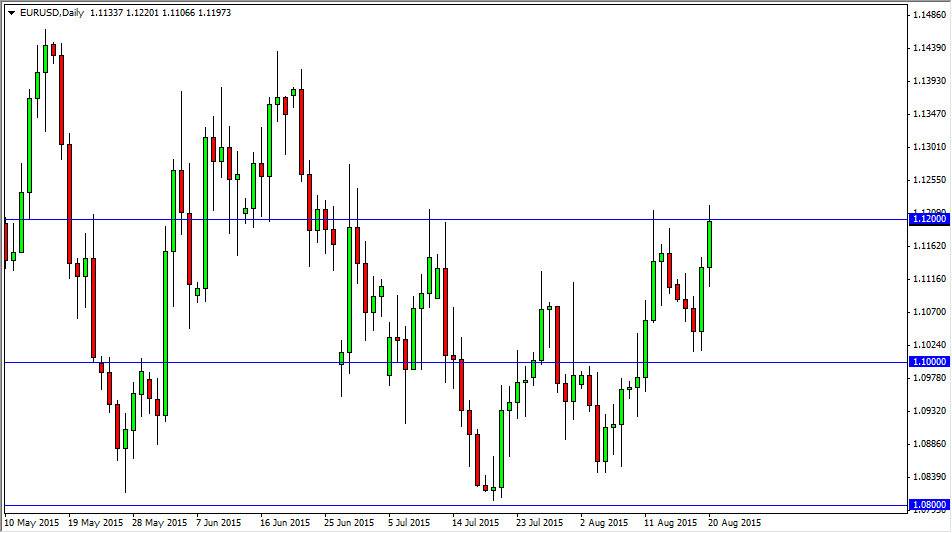

Looking at the EUR/USD pair, we most certainly had a strong session on Thursday. We slammed into the 1.12 level, which of course was the top of the larger consolidation area that we have been working with for some time. I think that this candle will be very important, as it will show which direction we go from. If we can break above the top of the range for the session on Thursday, we would more than likely see this market head towards the 1.14 handle. On the other hand though, I think that a resistive candle in this general vicinity would be an excellent selling opportunity as it would just simply validate the massive resistance.

A break down from here should see support at the 1.10 level though, because quite frankly that has been so important recently. As long as we stay in the area, we should see a reaction to that level again and again.

Summertime

It is the summertime though, so I have to wonder whether or not we can truly move in one direction or the other for any real length of time. Ultimately, this is a market that will need to see a bit more of volume in the breakout. Because of this, I feel that short-term traders are probably going to be the best way to go. I find it very difficult to imagine hanging onto a longer-term trade from here but I do recognize that here in about 2 weeks we should have more volatility and more importantly more volume as the market will welcome back the longer-term and larger traders from vacation.

Keep in mind that in the meantime there will be a lot of choppiness, so I have been personally trading positions half the normal size that I would. With this, I am very interested in seeing how this daily candle forms and develops in order to make my next trading position. At this point in time, I feel that the market is either going to go to the 1.10 level, or the 1.14 level. The next candle should determine that.