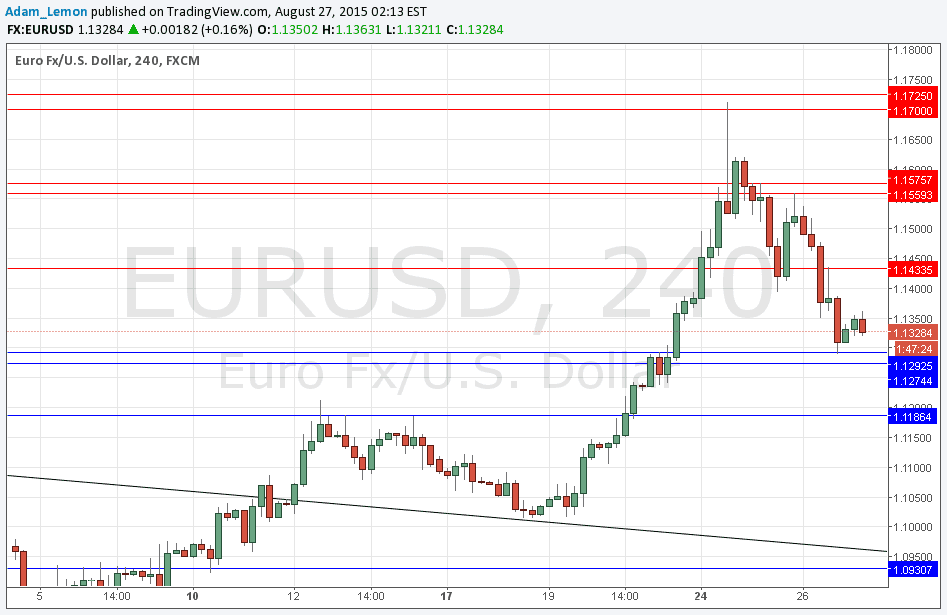

EUR/USD Analysis

It was another wild ride for this pair yesterday, as the Euro sold off massively everywhere, in tandem with the British Pound. This pair did get some initial support a little below 1.1400 which I thought might prove to be a turning point, but the fall kept going all the way to my anticipated support at 1.1292.

We have begun falling again down towards that level at the time of writing. If we hit it again and make a double bottom, we might see a sizeable pull back.

Above I see resistance from around 1.1400 to 1.1433, so that round number could be a good place to take at least partial profit on any long trade.

If we break below 1.1274 today, we could see a further fall all the way down to the next support level at 1.1186.

It has been a really wild week, we are currently more than 50 pips below the weekly open, and almost 400 pips off the weekly high.

There is nothing concerning the EUR due today. Regarding the USD, there will be a release of Preliminary GDP and Unemployment Claims data at 1:30pm London time.