The EUR/USD pair initially fell during the course of the session on Friday, but after the Nonfarm Payroll Numbers came out, we did up seeing this market turn things back around and form a massive hammer. A little bit of a disclaimer here: I absolutely hate trading this pair. I know a lot of people out there will consider that blasphemy, as the small spread seems to attract a lot of newbie traders. However, the reality is that this pair is getting choppy here and choppy or as time goes along. On the flip side of that, you can almost say that if you hang onto the trade long enough, you will make money.

Anyway, I remember when this pair used the trend nicely. The high-frequency traders that are out there dominating the market anymore have all but wiped those qualities away, but luckily when the volume picks up in September that should help a bit.

Tight trading

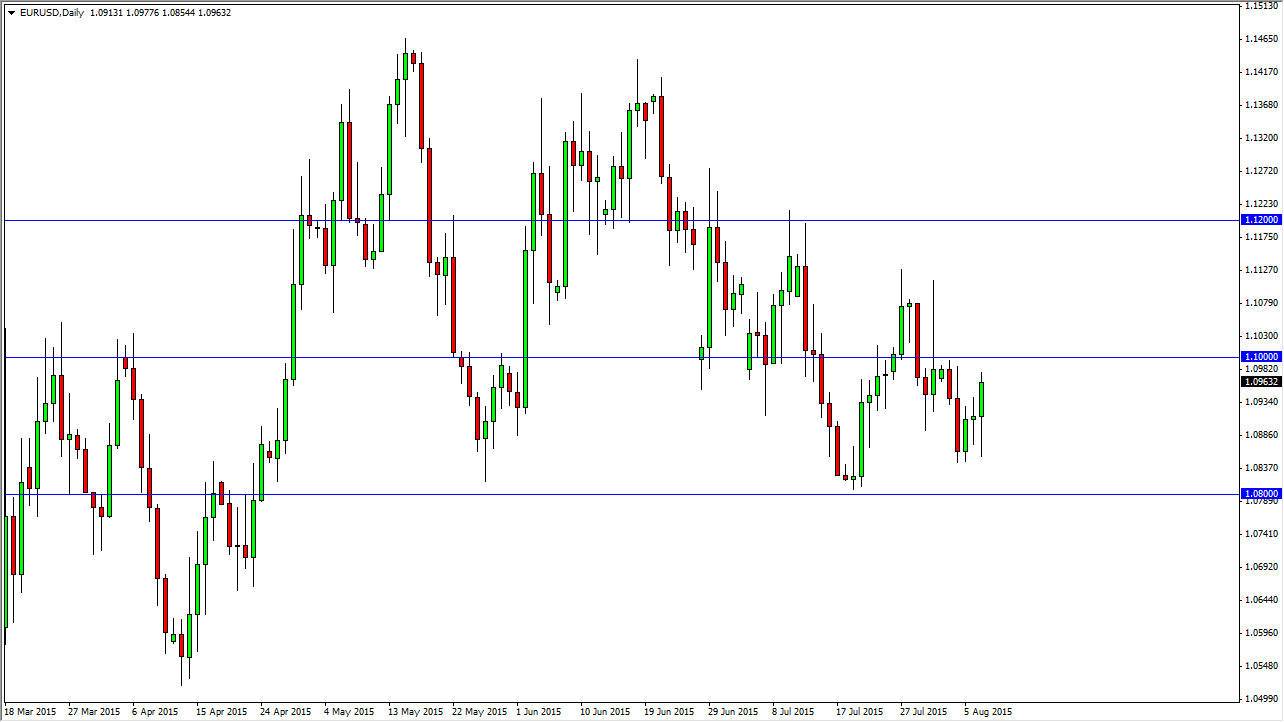

On the chart before you, I have 3 levels pointed out. I have the 1.08 level, which I essentially think of as the “floor” in this market, I have the 1.12 level which I consider to be a bit of a “ceiling” in this market, and then I have the 1.10 level which I consider to be “fair value” in this market now. In other words, that is where prices will be attracted to time and time again, at least until we get more volume.

Since we are so close to the 1.10 level, I think it is going to be difficult to trade this market unless of course we get some type of resistant candle near that area. You will be relegated to trying to pick 20 to 30 pips at a time, and bigger moves are all but an impossibility during this particular time in a year. The trading environment simply will not allow for it. Because of this, I am more apt to trade this market off of the one hour chart than anything else.