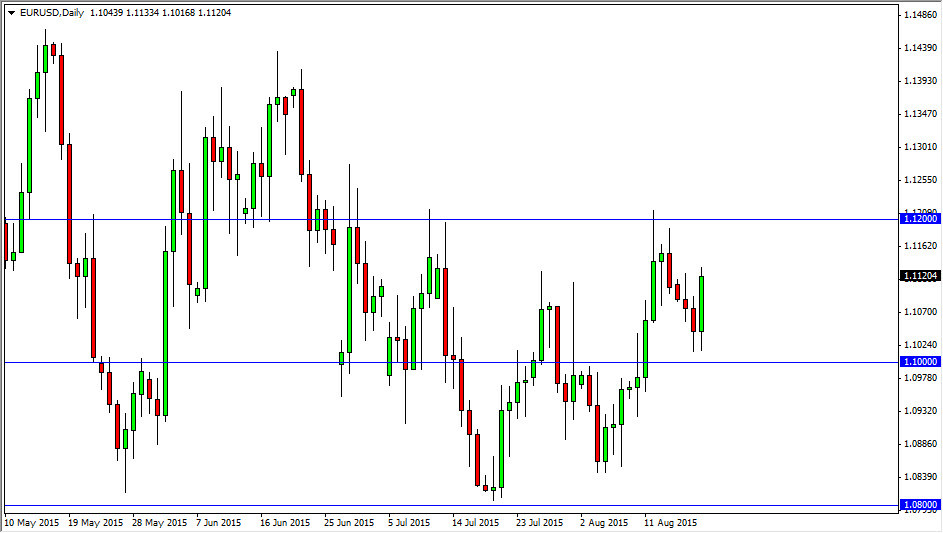

The EUR/USD pair initially fell during the day on Wednesday, but found support just above the 1.10 level as it did on Tuesday. By seeing the support, the market ended up turning back around and rallied much higher. With that, I am impressed with this action but I also recognize that we are still in consolidation, no matter how strong this move has been. After all, the 1.12 level above still offers resistance, so until we break above there I wouldn’t get overly excited about any move to the upside. That’s not to say that we can’t trade this pair though, there are quite a few different ways to go about it.

Without a doubt, I believe that the easiest way to trade this pair though is going to be on short-term charts. We obviously have an impulsive candle higher for the session on Wednesday, so I think looking to short-term charts that show signs of support might be the best way to think about going long in this pair.

Continued choppiness

Within this market, I believe that there will be continued choppiness going forward, and as a result I think it’s only a matter of time before we will reverse again. Because of this, I’m not willing to put a lot of money into this market, and they do realize and hanging onto a longer-term trade is a bit foolish this point. However, if we broke above the 1.12 level, I would have to start to rethink my trading strategy. With this being the very end of the summer though, I anticipate that we will see real volume come back in a couple of weeks though, and at that point in time we can really start to look at making a more significant move. In the meantime, you’re simply going to have to trade what the market offers you, and right now it’s not going to be a lot in the way of direction.